CLASS 12 CBSE TERM2 ACCOUNTS SPECIMEN 2022

BOARD -

CLASS -

SUBJECT -

CBSE

12th

ACCOUNTS

Paper Pattern for Written Term-I

TIME -

MARKS -

1 Hour 30 Minutes

40

Visit CBSE OFFICIAL PAGE for Regulations and Syllabus of Class 12th CBSE

Solved Specimen Paper Semester-2 2022

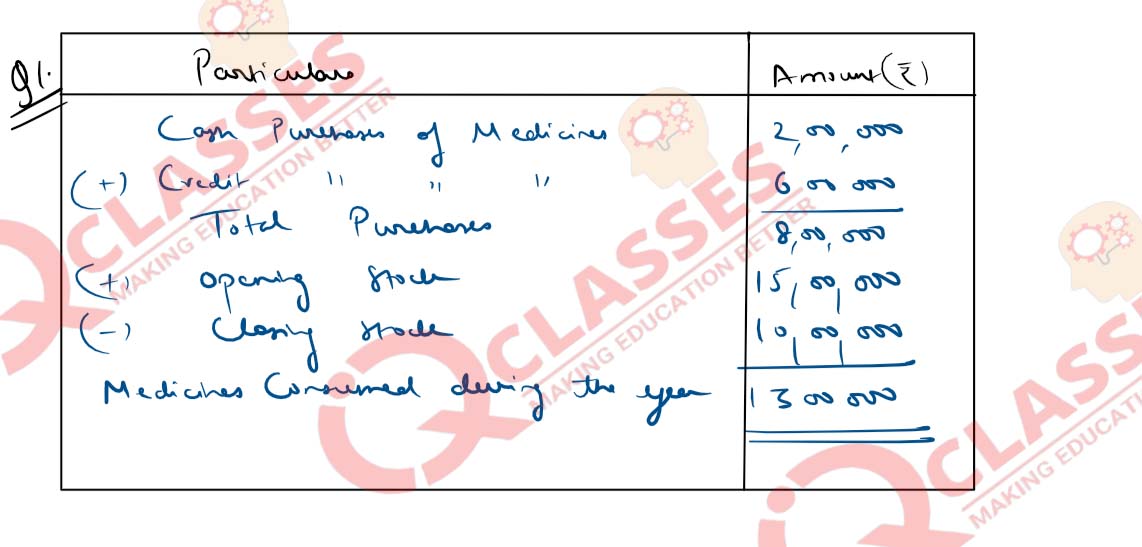

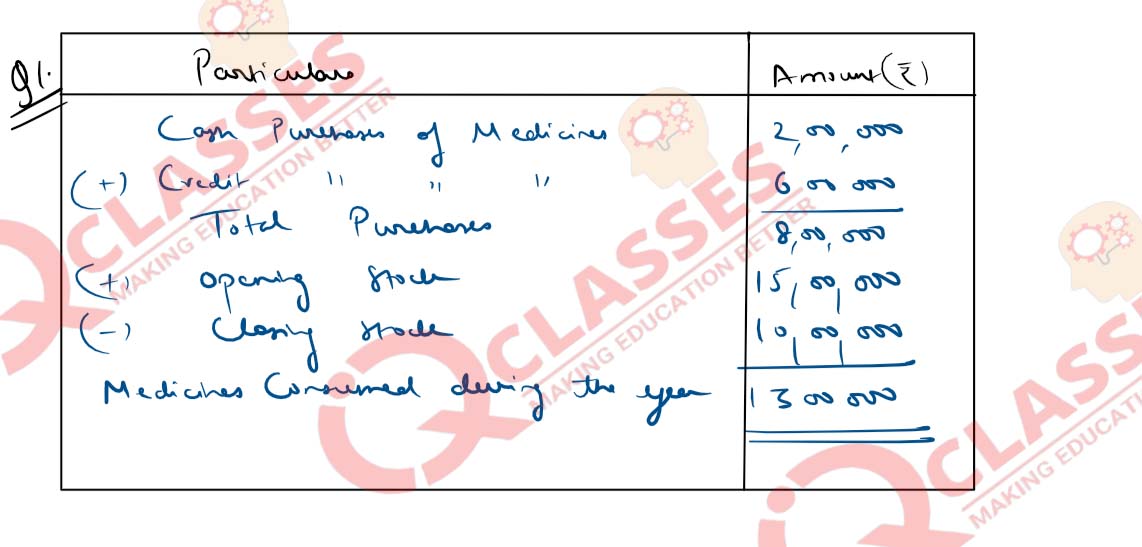

Q1

Following information has been provided by M/s Achyut Health Care.

You are required to calculate the amount of medicines consumed

during the year 2020-21:

solutions

| Particulars | Amount (₹) |

|---|---|

| Stock of medicines as on April 1, 2020 | 15,00,000 |

| Creditors for medicines as on April 1,2020 | 3,50,000 |

| Stock of medicines as on March 31,2021 | 10,00,000 |

| Creditors for medicines as on March31, 2021 | 4,20,000 |

| Cash purchases of medicines during the year 2020-21 | 2,00,000 |

| Credit purchases of medicines duringthe year 2020-21 | 6,00,000 |

solutions

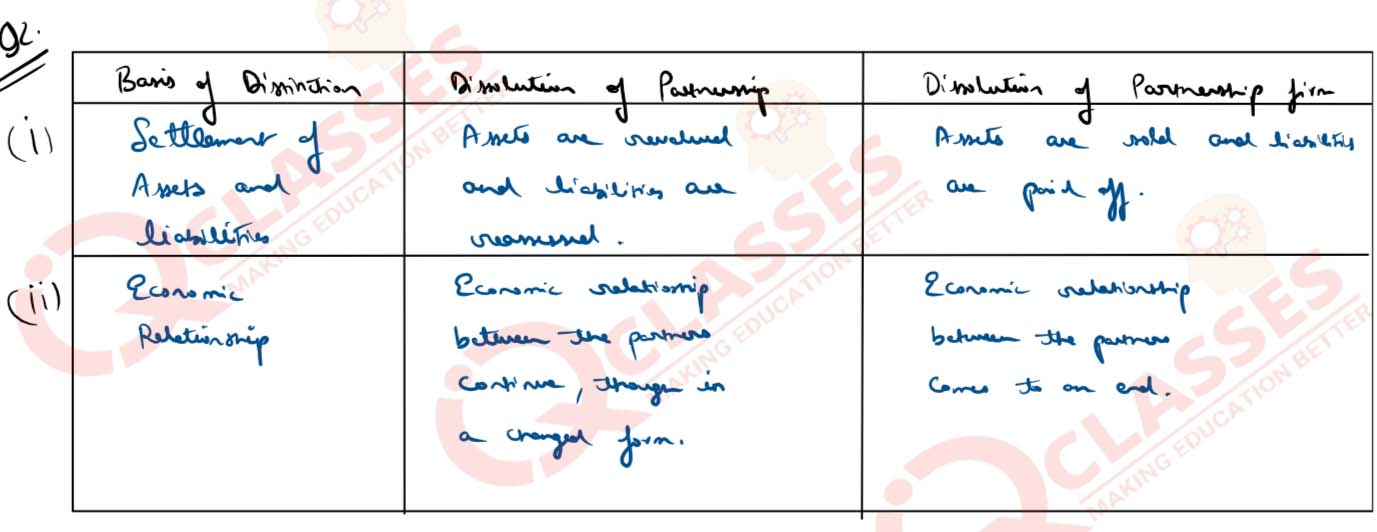

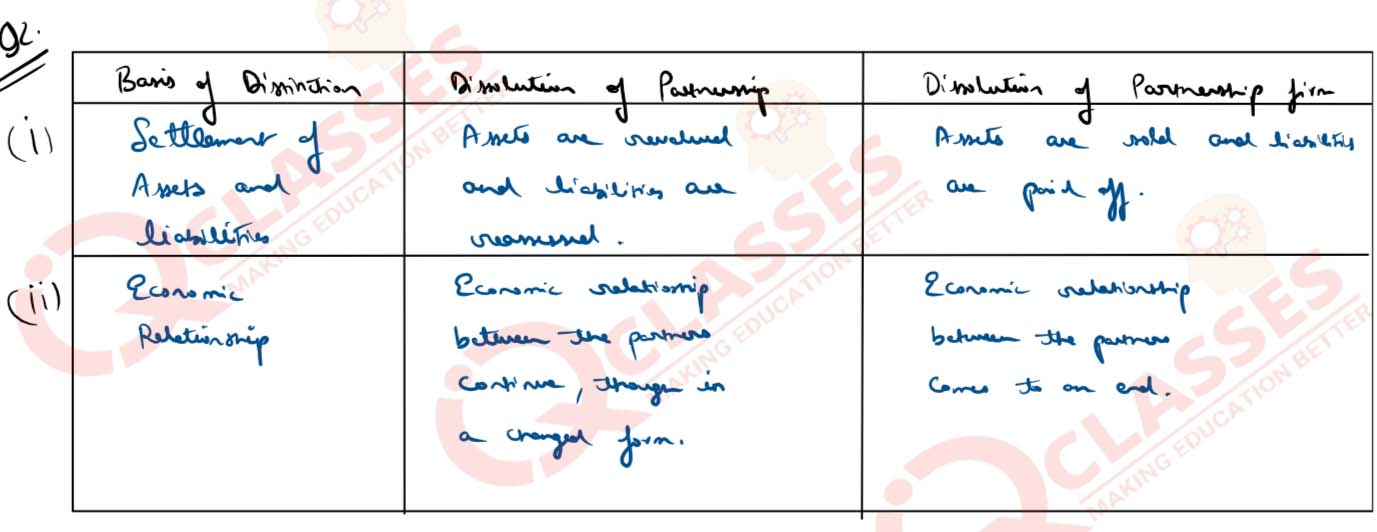

Q2

Distinguish between ‘Dissolution of Partnership’ and ‘Dissolution of

Partnership Firm’ based on:

solutions

- Settlement of assets and liabilities

- Economic relationship

solutions

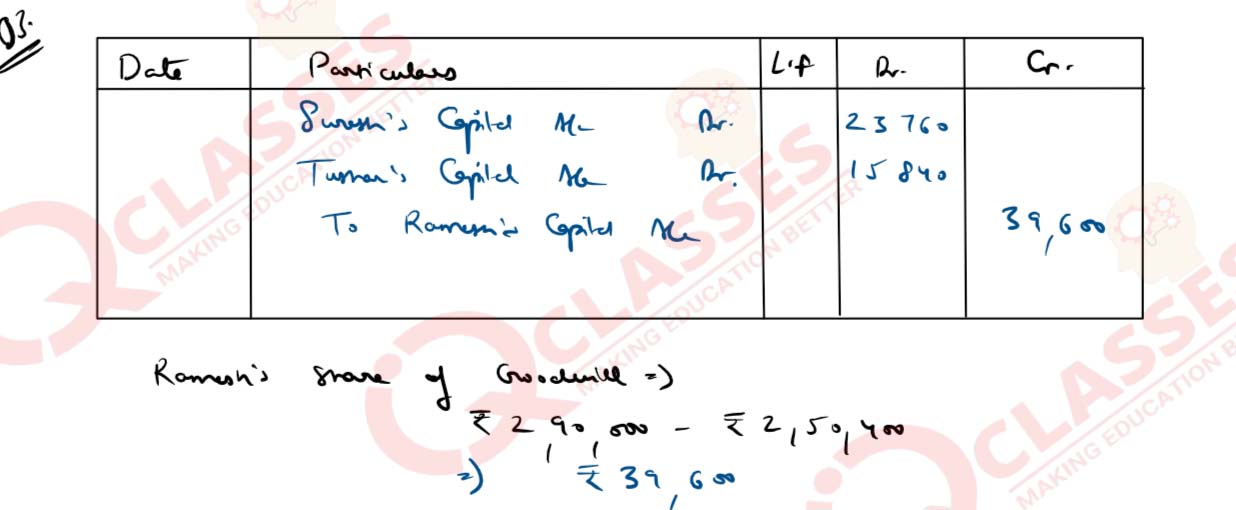

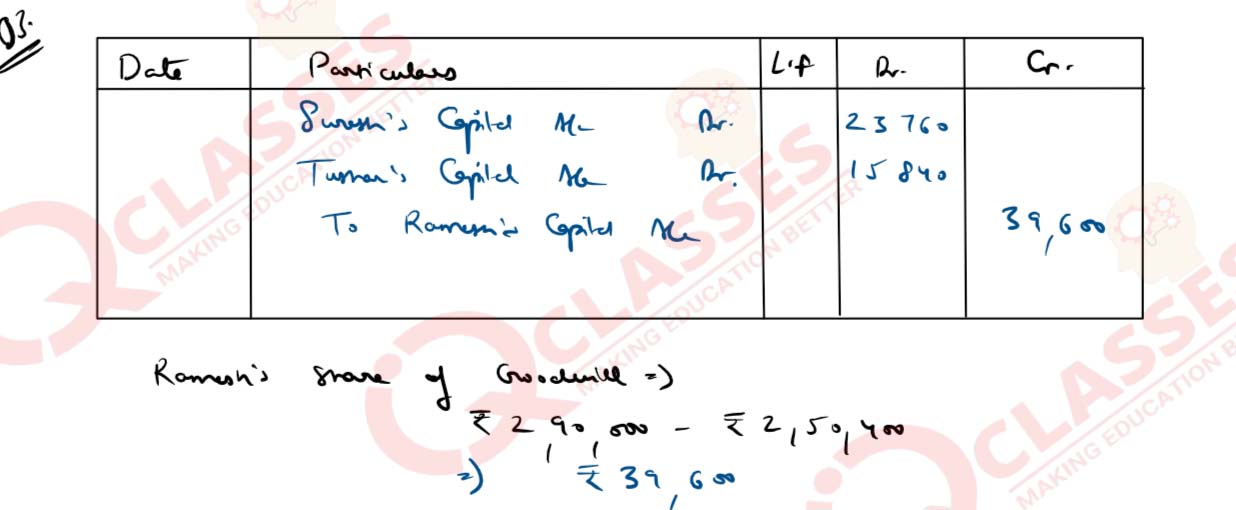

Q3

Suresh, Ramesh and Tushar were partners of a firm sharing profits in

the ratio of 6:5:4. Ramesh retired and his capital after making

adjustments on account of reserves, revaluation of assets and

reassessment of liabilities stood at ₹ 2,50,400. Suresh and Tushar

agreed to pay him ₹ 2,90,000 in full settlement of his claim.

Pass necessary journal entry for the treatment of goodwill. Show

workings clearly.

solutions

solutions

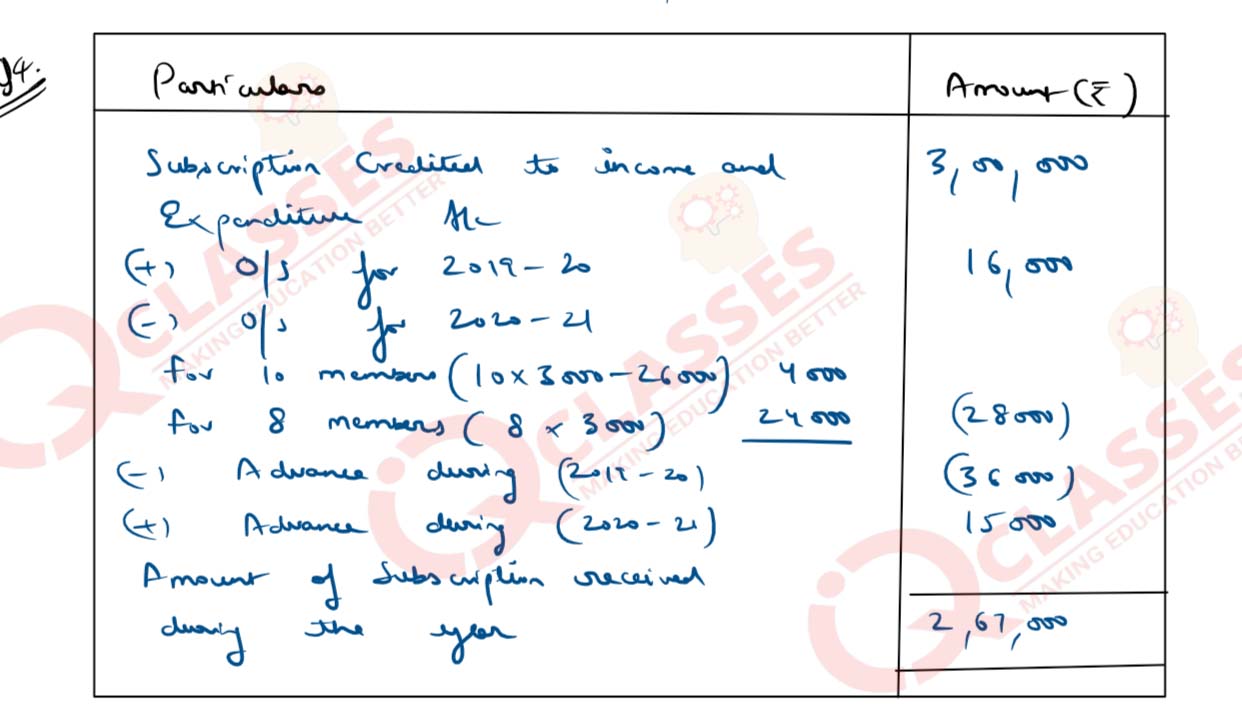

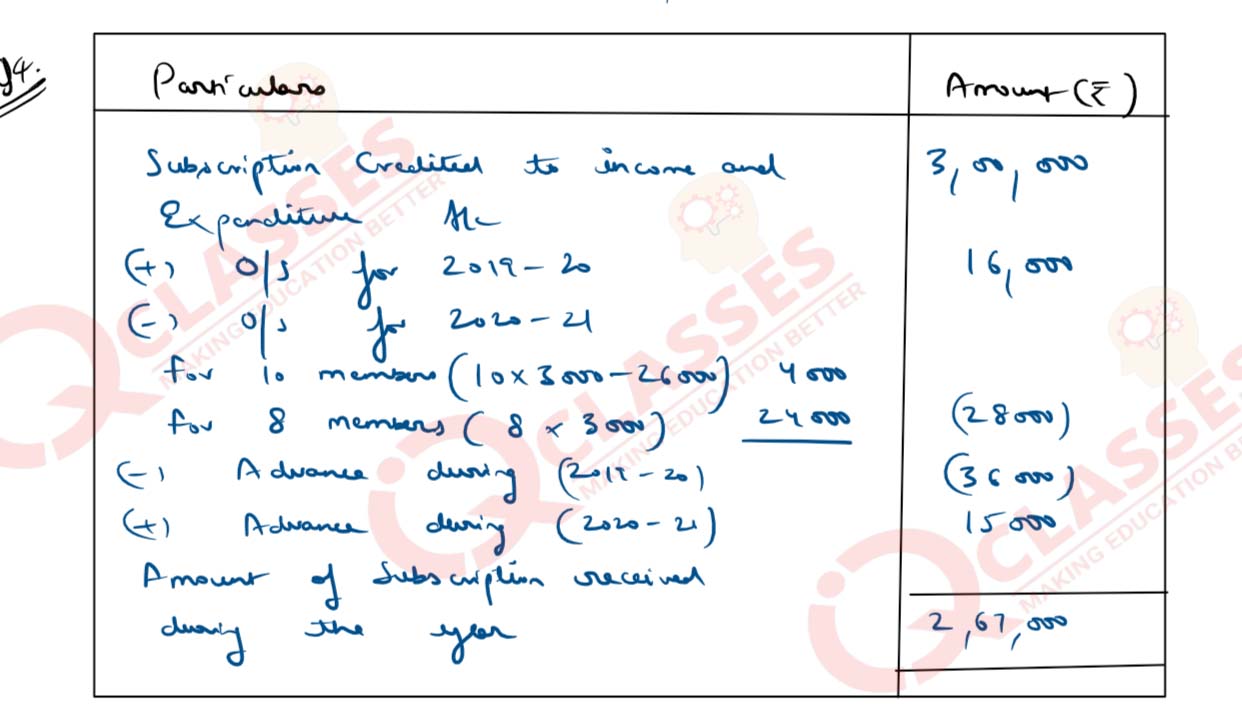

Q4

From the following information given by Modern Dance Academy,

calculate the amount of Subscription received during the year 2020-

21.

