Class 12 ISC Accounts Specimen 2024

Maximum Marks: 80

Time Allowed: Three hours

(Candidates are allowed additional 15 minutes for only reading the paper.)

(They must NOT start writing during this time).

The Question Paper contains three sections.

Section A is compulsory for all candidates.

Candidates have to attempt all questions from either Section B or Section C.

There are internal choices provided in each section.

The intended marks for questions or parts of questions are given in the brackets [].

All calculations should be shown clearly.

All working, including rough work, should be done on the same page as, and

adjacent to, the rest of the answer.

Section-A

In subparts (i) to (iv) chose the correct option and in subparts (v) to (x) answer the questions

as instructed

(i) A firm has an unrecorded liability for workmen compensation of ₹ 10,000. The firm

was not prudent enough to create a workmen compensation reserve.

How will this liability be treated in the books of the firm at the time of retirement of

a partner?

- By debiting it to the capital accounts of all the partners

- By crediting it to Revaluation A/c

- By debiting it to Revaluation A/c

- By debiting it to Workmen Compensation Reserve A/c

(ii) Neptune Ltd., an unlisted manufacturing company has to redeem its 3,000, 7% Debentures of ₹ 100

each

on 30th September, 2022.

As per the provisions of the Companies Act, 2013, on which date should the

company invest in specified securities?

(a) On or before 30th September, 2021

(b) On or before 30th September, 2022

(c) On or before 30th April, 2021

(d) On or before 30th April, 2022

(iii) When a partnership firm dissolves, its losses including deficiencies of capital are to

be paid first out of:

(a) The profits of the firm

(b) The capitals of the partners

(c) From the partners individually in their profit-sharing ratio

(d) From the proceeds from sale of assets

(iv) A company forfeits 1,000 shares of ₹ 10 each. It had received ₹ 6,000 on these shares.

What is the maximum discount that can be allowed by the company on the reissue of

400 shares?

(a) ₹ 4,000

(b) ₹ 400

(c) ₹ 1,600

(d) ₹ 2,400

(v) What is the accounting treatment of Employees Provident Fund appearing in the

Balance Sheet of a partnership firm at the time of dissolution of the firm?

(vi) Give any one important feature of non- purchased goodwill.

(vii) Mention the heading and sub-heading under which Calls-in Arrears and Calls-in

Advance are shown in the Balance Sheet of a company prepared as per Schedule III

of the Companies Act,2013.

(viii) Give any one difference between Securities Premium Reserve and Premium on

Redemption of Debentures.

(ix) Joy and Deb were partners sharing profits & losses in the ratio of 2:1. They admitted

Gopi into partnership for 1/5 share. At the time of Gopi’s admission, Furniture (book

value ₹ 2,50,000) was reduced by 40% and Machinery (book value ₹ 1,50,000) was

reduced to 40%

What was the net decrease in value of assets?

(x) Gabby Ltd. (a listed NBFC) has 30,000, 5% Debentures of ₹100 each due for

redemption at par on 31st March, 2022.

The Debenture Redemption Investment which was purchased on 30th April, 2021, was

realized on the date of redemption at 102% less 0·5% brokerage, and the debentures

were redeemed.

You are required to calculate the sale price of the Debenture Redemption

Investment.

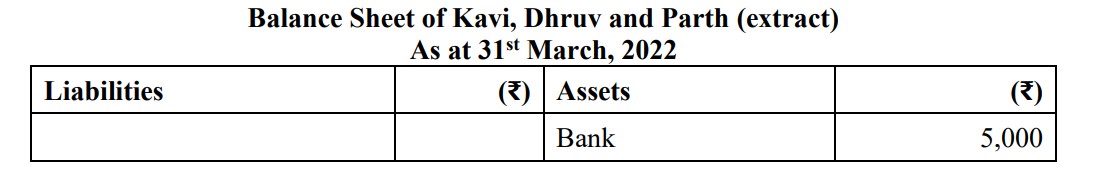

Kavi, Dhruv and Parth are partners in a firm sharing profits and losses in the ratio of

3:1:1.

