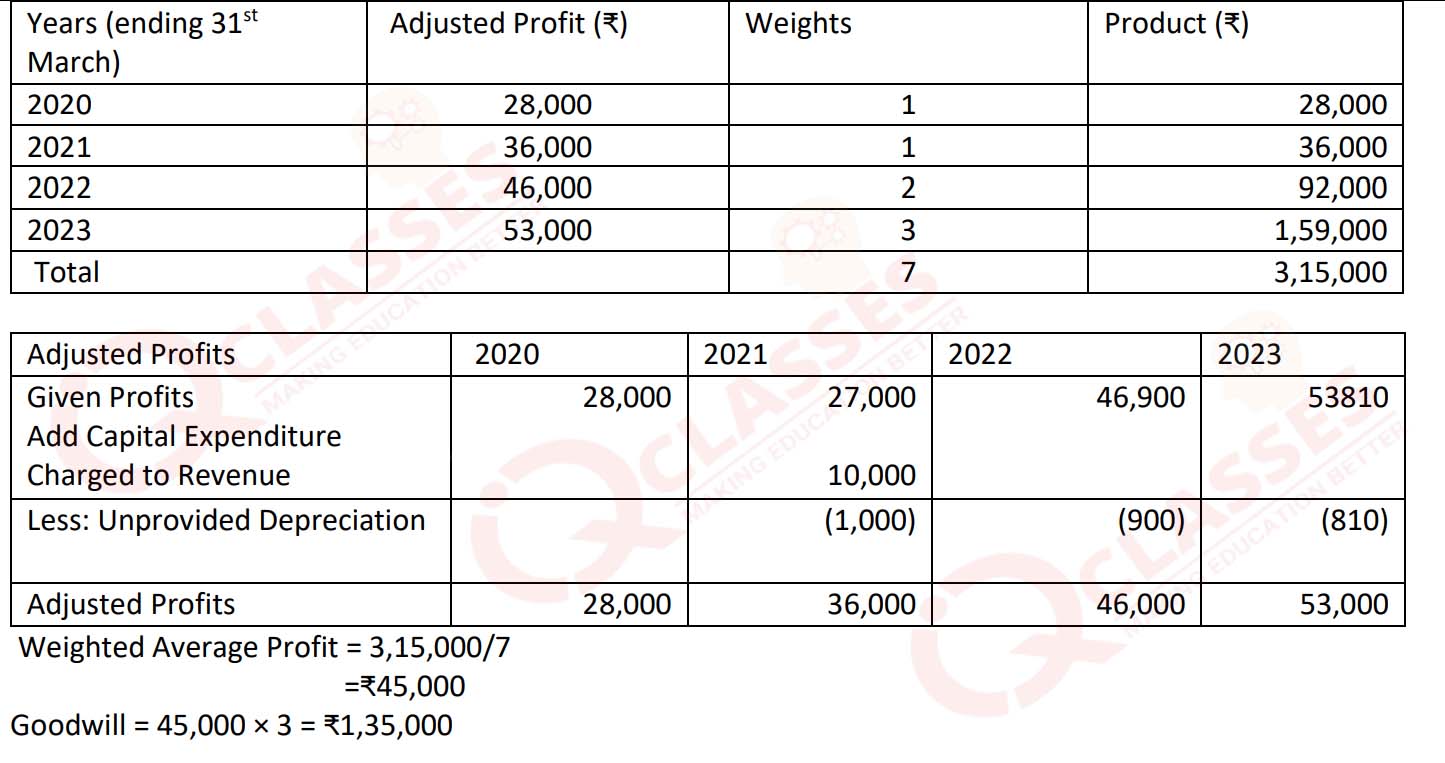

Calculate goodwill of a firm on the basis of three years purchases of the Weighted Average Profits of the last four years. The profits of the last four years were:

a) On 1st April, 2020 a major plant repair was undertaken for ₹10,000 which was charged to revenue. The said sum is to be capitalized for goodwill calculation subject to adjustment of depreciation of 10% on reducing balance method.

b) For the purpose of calculating Goodwill the company decided that the years ending 31.03.2020 and 31.03.2021 be weighted as 1 each (being COVID affected) and for year ending 31.03.2022 and 31.03.2023 weights be taken as 2 and 3 respectively.

Solution

,

,