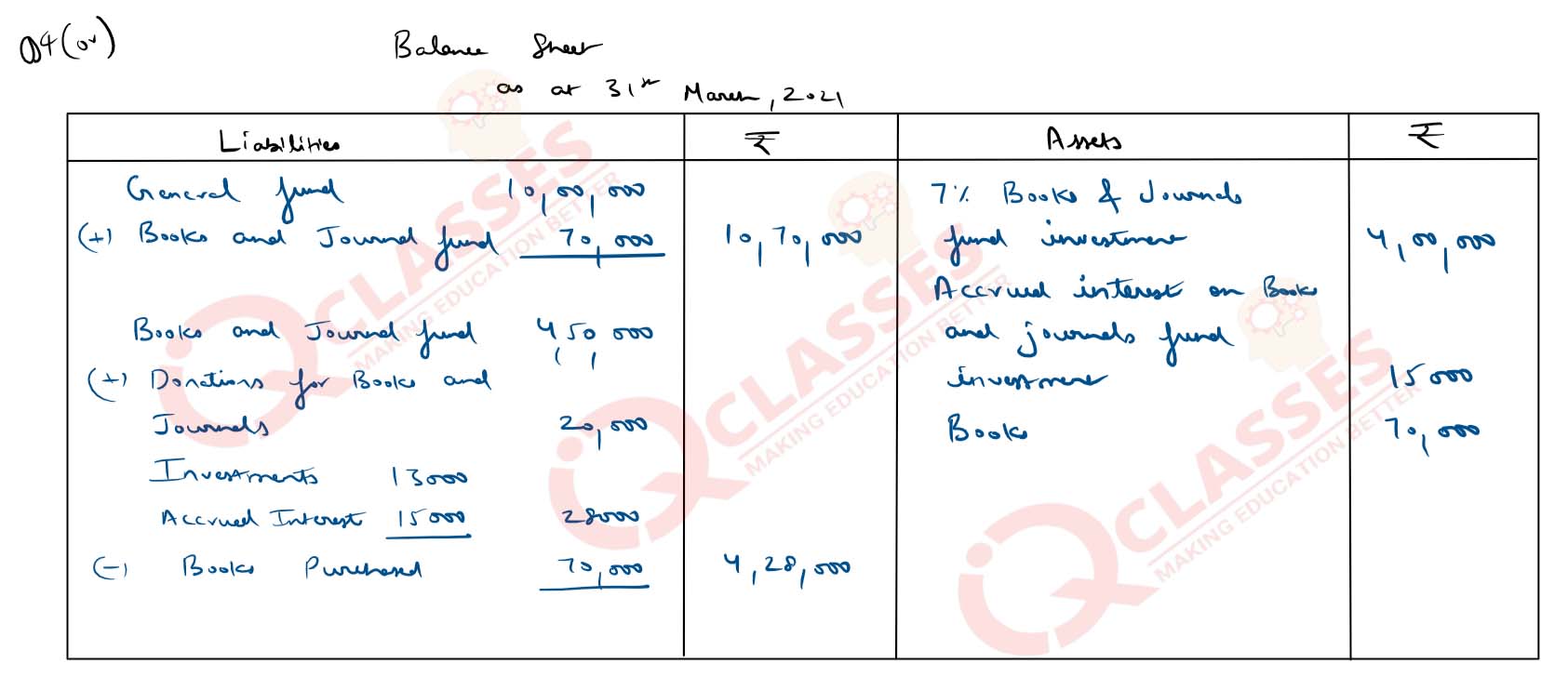

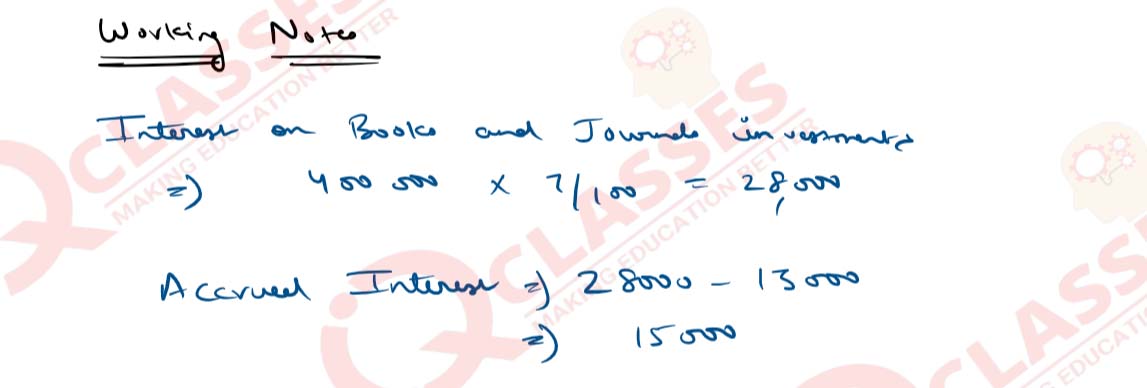

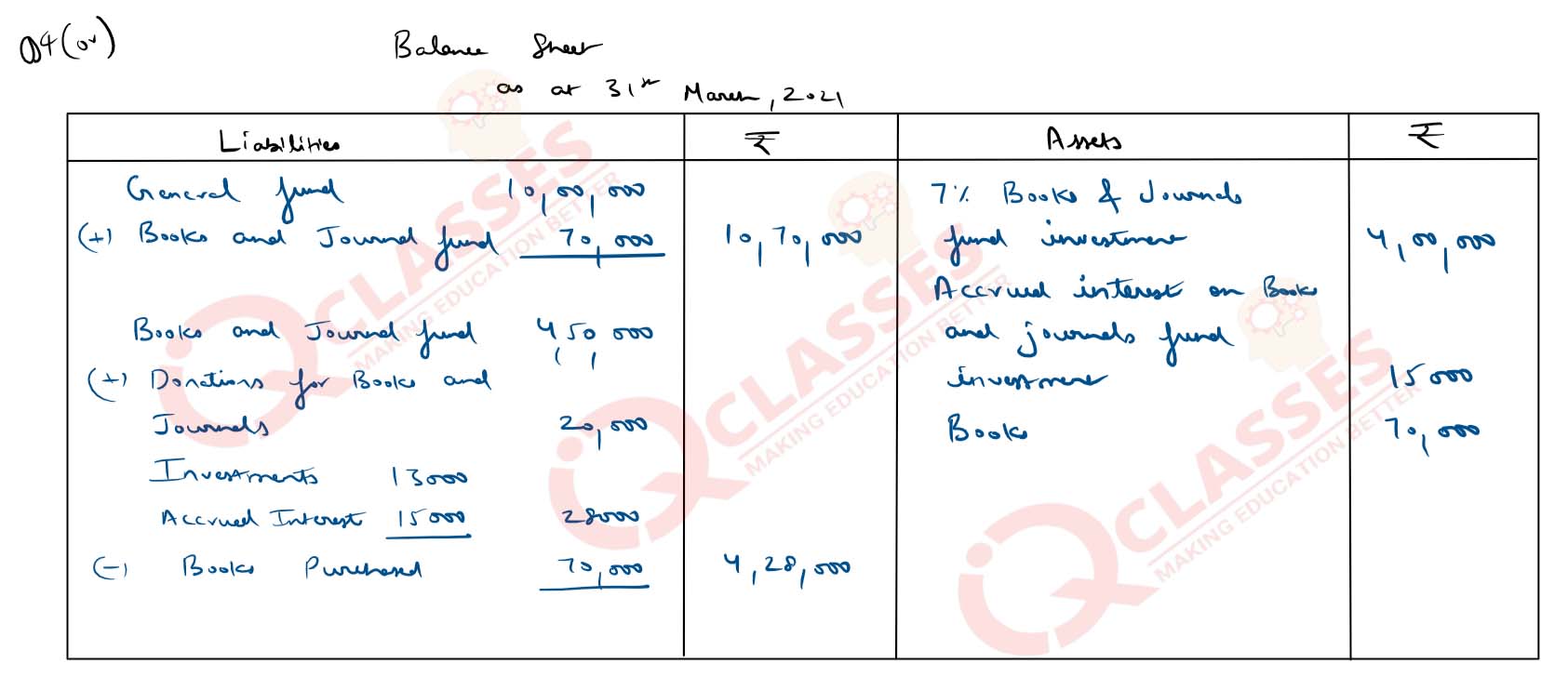

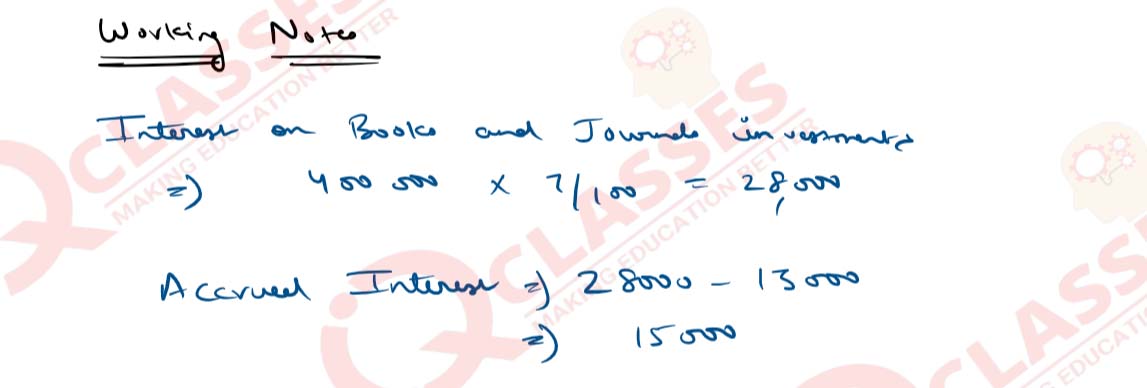

OR

Show the accounting treatment of the above-mentioned items in the

Balance Sheet of the Alchemy Medical College as at 31st March,2021.

solutions

- Subscription credited to Income & Expenditure A/c for the year ending 31st March ,2021 amounted to ₹3,00,000 and each member is required to pay an annual subscription of ₹ 3,000.

- Subscription in arrears as on 1st April 2020 amounted to ₹ 16,000.

- During the year 2020-21, 10 members made partial payment of ₹26,000 towards subscription, 8 members failed to pay the subscription amount and 5 members paid the subscription amount for the year2021-22.

- During the year 2019-20, 12 members paid the subscription amount for the year 2020-21.

OR

| Particulars | Amount (₹) |

|---|---|

| Books and Journals Fund as on 1.4.2020 | 4,50,000 |

| 7% Books and Journals Fund Investments as on 1.4.2020 | 4,00,000 |

| Interest on Books and Journals Fund Investments | 13,000 |

| Donations for Books and Journals | 20,000 |

| Cash purchases of medicines during the year 2020-21 | 2,00,000 |

| Credit purchases of medicines duringthe year 2020-21 | 6,00,000 |

| Books Purchased | 70,000 |

| General Fund as on 1.4.2020 | 10,00,000 |

solutions

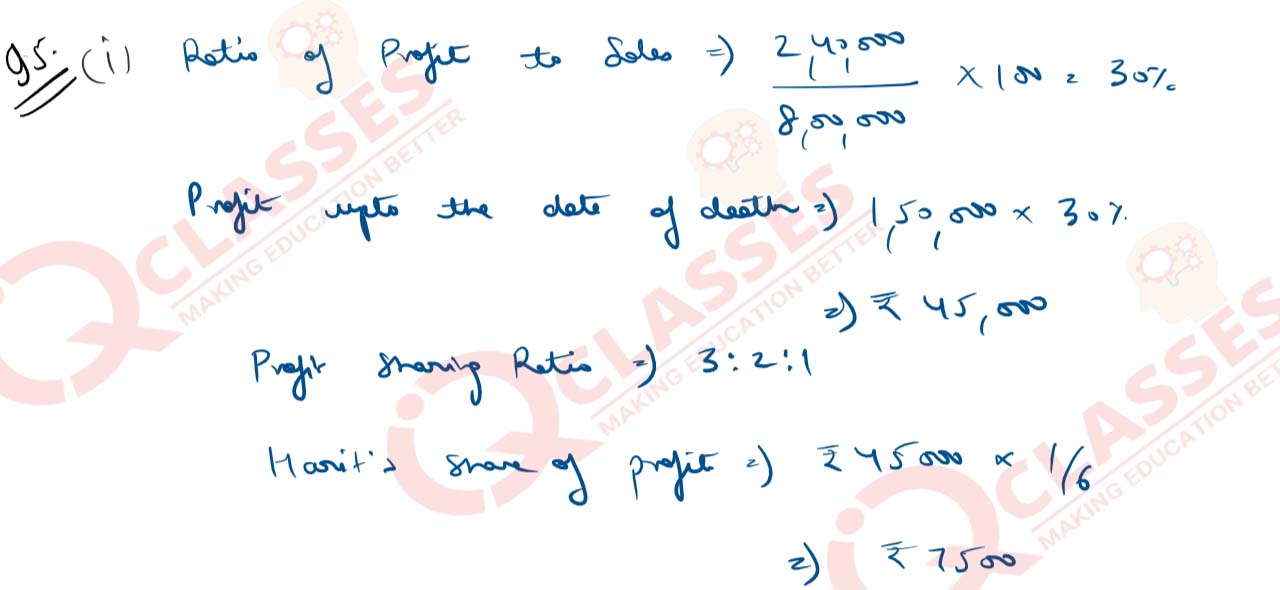

Q5

Harihar, Hemang and Harit were partners with fixed capitals of

₹3,00,000, ₹ 2,00,000 & ₹ 1,00,000 respectively. They shared profits

in the ratio of their fixed capitals. Harit died on 31st May, 2020,

whereas the firm closes its books of accounts on 31st March every

year. According to their partnership deed, Harit’s representatives

would be entitled to get share in the interim profits of the firm on the

basis of sales. Sales and profit for the year 2019-20 amounted to

₹8,00,000 and ₹2,40,000 respectively and sales from 1st April, 2020

to 31st May 2020 amounted to ₹ 1,50,000. The rate of profit to sales

remained constant during these two years. You are required to:

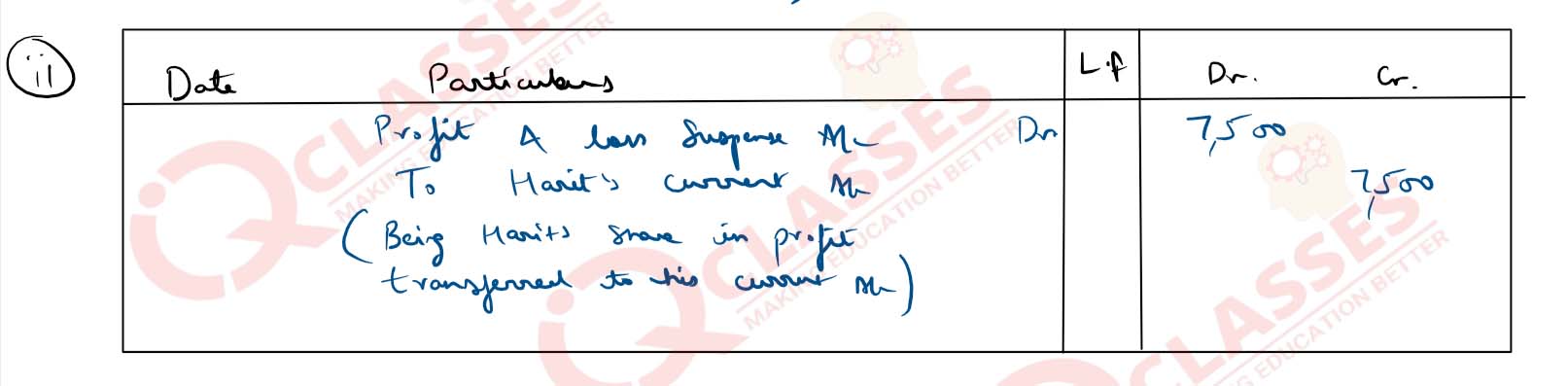

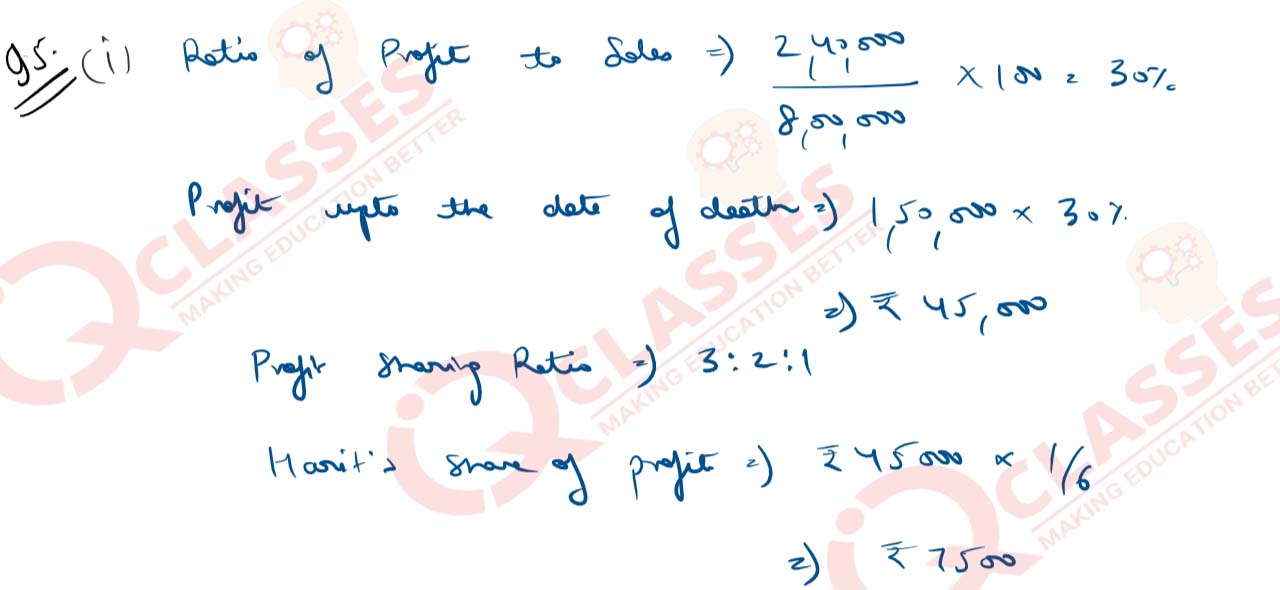

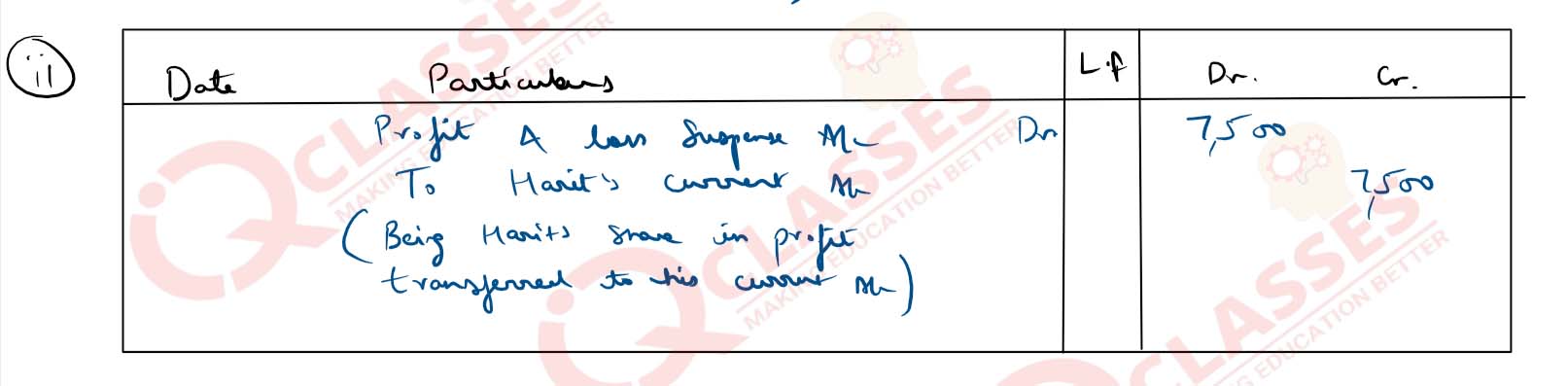

solutions

- Calculate Harit’s share in profit

- Pass journal entry to record Harit’s share in profit

solutions

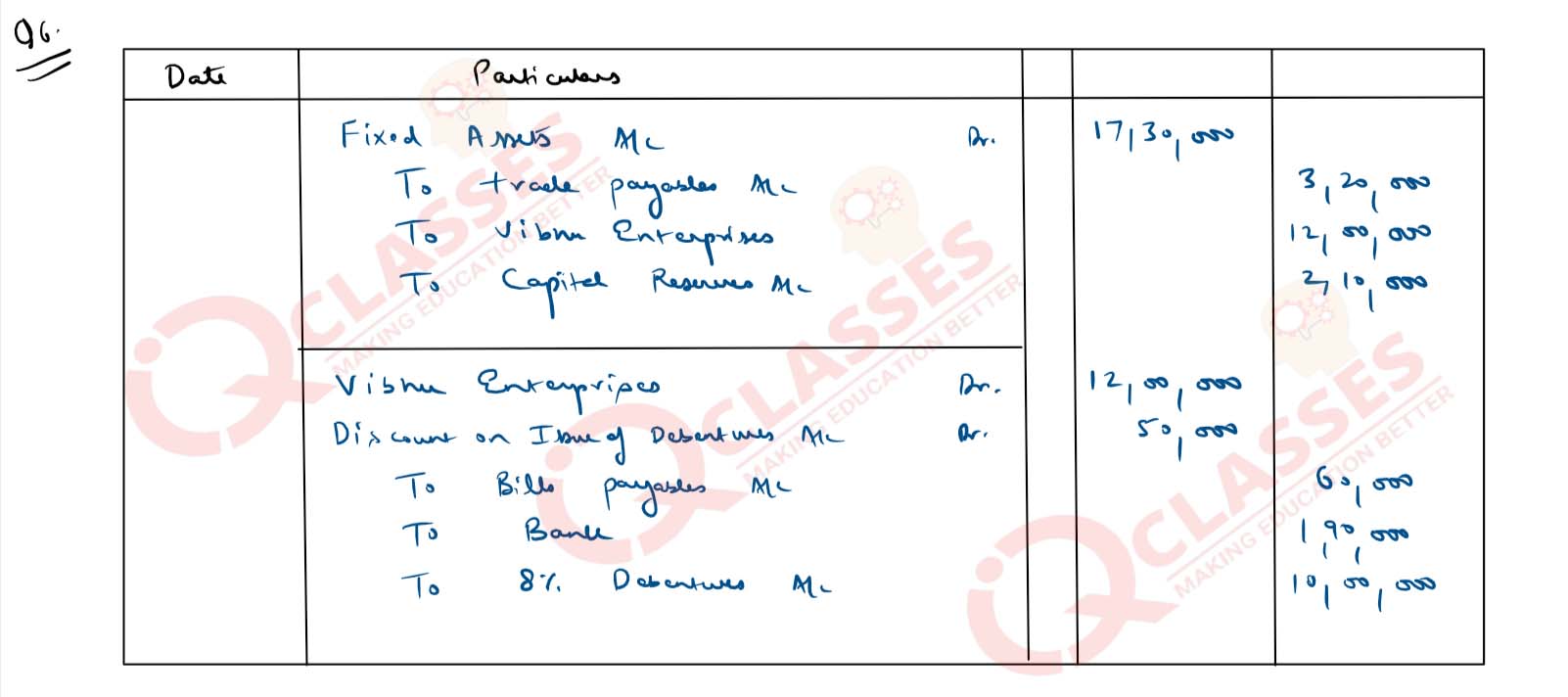

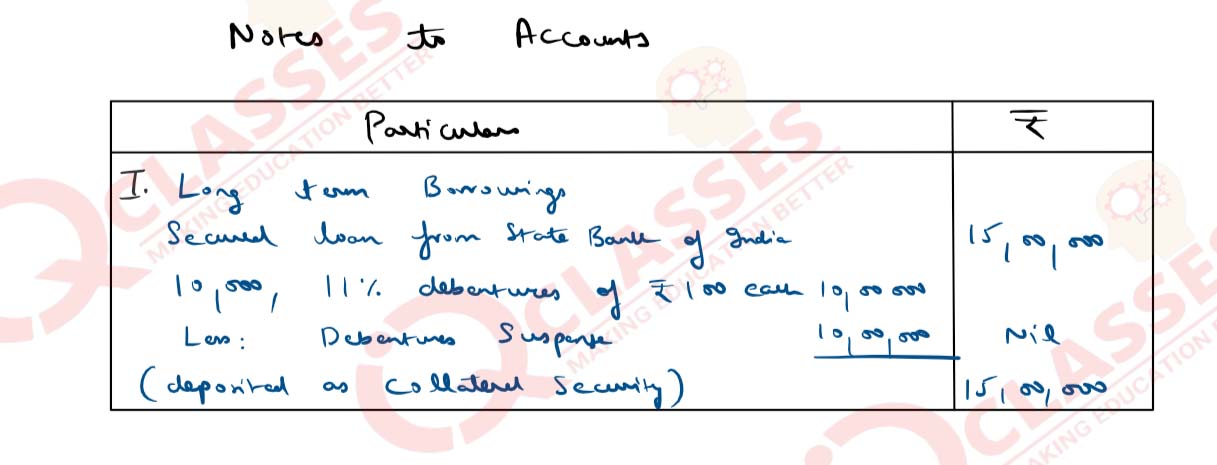

Q6

Vedesh Ltd. purchased a running business of Vibhu Enterprises for a

sum of ₹ 12,00,000. Vedesh Ltd. paid ₹ 60,000 by drawing a

promissory note in favour of Vibhu Enterprises., ₹1,90,000 through

bank draft and balance by issue of 8% debentures of ₹ 100 each at a

discount of 5%. The assets and liabilities of Vibhu Enterprises

consisted of Fixed Assets valued at ₹ 17,30,000 and Trade Payables

at ₹ 3,20,000.

You are required to pass necessary journal entries in the books of Vedesh Ltd.