On Kavi’s retirement from the firm on 1st April, 2022, the amount due to him is determined

at ₹ 20,000.

The firm took sufficient loan from the bank to pay the amount due to Kavi.

You are required to pass the necessary journal entries to pay the amount due to Kavi.

OR

Gita, Sita and Meena were partners in a firm sharing profits and losses in the ratio of 2:

2:1.

Gita died on 30th June, 2022.

The firm closes its books on 31st March every year.

According to their Partnership Deed, the representatives of the deceased partner would be

entitled to get Gita’s share in the interim profits of the firm calculated on sales basis.

Sales for the year 2020-21 were ₹ 6,00,000 and in the year 2021-22, till the date of her

death,

sales amounted to ₹ 1,20,000.

The profits of the firm for the year 2020-21 were ₹ 1,80,000

You are required to:

(i) Calculate Gita’s share of interim profit.

(ii) Pass the necessary journal entry for giving Gita’s representative her share of

interim profit.

Veena and Soma are partners in a firm. They admit Sara on 1st April, 2022, for 1/4 share in

the profits of the firm.

On an average, the profits earned by Veena and Soma are ₹ 21,000. The average capital

employed by the firm is ₹ 1,50,000.

The normal rate of return in the industry is 10%.

It is decided to value goodwill on the basis of four years’ purchase of profits in excess of

profits @ 10% on the money invested.

You are required to:

(i) Calculate the goodwill of the firm.

(ii) Pass the journal entries in the books of the firm if Sara brings into the firm her

share of goodwill in cash.

On 31st March, 2021, the books of Pragya Ltd. (an unlisted manufacturing company) showed

the following closing balances:

7% Debentures (redeemable on 30th September, 2022) ₹ 60,00,000

Debenture Redemption Reserve ₹ 2,00,000

In order to meet the provisions of the Companies Act, 2013, the company transferred the

required balance amount to Debenture Redemption Reserve Account on 31st March, 2022.

It met the requirements of Debenture Redemption Investment.

You are required to prepare the Debenture Redemption Reserve Account for the years

2021-22, 2022-23.

OR

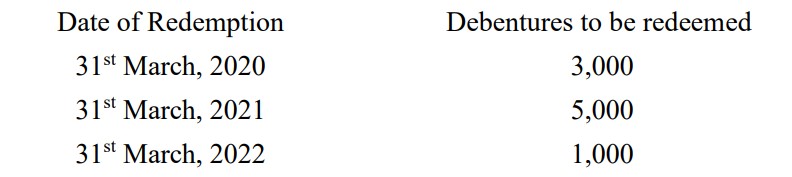

Barua Ltd. (a listed NBFC) redeems its 9,000, 10% Debentures of ₹ 100 each in instalments

as follows

You are required to prepare the Debenture Redemption Investment Account for the

years 2020-21, 2021-22.

On 1st February, 2022, Swadesh Ltd. issued to the public 12,000, 10% Debentures of ₹ 100

each at a discount of 3% payable:

₹ 20 on application.

The balance on allotment being made on 1st May, 2022.

The public applied for 20,000 debentures. Pro-rata allotment was made on 15,000

debentures.

The debentures were to be redeemed at par after four years.

You are required to pass journal entries for the year 2021-2022.