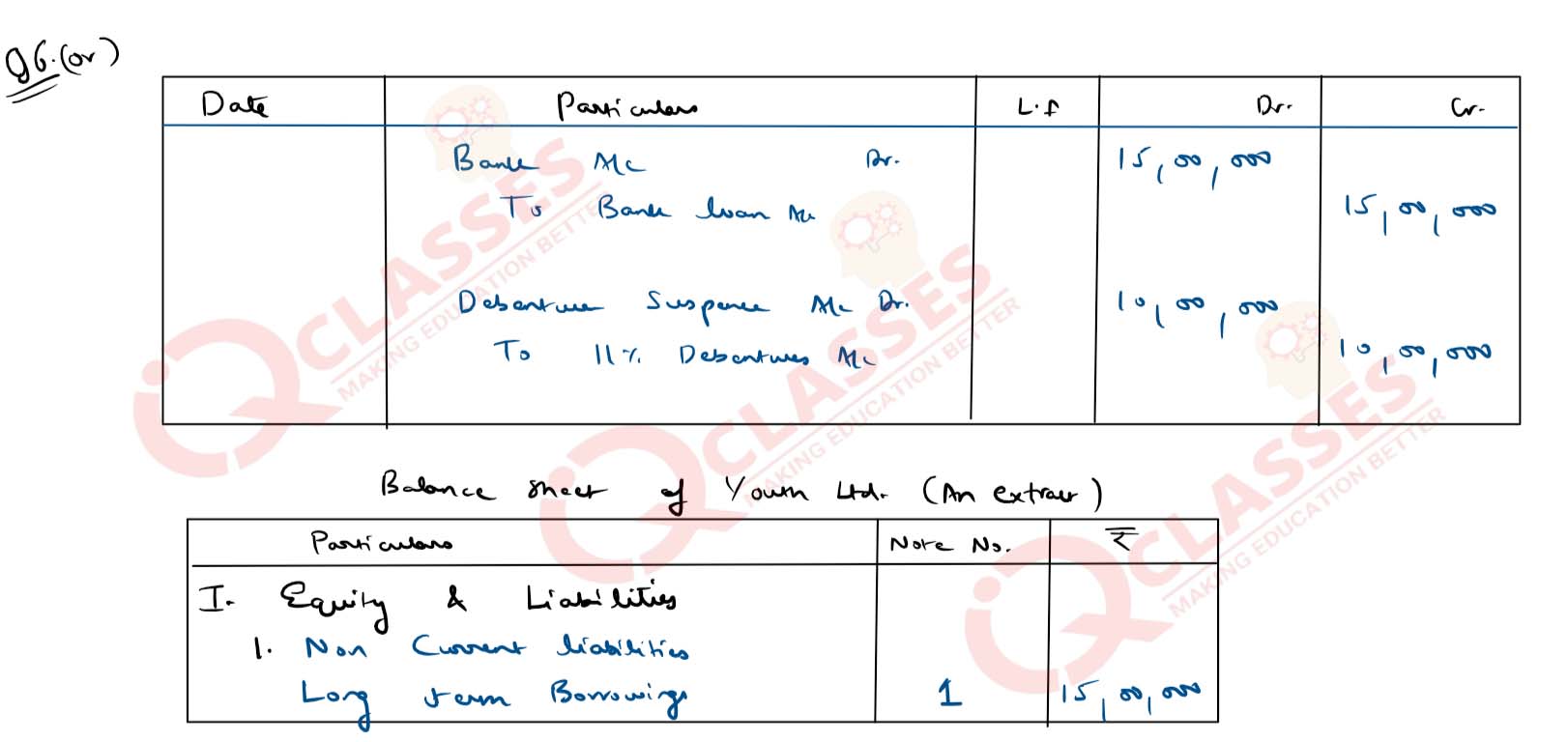

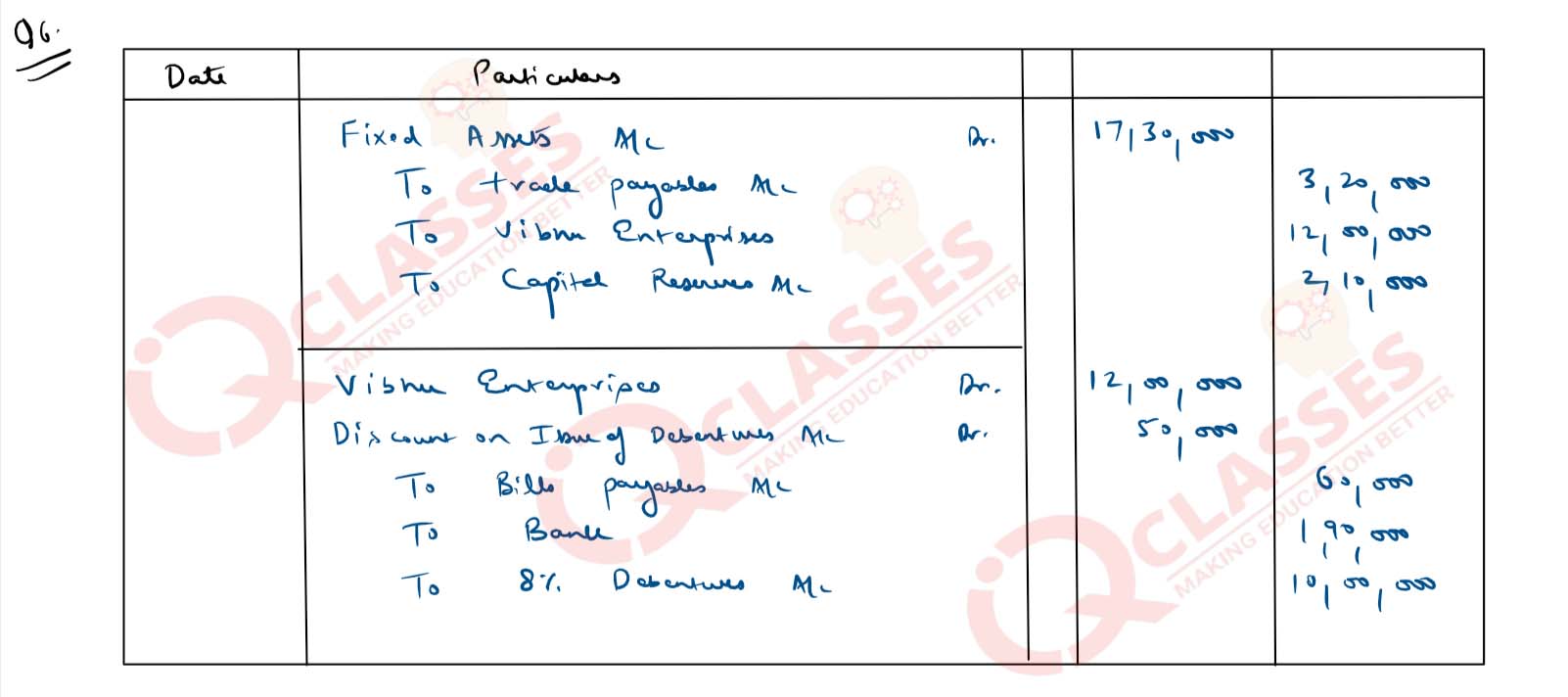

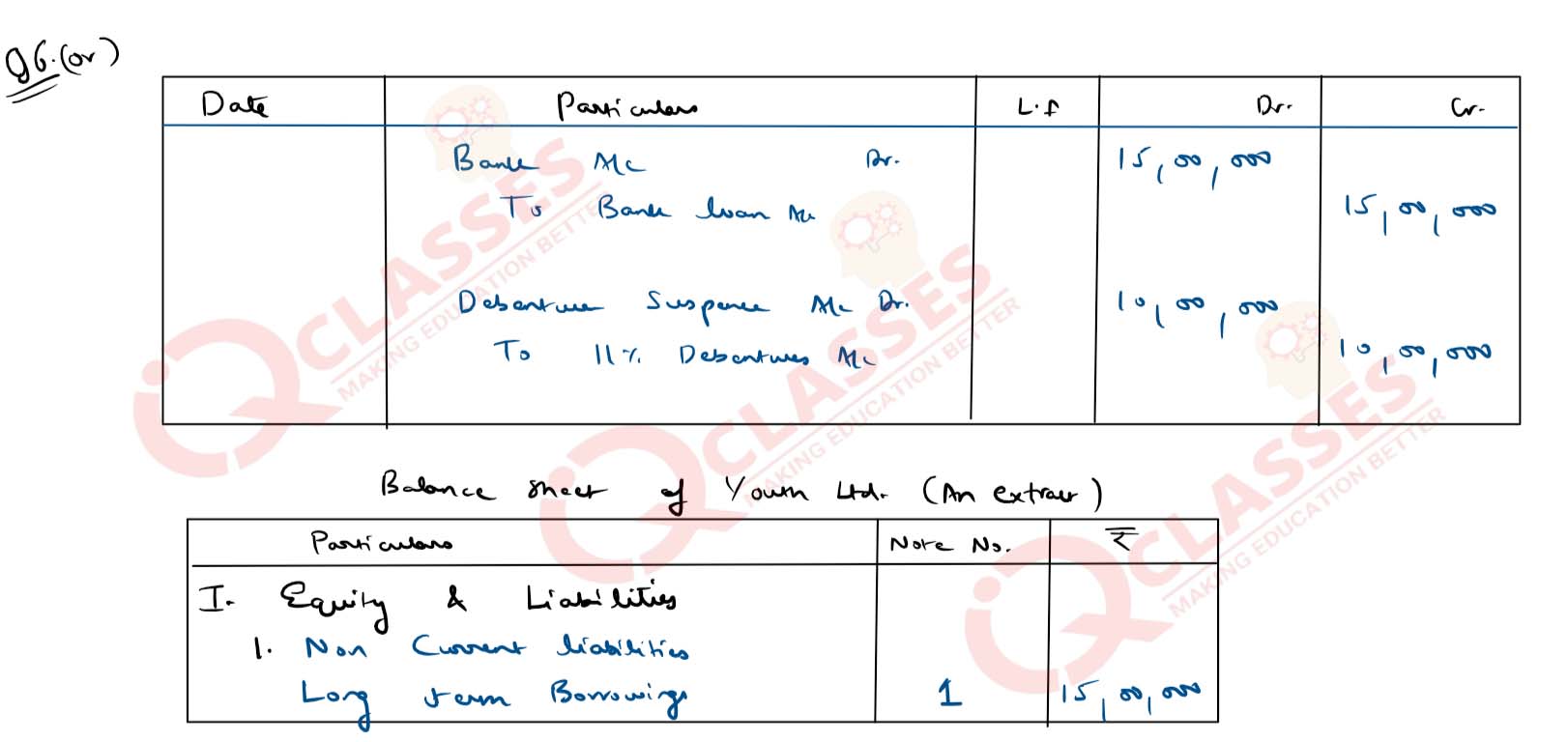

OR

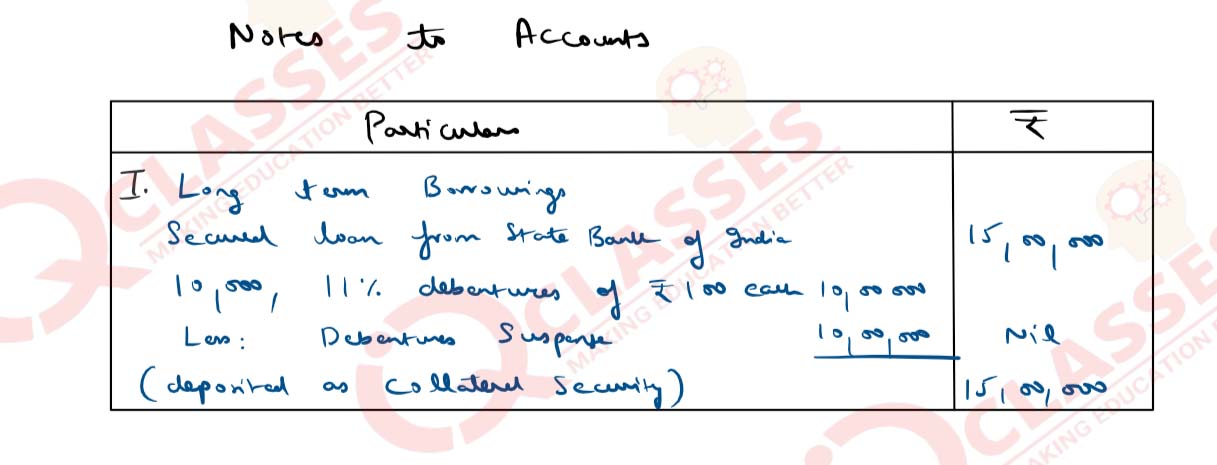

Youth Ltd. took a loan of ₹ 15,00,000 from State Bank of India against the security of tangible assets. In addition to principal security, it issued 10,000 11% debentures of ₹ 100 each as collateral security.

Pass necessary journal entries for the above transactions, if the company decided to record the issue of 11% debentures as collateral security and show the presentation in the Balance Sheet of Youth Ltd.

solutions

You are required to pass necessary journal entries in the books of Vedesh Ltd.

OR

Youth Ltd. took a loan of ₹ 15,00,000 from State Bank of India against the security of tangible assets. In addition to principal security, it issued 10,000 11% debentures of ₹ 100 each as collateral security.

Pass necessary journal entries for the above transactions, if the company decided to record the issue of 11% debentures as collateral security and show the presentation in the Balance Sheet of Youth Ltd.

solutions

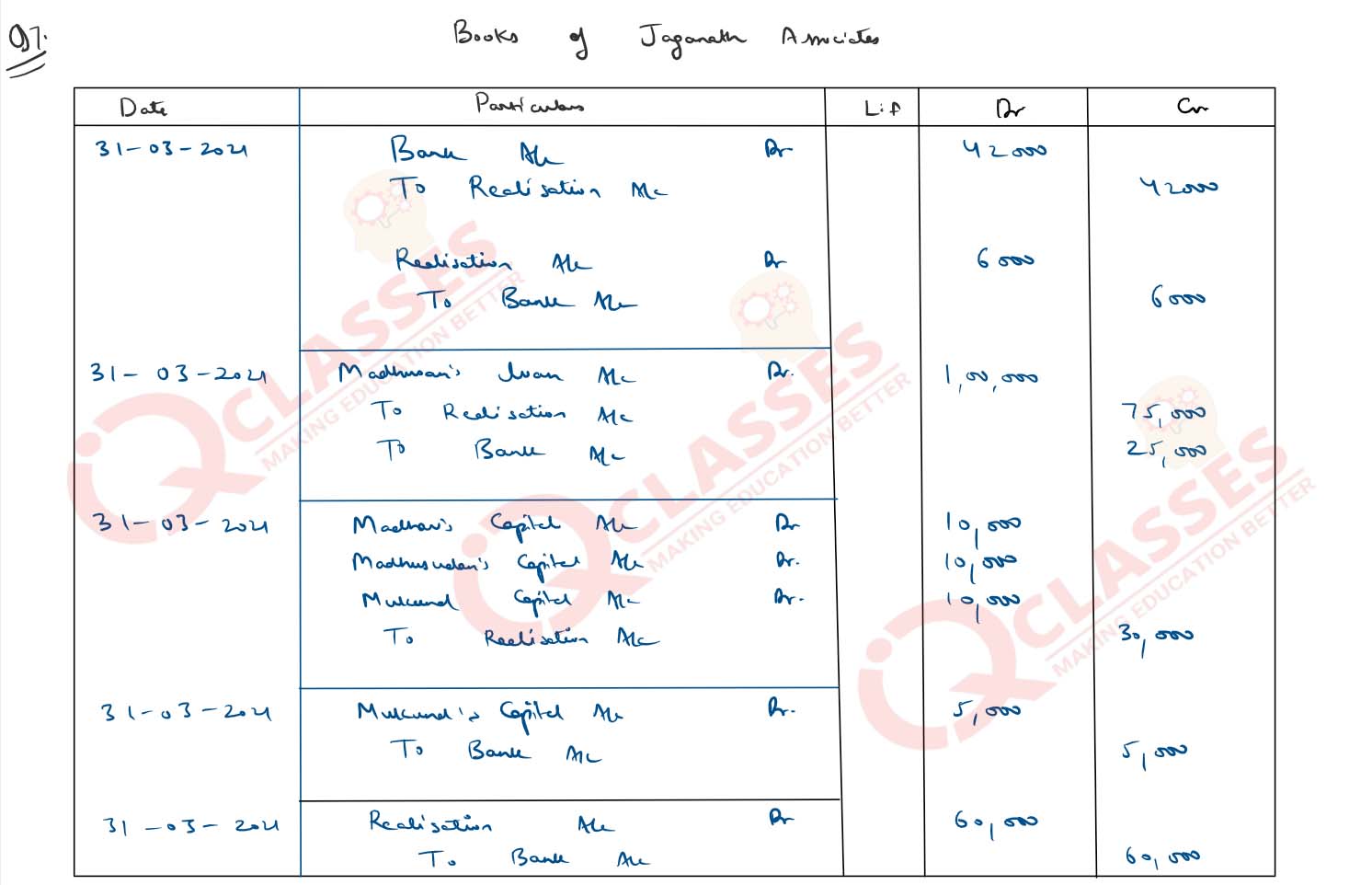

Q7

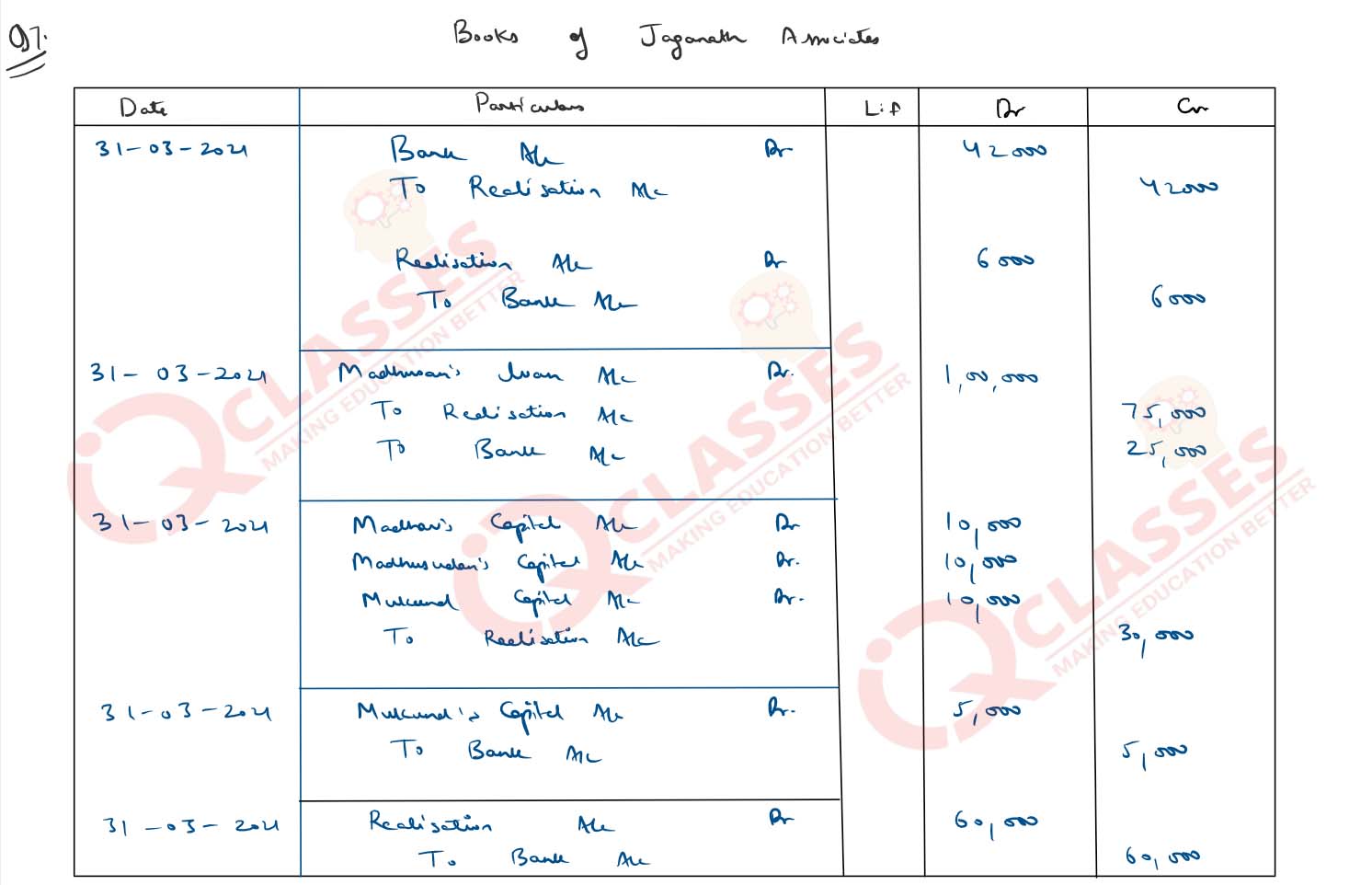

Madhav, Madhusudan and Mukund were partners in Jaganath

Associates. They decided to dissolve the firm on 31st March 2021.

Pass necessary journal entries for the following transactions after

various assets (other than cash) and third-party liabilities have been

transferred to realization account:

OR

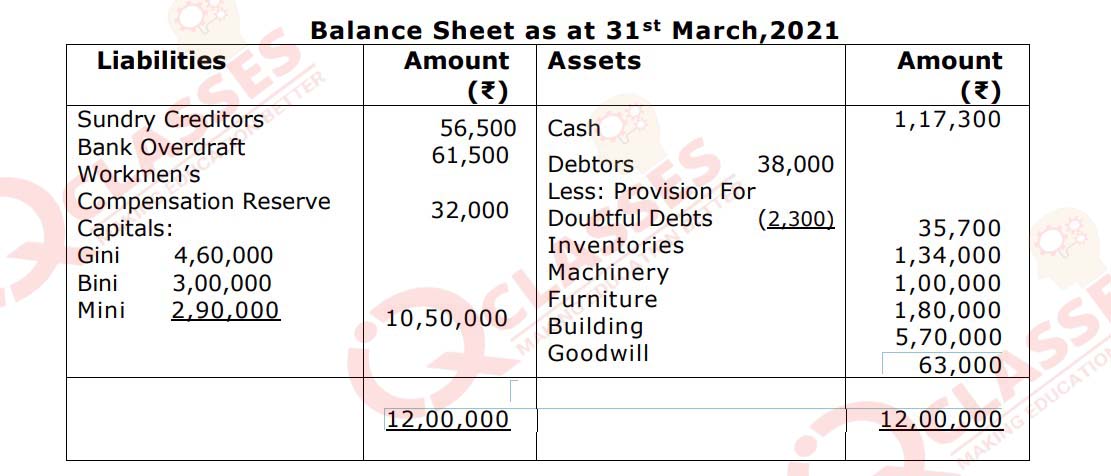

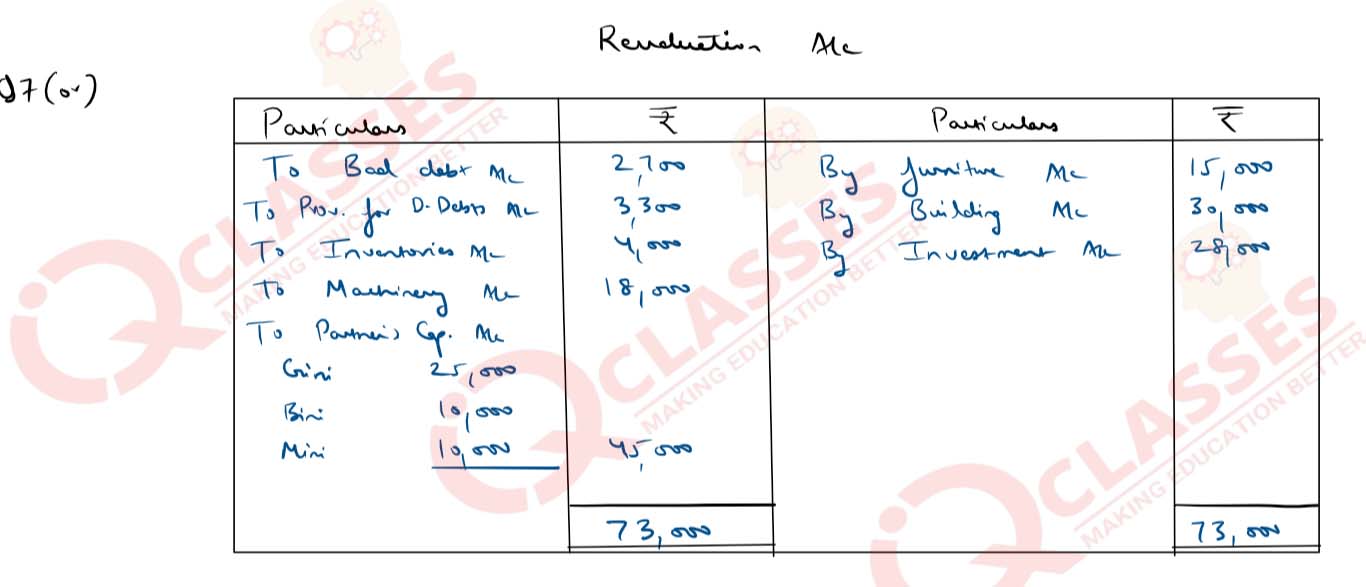

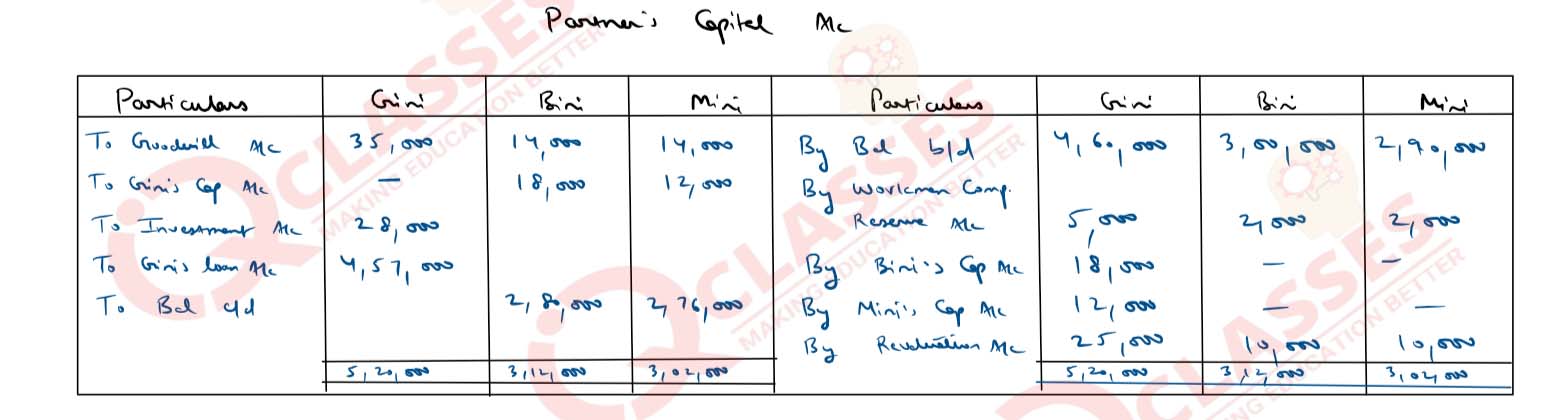

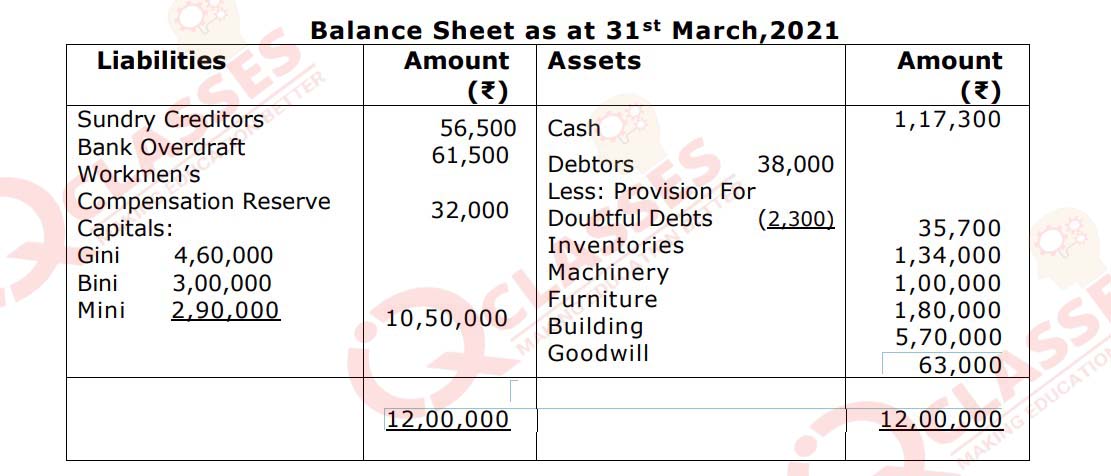

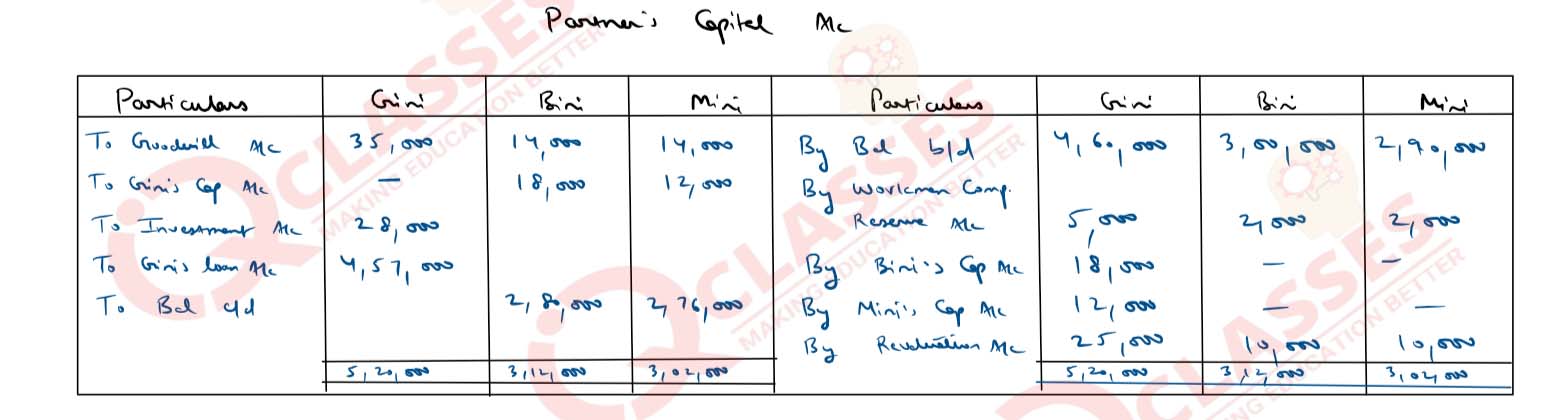

Gini, Bini and Mini were in partnership sharing profits and losses in the ratio of 5:2:2. Their Balance Sheet as at 31st March, 2021 was as follows:

On 31st March, 2021, Gini retired from the firm. All the partners agreed to revalue the assets and liabilities on the following basis:

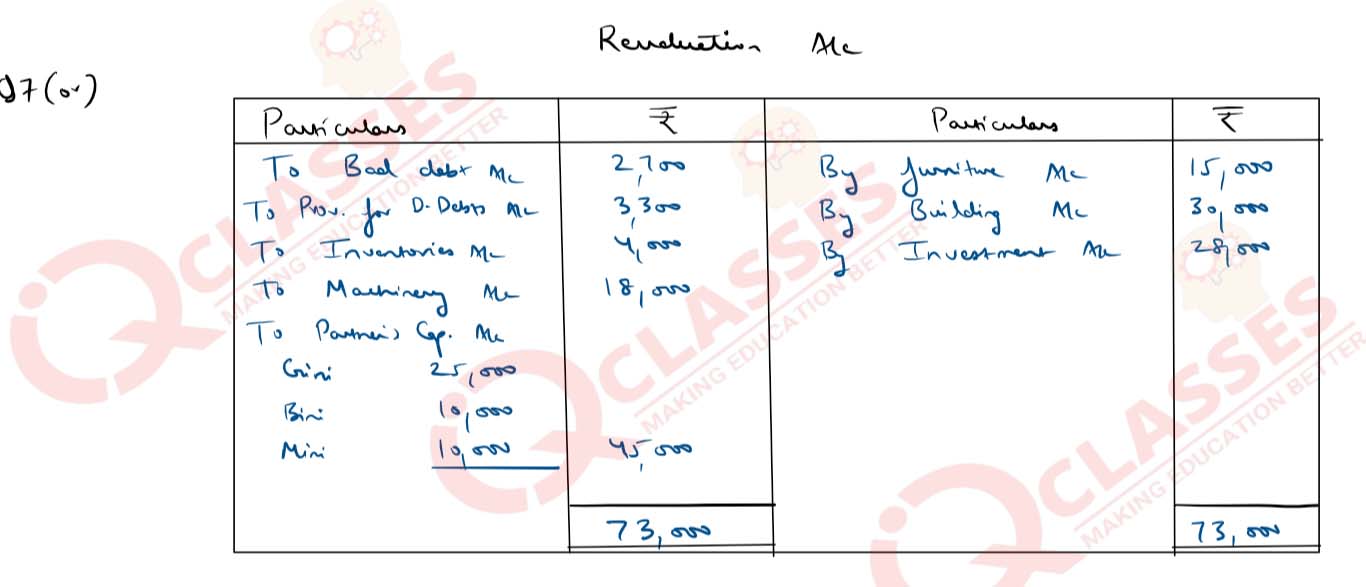

Prepare Revaluation Account and Partners’ Capital Accounts as on 31st March, 2021.

solutions

- Old machine fully written off was sold for ₹ 42,000 while a payment of ₹ 6,000 is made to bank for a bill discounted being dishonoured.

- Madhusudan accepted an unrecorded asset of ₹80,000 at ₹75,000 and the balance through cheque, against the payment of his loan to the firm of ₹1,00,000

- Stock of book value of ₹30,000 was taken by Madhav, Madhusudan and Mukund in their profit sharing ratio

- The firm had paid realization expenses amounting to ₹5,000 on behalf of Mukund.

- There was a vehicle loan of ₹ 2,00,000 which was paid by surrender of asset to the bank at an agreed value of ₹ 1,40,000 and the shortfall was met from firm’s bank account.

OR

Gini, Bini and Mini were in partnership sharing profits and losses in the ratio of 5:2:2. Their Balance Sheet as at 31st March, 2021 was as follows:

On 31st March, 2021, Gini retired from the firm. All the partners agreed to revalue the assets and liabilities on the following basis:

- Bad debts amounted to ₹ 5,000. A provision for doubtful debts was to be maintained at 10% on debtors

- Partners have decided to write off existing goodwill.

- Goodwill of the firm was valued at ₹ 54,000 and be adjusted into the Capital Accounts of Bini and Mini, who will share profits in future in the ratio of 5:4.

- The assets and liabilities valued as: Inventories ₹1,30,000; Machinery ₹ 82,000; Furniture ₹1,95,000 and Building ₹ 6,00,000.

- Liability of ₹23,000 is to be created on account of Claim for Workmen Compensation.

- There was an unrecorded investment in shares of ₹ 25,000. It was decided to pay off Gini by giving her unrecorded investment in full settlement of her part payment of ₹ 28,000 and remaining amount after two months.

Prepare Revaluation Account and Partners’ Capital Accounts as on 31st March, 2021.

solutions

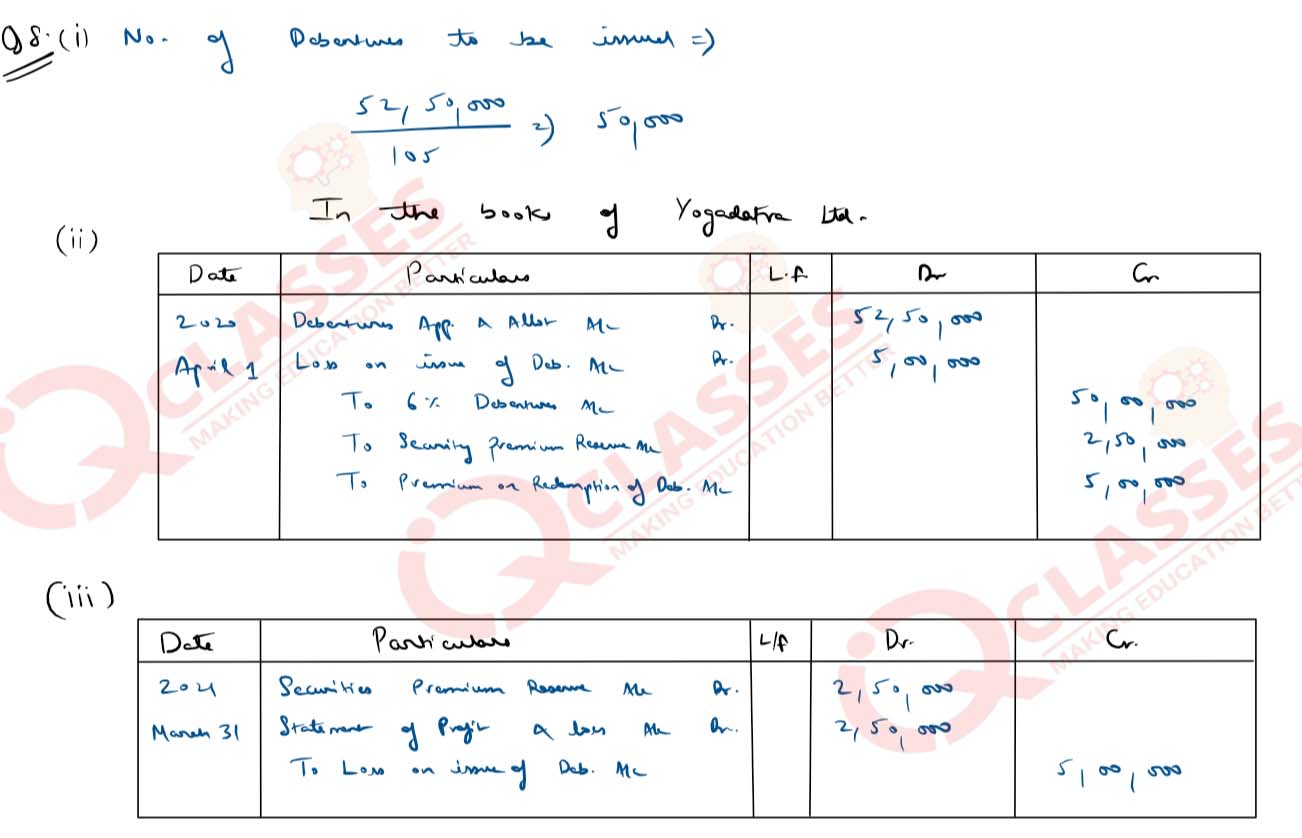

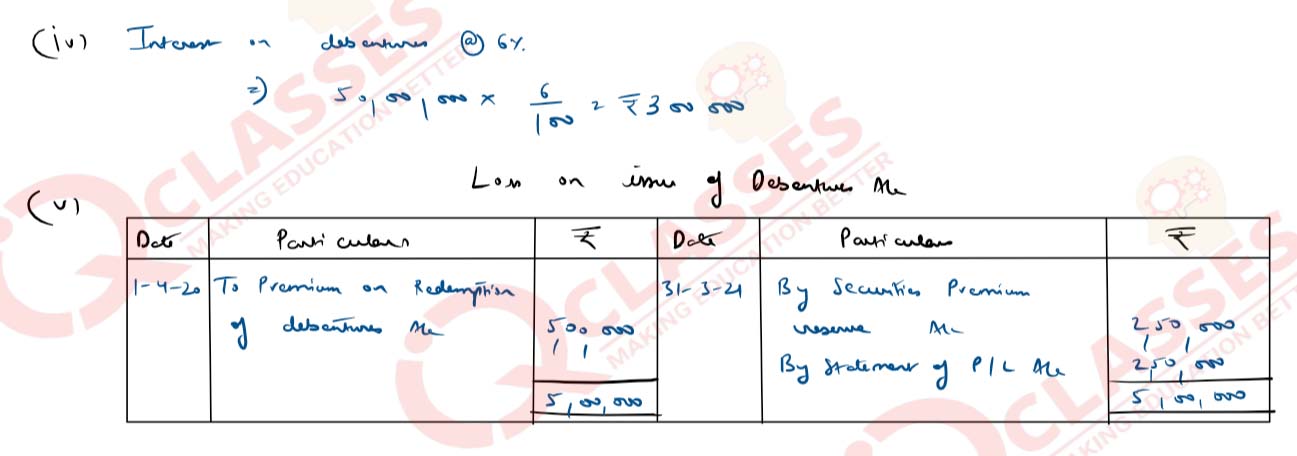

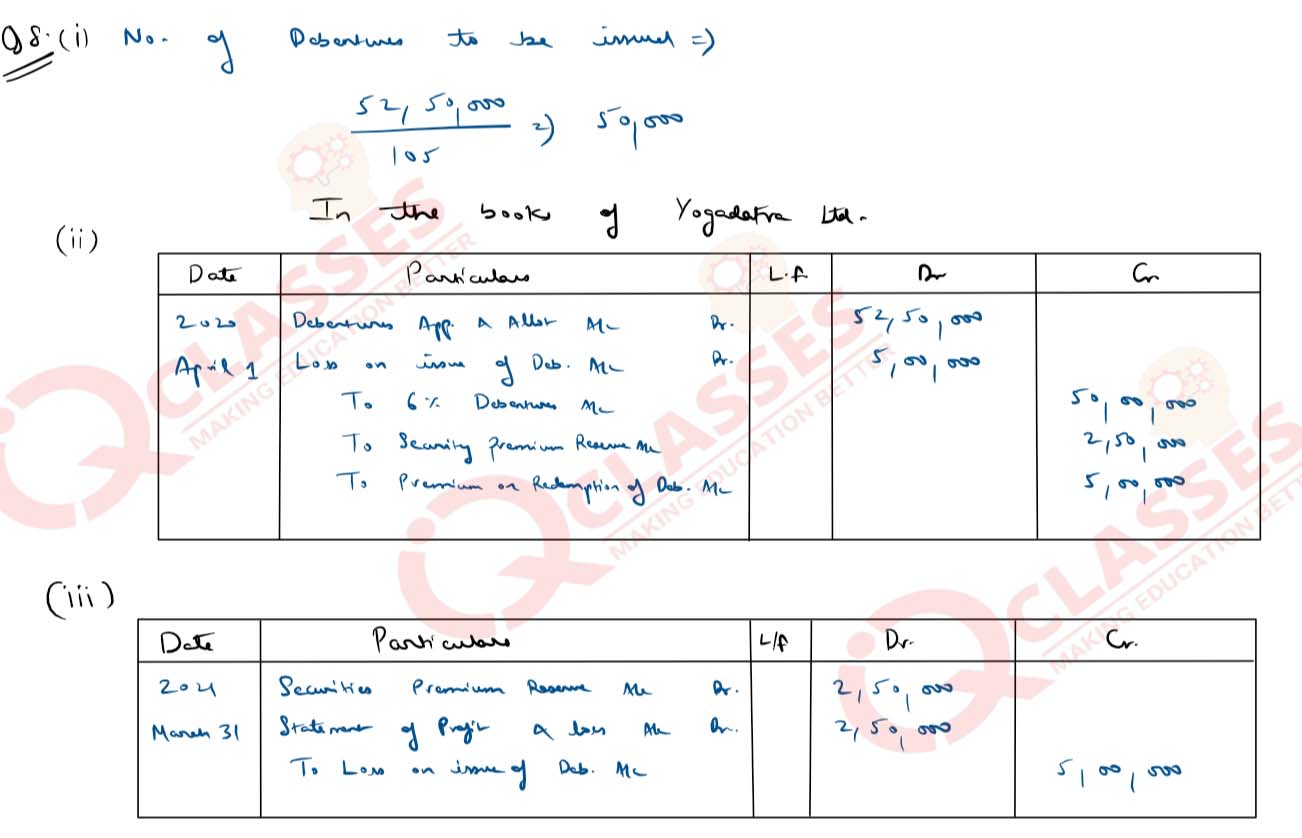

Q8

Yogadatra Ltd. (pharmaceutical company) appointed marketing expert,

Mr. Kartikay as the CEO of the company, with a target to penetrate their

roots in the rural regions. Mr. kartikay discussed the ways and means to

achieve target of the company with financial, production and marketing

departmental heads and asked the finance manager to prepare the

budget. After reviewing the suggestions given by all the departmental

heads, the finance manager proposed requirement of an additional fund

of ₹52,50,000.

Yogadatra Ltd. is a zero-debt company. To avail the benefits of financial leverage, the finance manager proposed to include debt in the capital structure. After deliberations, on April1,2020, the board of directors had decided to issue 6% Debentures of ₹100 each to the public at a premium of 5%, redeemable after 5 years at ₹110 per share.

You are required to answer the following questions:

solutions

Yogadatra Ltd. is a zero-debt company. To avail the benefits of financial leverage, the finance manager proposed to include debt in the capital structure. After deliberations, on April1,2020, the board of directors had decided to issue 6% Debentures of ₹100 each to the public at a premium of 5%, redeemable after 5 years at ₹110 per share.

You are required to answer the following questions:

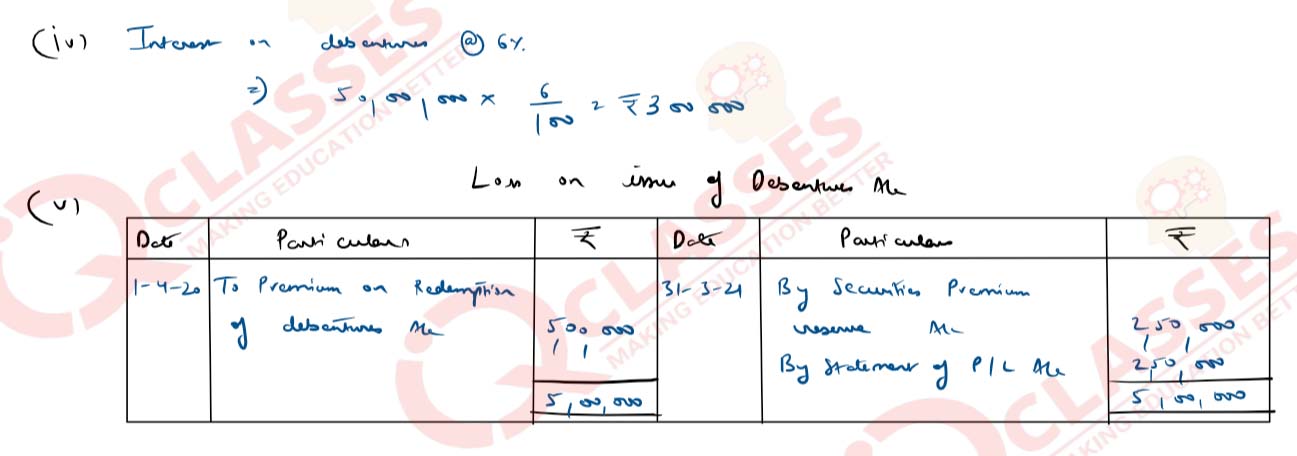

- Calculate the number of debentures to be issued to raise additional funds.

- Pass Journal entry for the allotment of debentures.

- Pass Journal entry to write off loss on issue of debentures

- Calculate the amount of annual fixed obligation associated with debentures.

- Prepare Loss on Issue of Debentures Account.

solutions

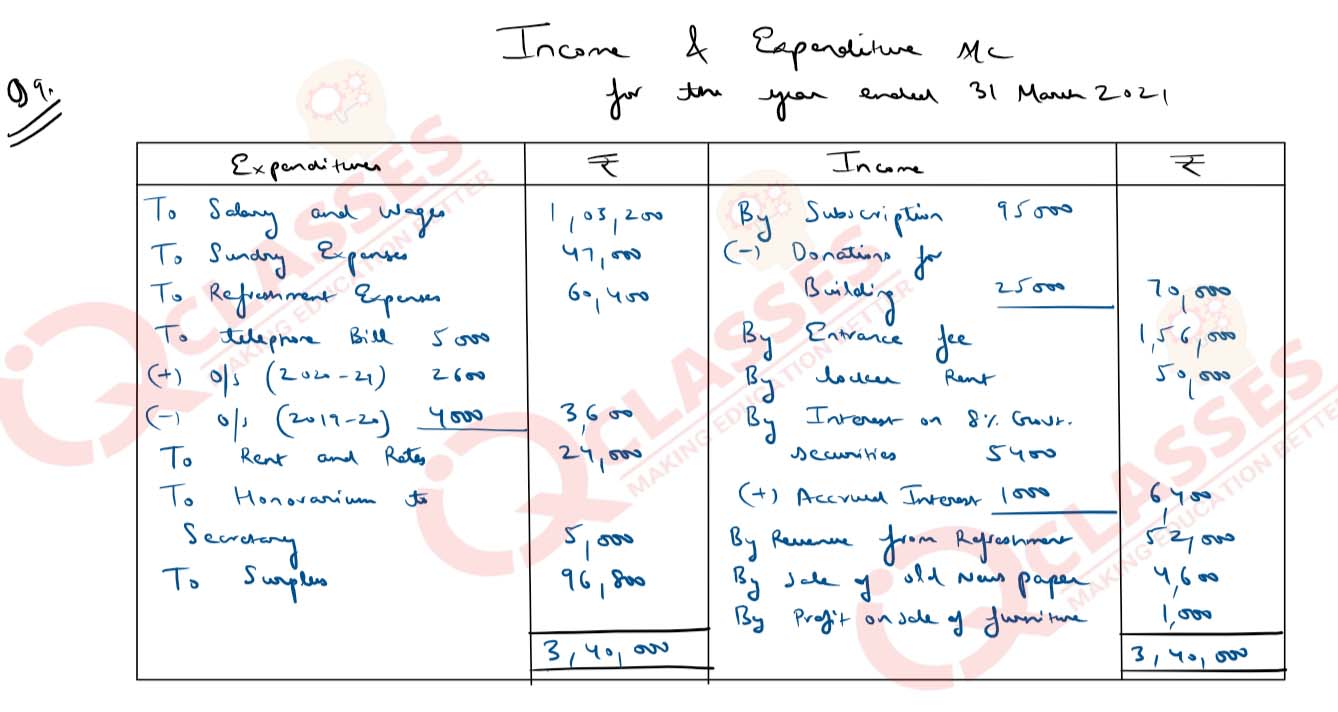

Q9

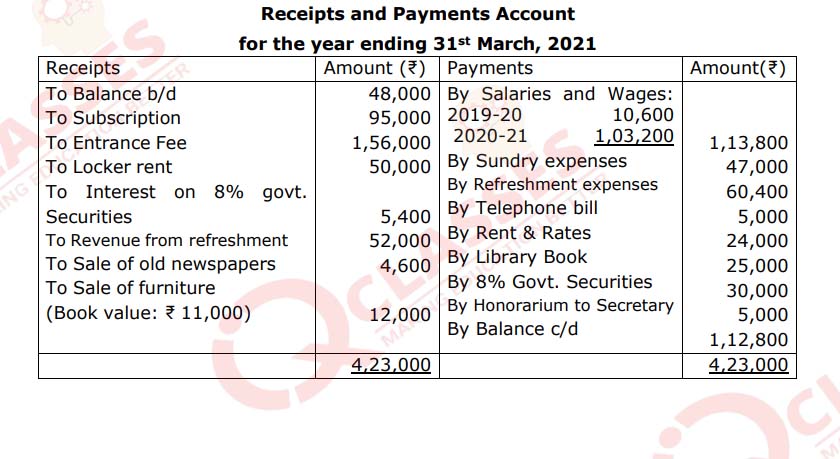

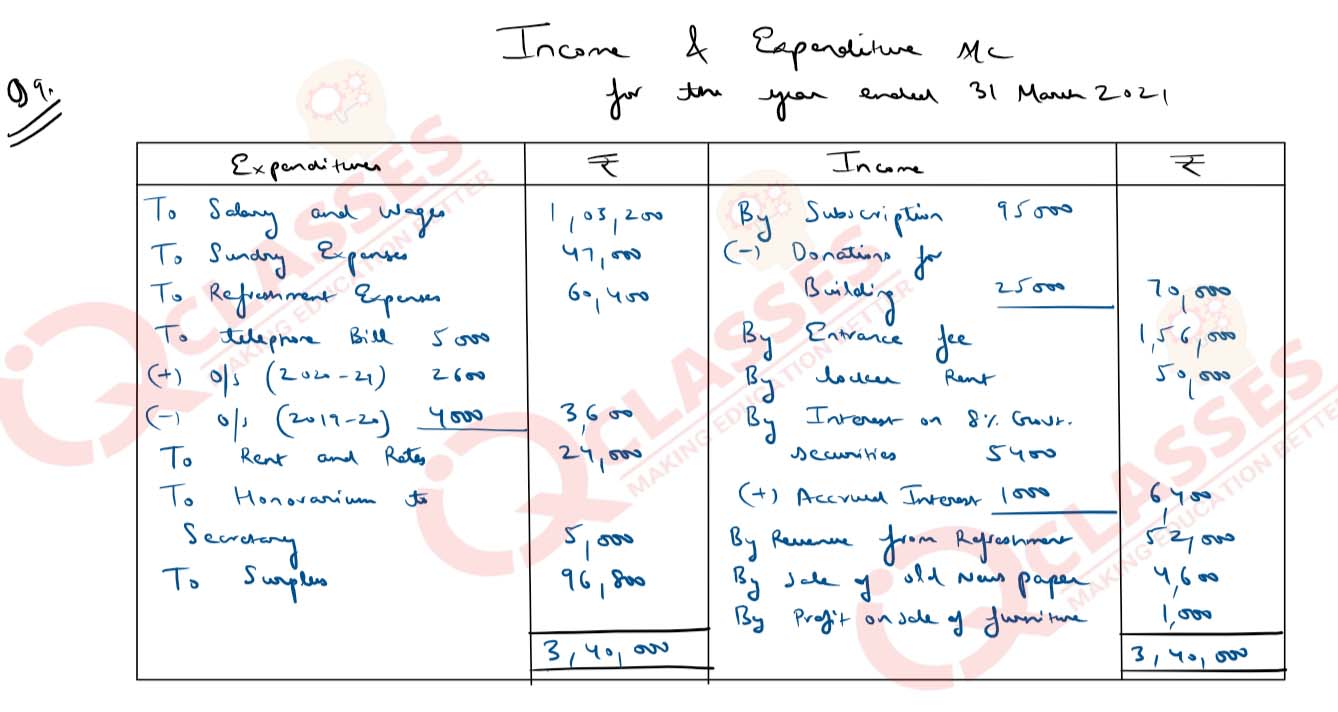

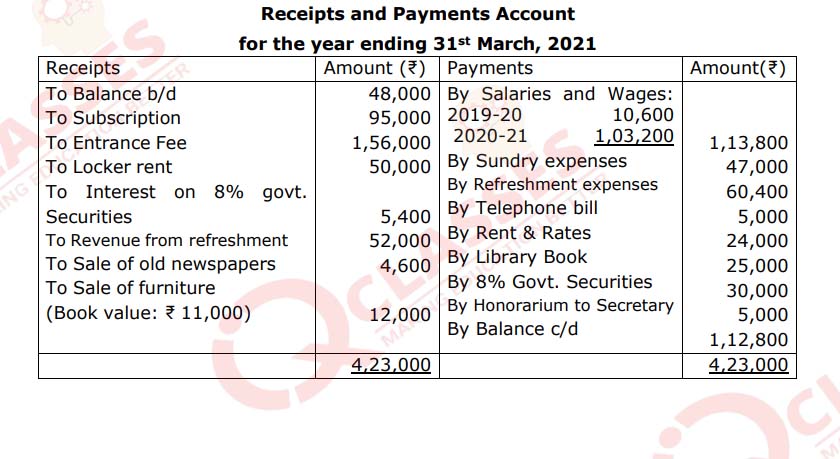

From the following Receipts and Payments Account and additional

information provided by Ramanath Club, Prepare Income and

Expenditure Account for the year ending on 31st March 2021.

Additional Information:

solutions

Additional Information:

- Subscription received during the year includes ₹ 25,000 as donation for Building.

- Telephone bill unpaid as on March 31, 2020 was ₹ 4,000 and on March 31, 2021 ₹ 2,600.

- Value of 8% Government Securities on March 31, 2020 was ₹ 80,000.

- Value of 8% Government Securities on March 31, 2020 was ₹ 80,000.

solutions

Q10

State whether the following transactions will result in inflow, outflow or

no flow of cash while preparing cash flow statement:

solutions

- Decrease in outstanding employees benefits by ₹3000

- Increase in Current Investment by ₹ 6,000.

solutions

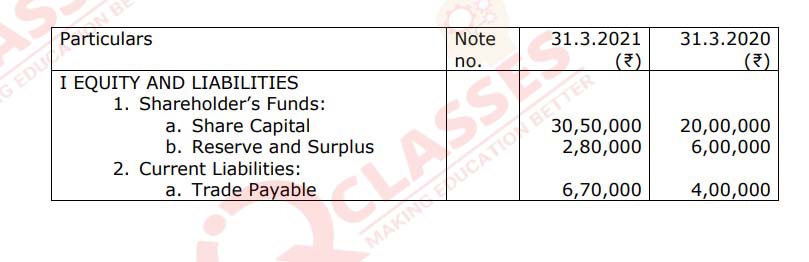

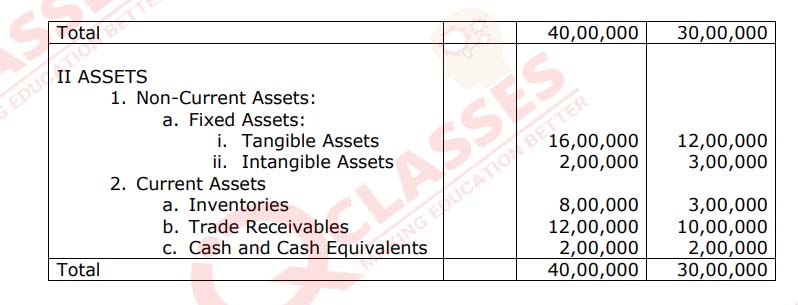

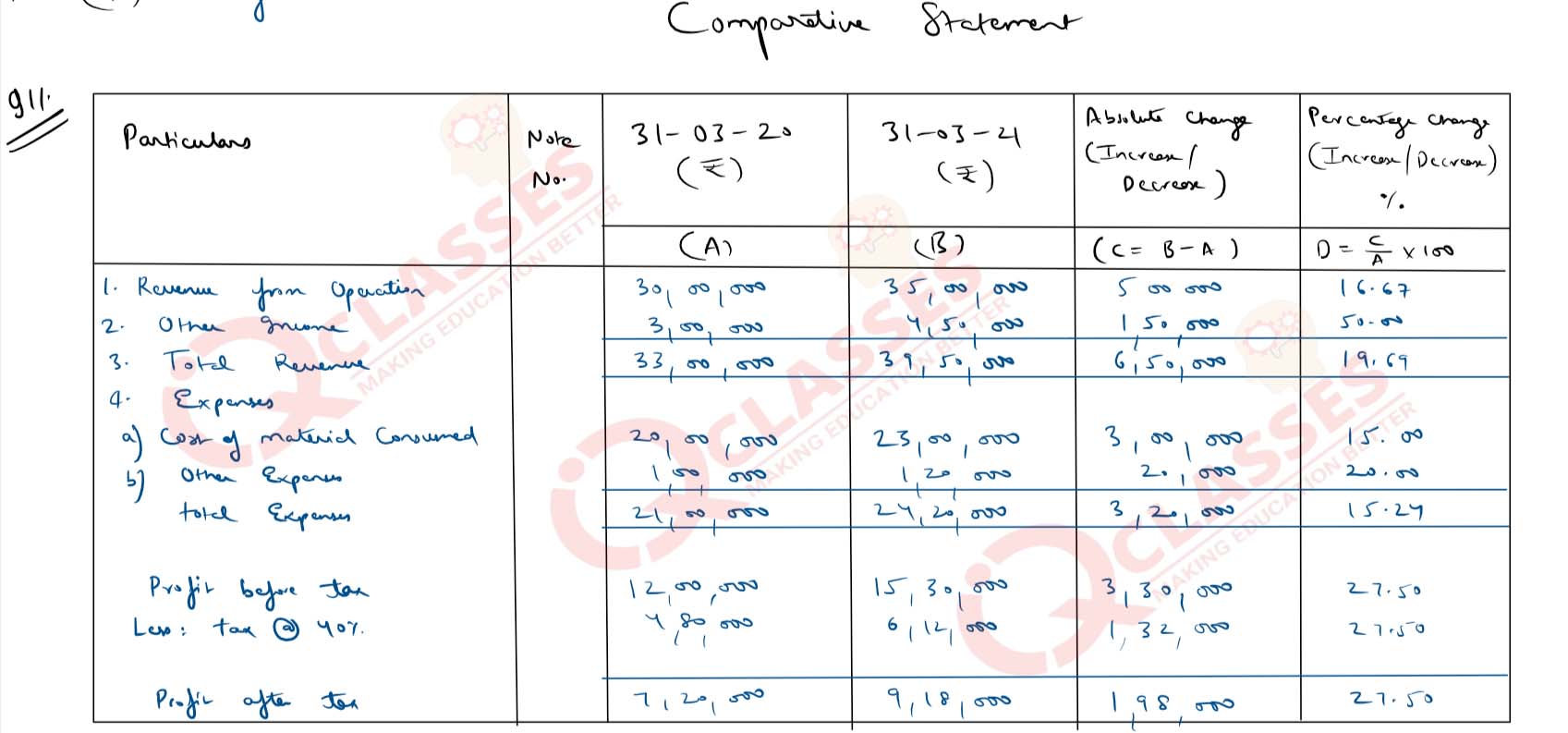

Q11

From the following details provided by Kumud Ltd., prepare

Comparative Statement of Profit & Loss for the year ended 31st March

2021:

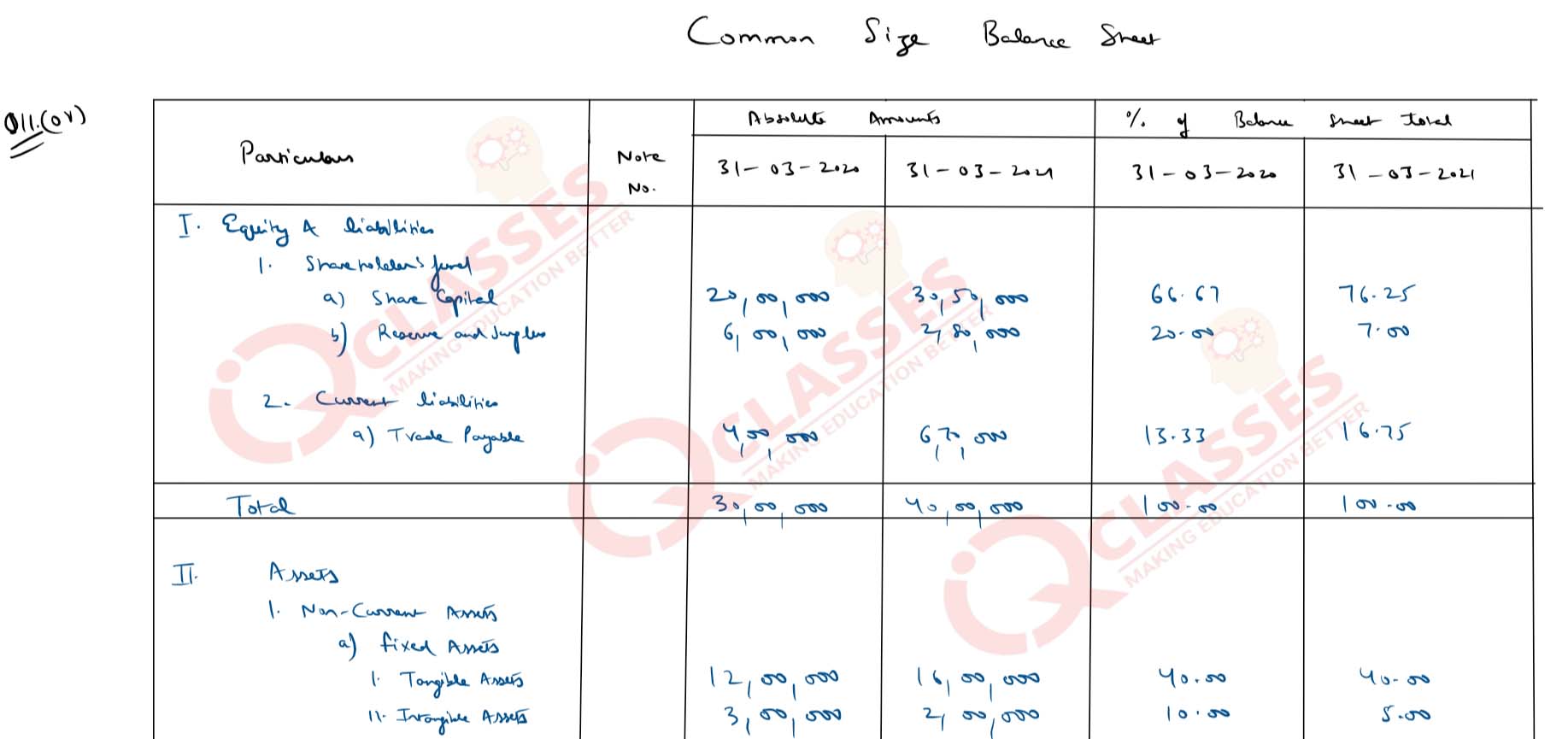

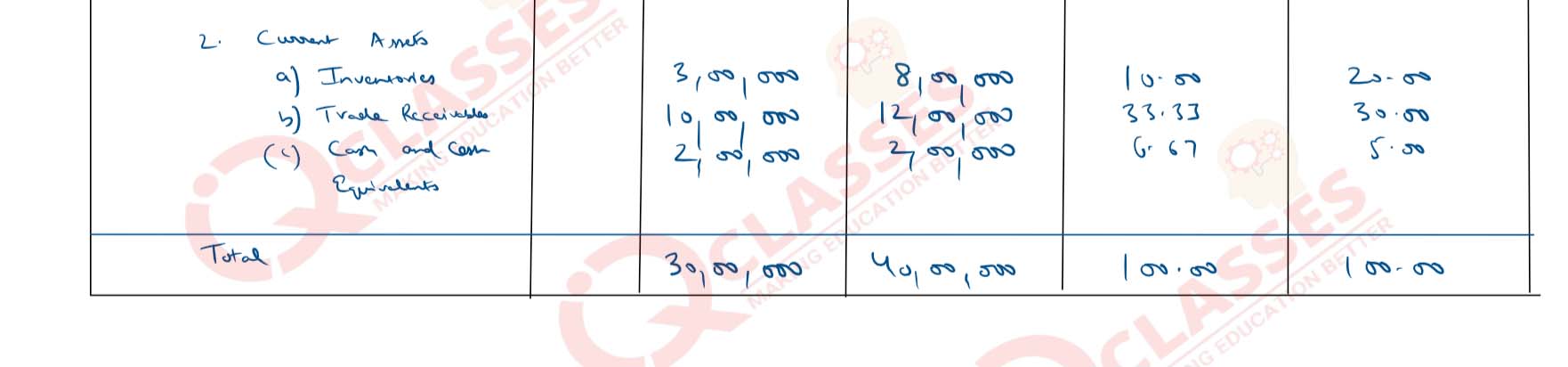

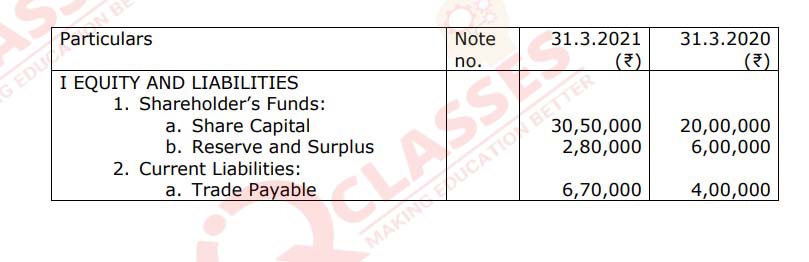

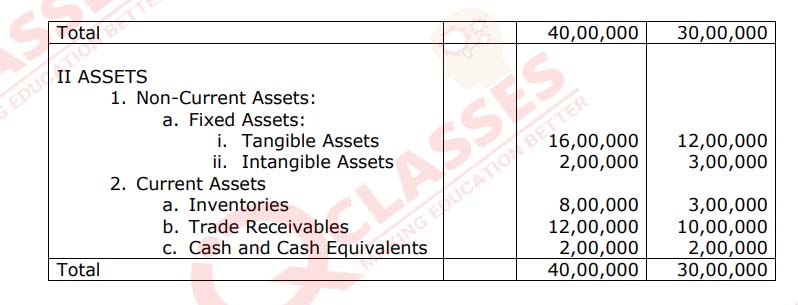

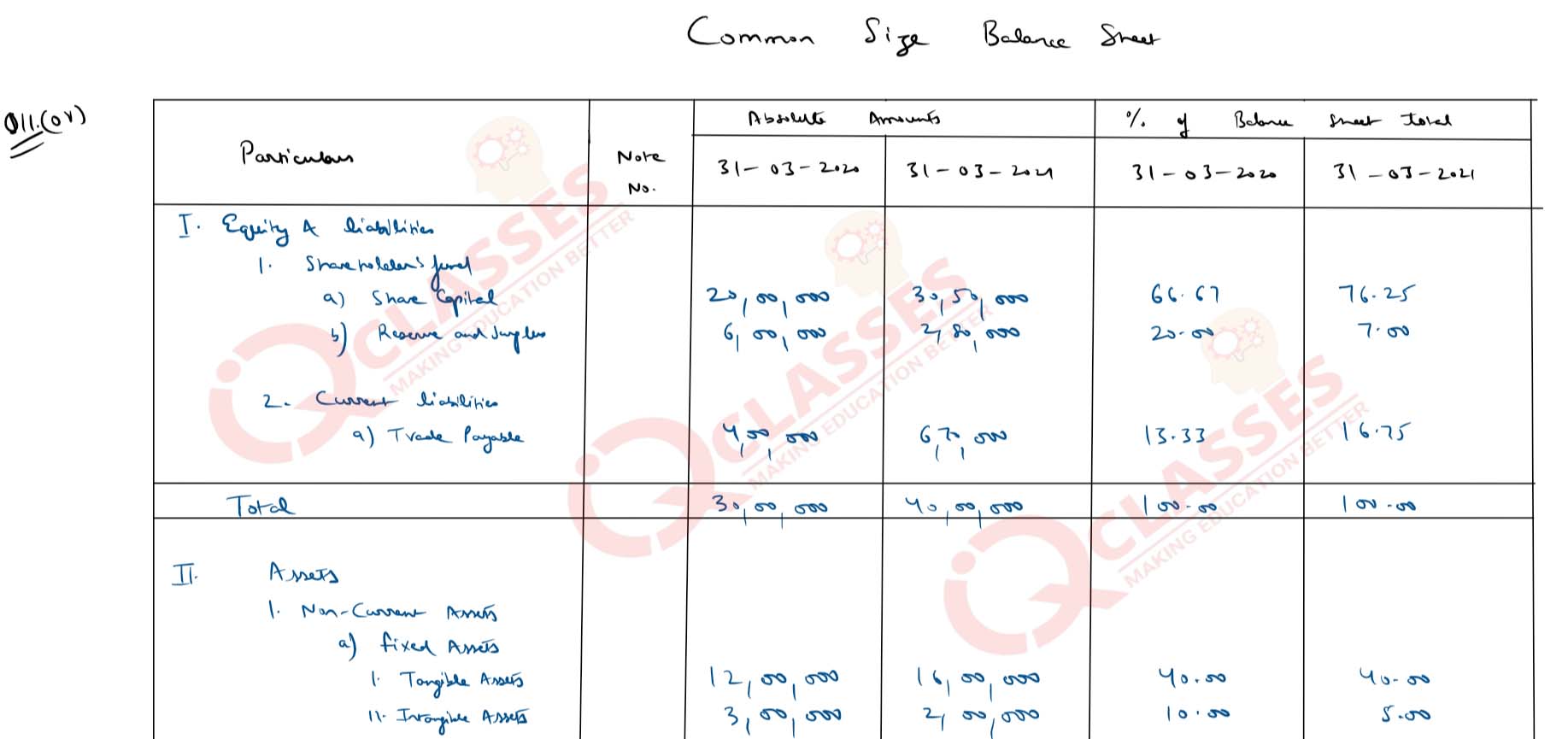

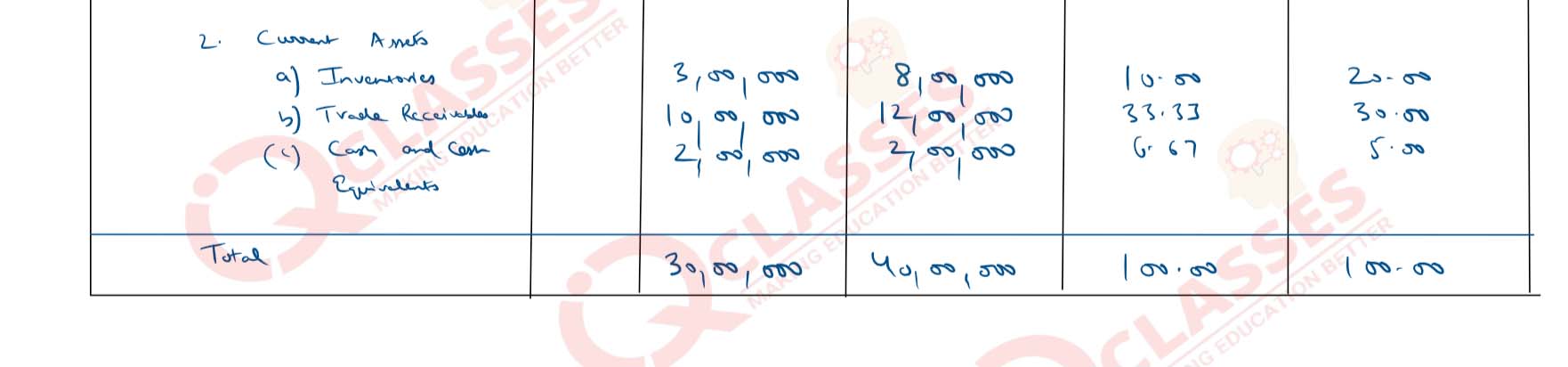

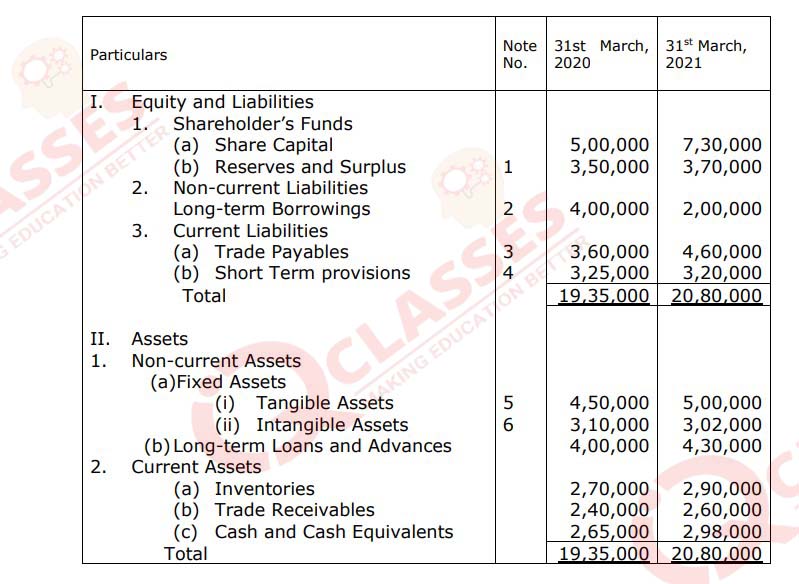

OR

From the following Balance Sheets of Vinayak Ltd. as at 31st March,2021, Prepare a Common-size Balance Sheet.

Vinayak Ltd.

Balance Sheet as on 31st March, 2021

solutions

| Particulars | 31.03.20 (₹) | 31.03.21 (₹) |

|---|---|---|

| Revenue from operations | 30,00,000 | 35,00,000 |

| Other Income | 3,00,000 | 4,50,000 |

| Cost of materials Consumed | 20,00,000 | 23,00,000 |

| Other Expenses | 1,00,000 | 1,20,000 |

| Tax rate | 40% | 40% |

OR

From the following Balance Sheets of Vinayak Ltd. as at 31st March,2021, Prepare a Common-size Balance Sheet.

Vinayak Ltd.