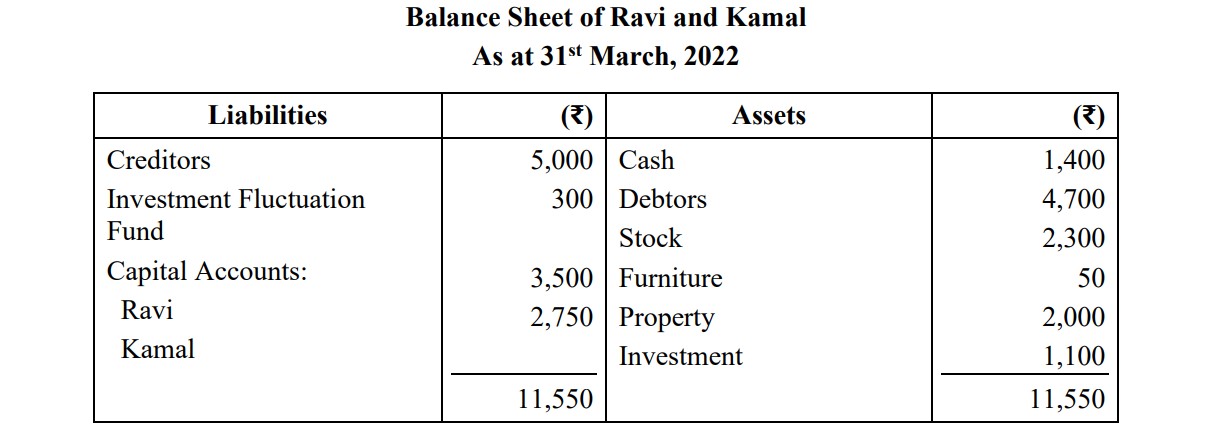

The Balance Sheet of Ravi and Kamal as at 31st March, 2022, was as follows:

The partners shared profits in the ratio of 9:7.

The partnership firm was dissolved on the date of the Balance Sheet subject to the

following adjustments:

(i) Property realized 75%.

(ii) Bad debts and discount amounted to ₹ 500.

(iii) Stock realized ₹ 2,525.

(iv) Creditors allowed a discount of 2%.

(v) Expenses of dissolution amounted to ₹ 75 which were paid by Ravi.

You are required to prepare the Realisation Account.

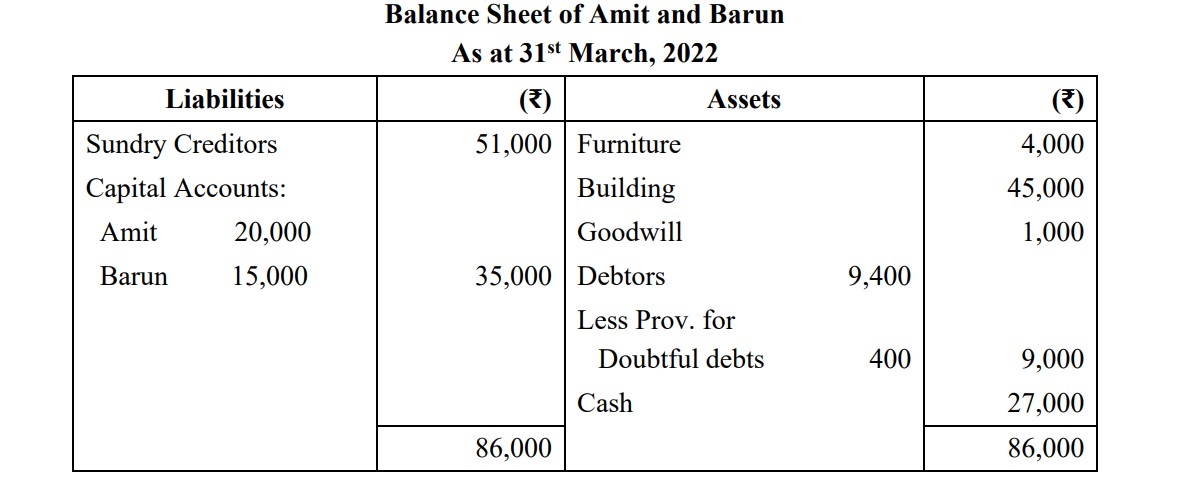

Amit and Barun are partners sharing profits in the ratio of 4:1. Their Balance Sheet as at

31st March, 2022, was as under:

On 1st April, 2022, Charan is admitted as a new partner on the following terms:

(i) The new profit-sharing ratio of the partners to be 2:1:1.

(ii) Charan to bring in ₹ 16,000 as his capital but would be unable to bring his share

of goodwill in cash.

(iii) The value of the goodwill of the firm to be calculated on the basis of Charan’s

share in the profits and the capital contributed by him.

(iv) Furniture, which had been undervalued by ₹ 600 to be brought up to its revised

value.

(v) Out of the total insurance premium paid, ₹ 3,400 to be treated as prepaid

insurance. The amount was earlier debited to Profit & Loss Account.