Balance Sheet as on 31st March, 2021

solutions

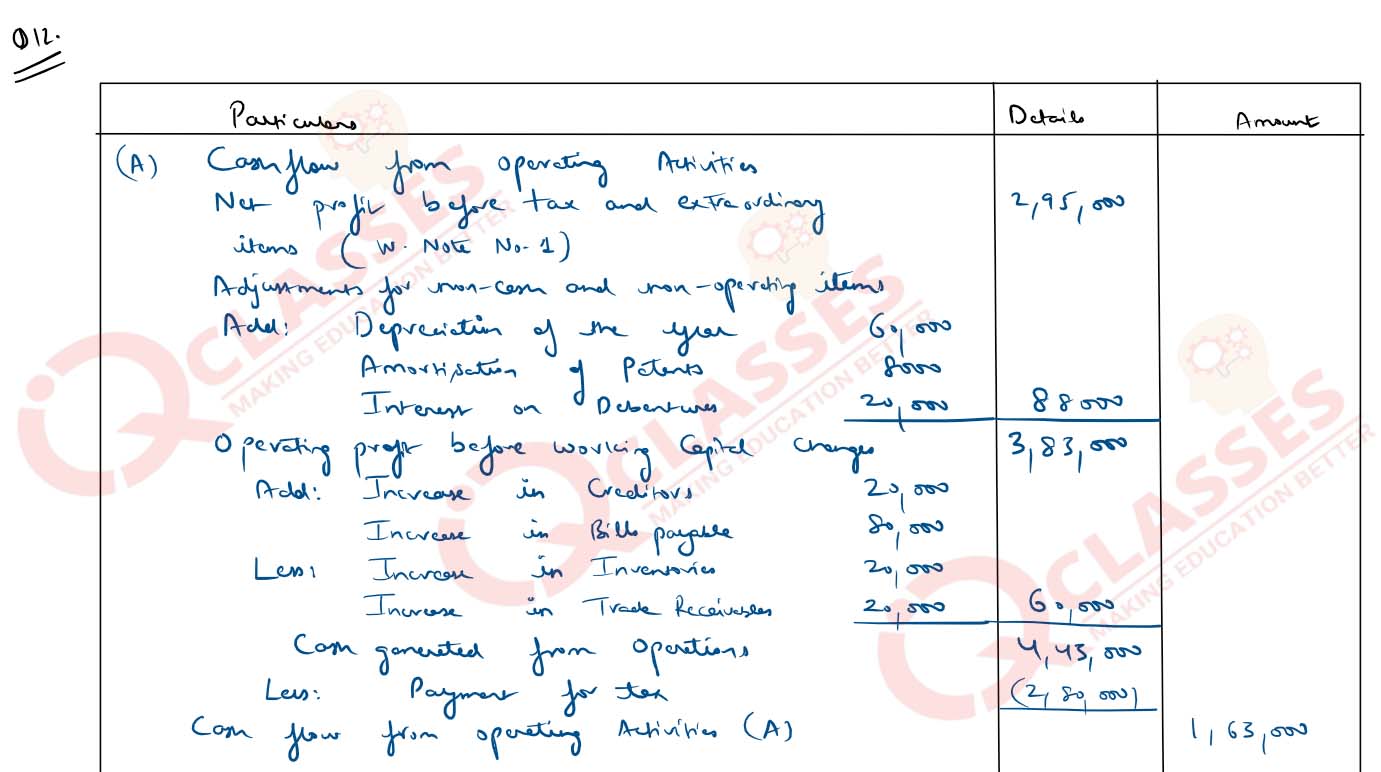

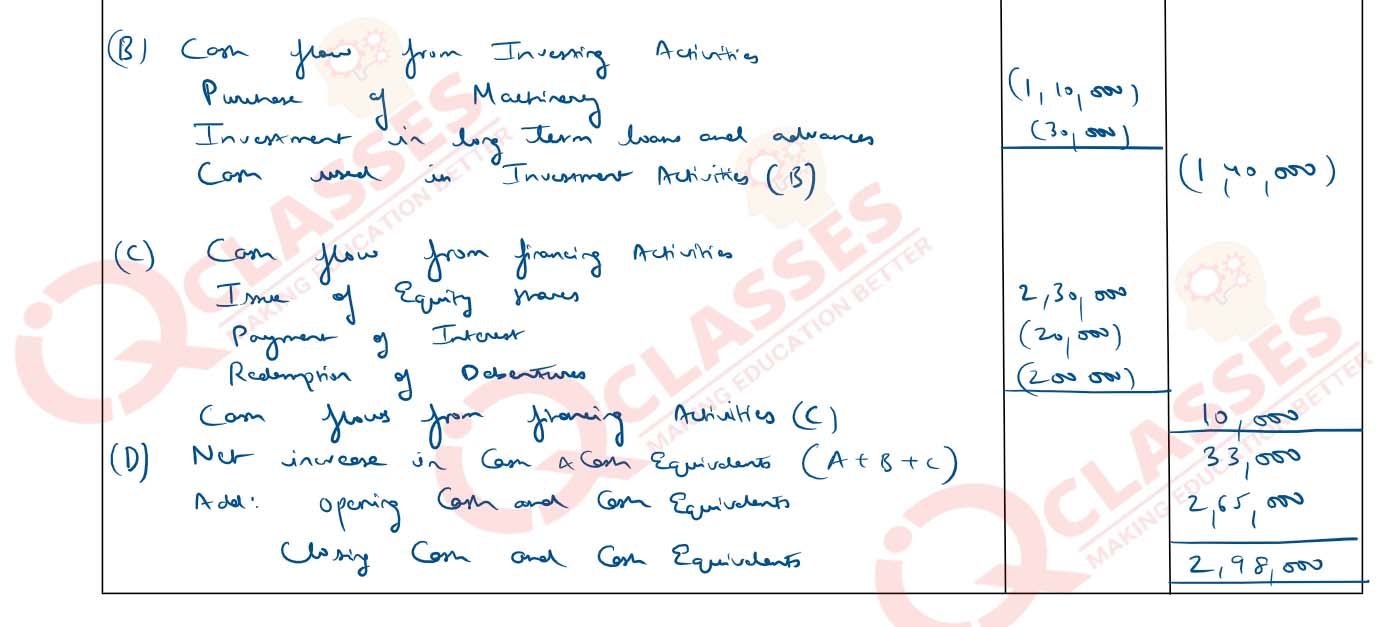

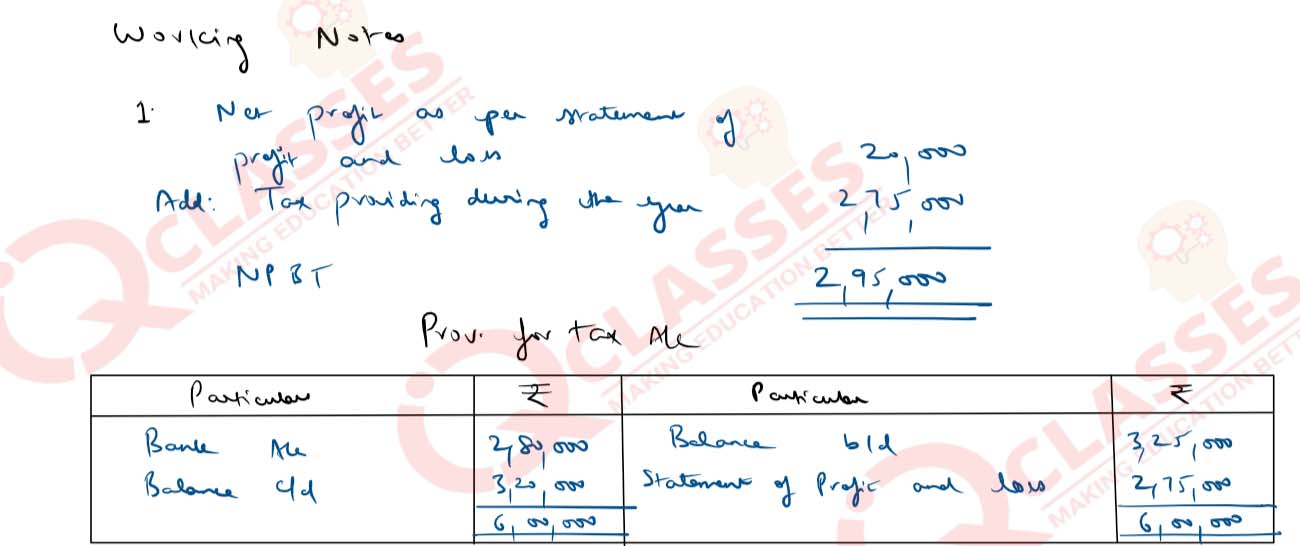

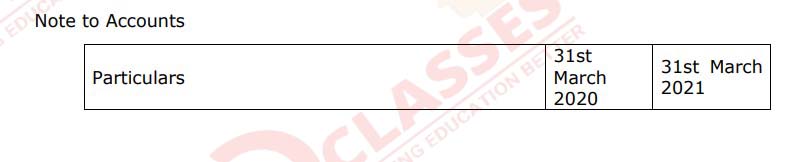

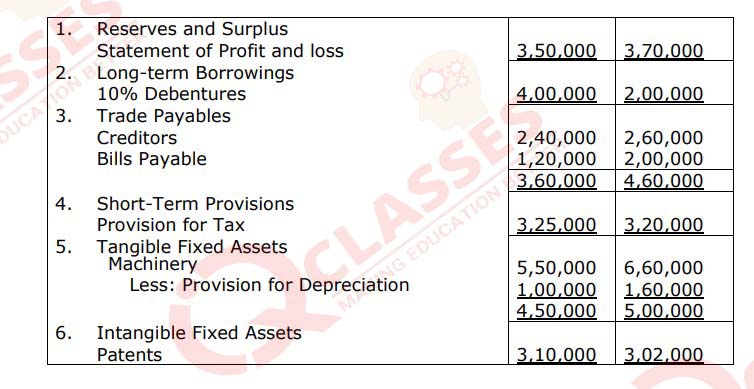

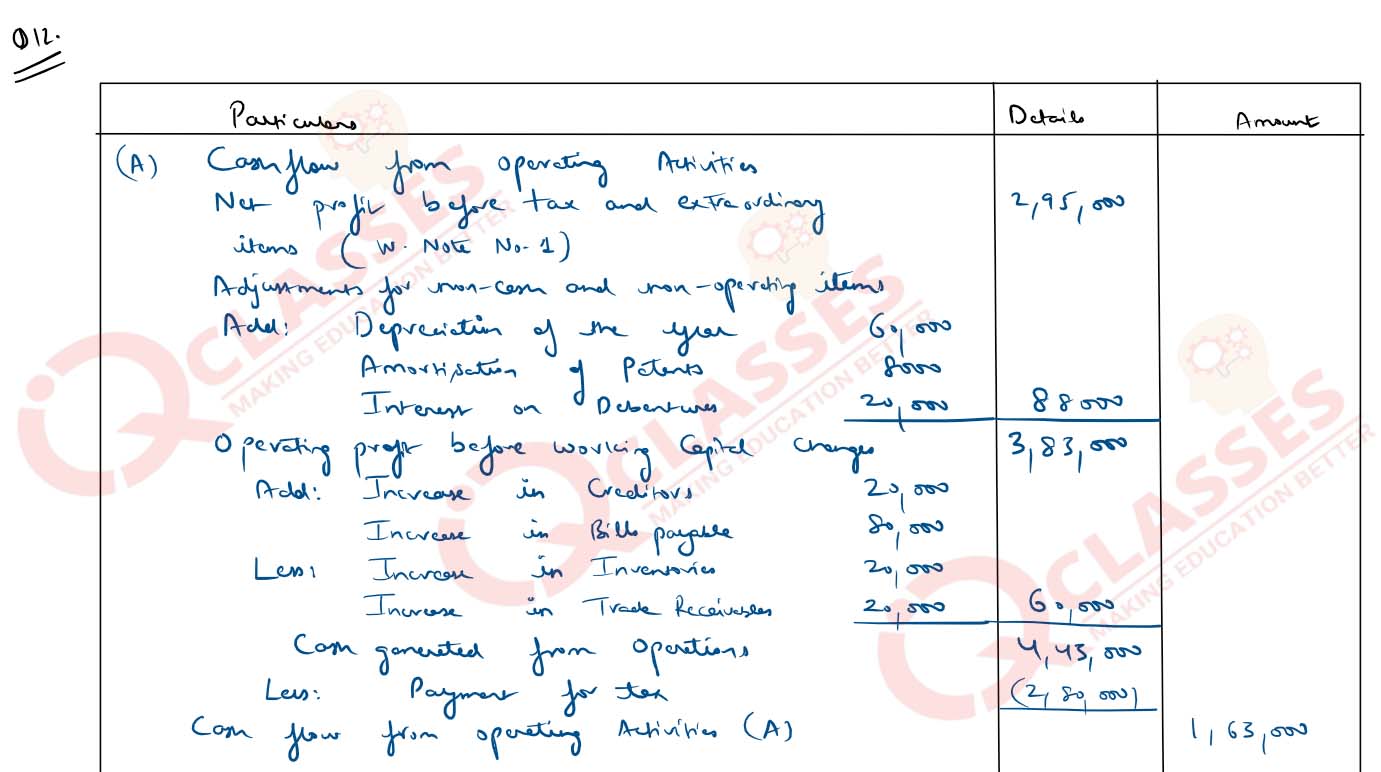

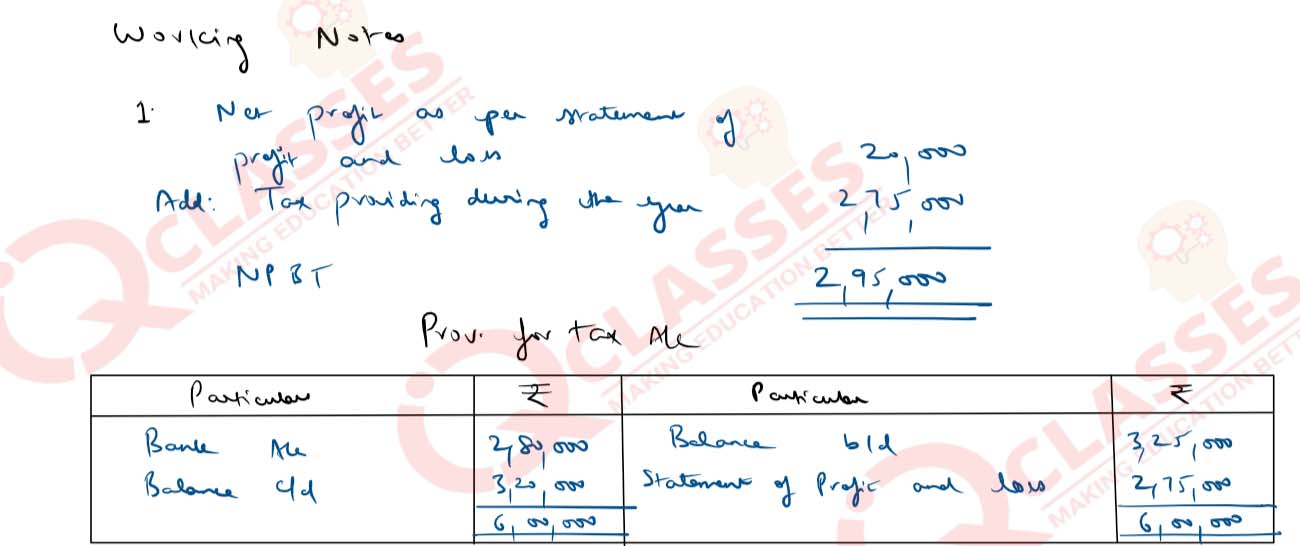

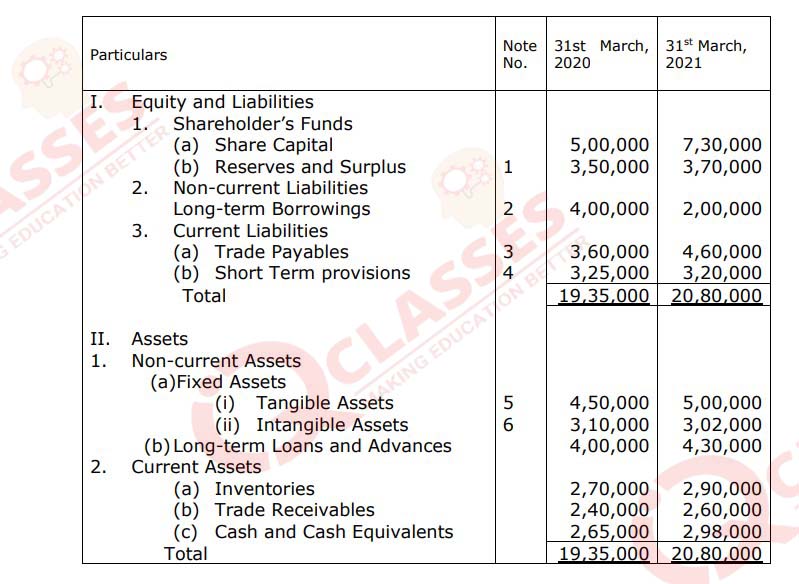

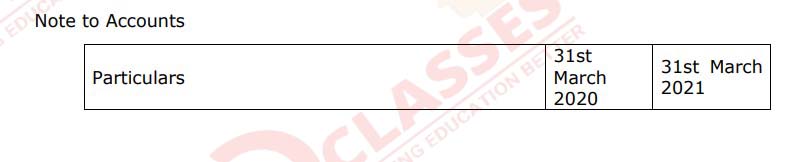

Q12

On the basis of information given by Aradhana Ltd., prepare Cash Flow

Statement for the year ending 31st March, 2021:

Aradhana Ltd

Balance Sheet as on 31st March, 2021

Additional Information:

solutions

Aradhana Ltd

Balance Sheet as on 31st March, 2021

Additional Information:

- Debentures were redeemed on 1st April,2020.

- Tax paid during the year ₹2,80,000.

solutions