You are required to prepare:

(i) Revaluation Account.

(ii) Partners’ Capital Accounts.

Karan and Vijay are partners in a firm sharing profits and losses in the ratio of 4:3. They

admit Shrey for 𝟏/3 share in the profits.

On the date of Shrey’s admission:

(a) The capitals of Karan and Vijay are: ₹ 40,000 and ₹ 30,000 respectively.

(b) Profit and Loss Account has a debit balance of ₹ 7,000.

(c) General Reserve shows a balance of ₹ 21,000 which is not to be disturbed.

(d) Goodwill of the firm is valued at ₹ 42,000.

(e) The cash at bank is ₹ 15,000.

(f) Shrey brings in proportionate capital and his share of goodwill in cash.

You are required to prepare:

(i) Partners’ Capital Accounts.

(ii) Cash at Bank Account of the reconstituted firm on the date of Shrey’s

admission.

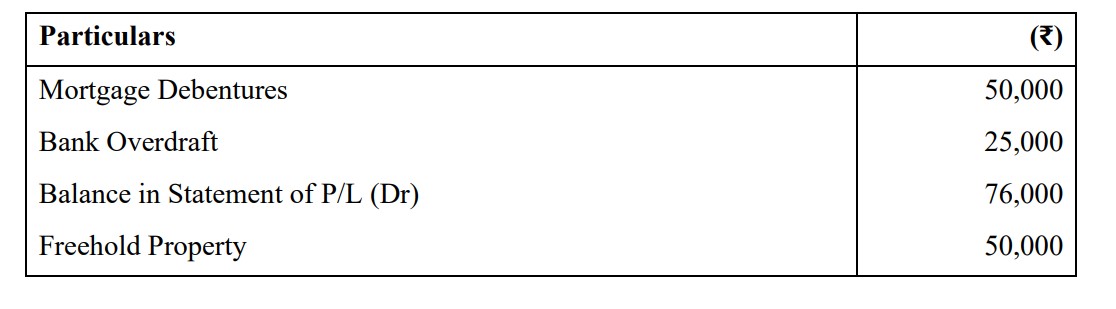

From the information of Prudence Ltd. given below, you are required to show how the

relevant items will appear in the company’s Balance Sheet (an extract) as at

31st March 2022.

The authorised capital of Prudence Ltd. consisted of 3,000, 10% Preference Shares of

₹ 100 each and 8,000 Equity Shares of ₹100 each, out of which:

(a) 1,000, 6% Preference shares were issued to the public, fully called and paid up

(b) 3,000 Equity shares were issued which were fully called up.

(c) There were arrears of ₹ 20 per share on 400 Equity shares.

Ajay and Vijay are in partnership sharing profits and losses in the ratio of 3:1.

On 1st April, 2021, their capitals were ₹ 1,00,000 and ₹ 90,000.

The terms of their partnership are as follows:

(i) Interest on capital to be allowed at @ 6% per annum.

(ii) Interest on drawings to be charged @ 4% per annum.

(iii) Partners to get a salary of ₹1,000 each per month.

(iv) Vijay to get a commission of 2% on the correct net profit.

(v) Any partner taking a loan from the firm to be charged interest on it @ 8% per annum

Ajay had borrowed ₹ 10,000 from the firm on 1st October, 2021.

Vijay had withdrawn ₹ 8,000 on 1st July, 2021.

During the year ending 31st March, 2022, the firm earned a net profit of ₹ 60,000 before

any of the provisions mentioned in the partnership deed.

You are required to prepare for the year ending 31st March, 2022:

(i) Profit and Loss Appropriation Account.

(ii) Ajay’s Capital Account.

OR

The partnership agreement of Rohit, Ali and Sneh provides that:

(i) Profits will be shared by them in the ratio of 2:2:1.

(ii) Interest on capital to be allowed at the rate of 6% per annum.

(iii) Interest on drawings to be charged at the rate of 3% per annum.

(iv) Ali to be given a salary of ₹ 500 per month.

(v) Ali’s guarantee to the firm that the firm would earn a net profit of at least ₹ 80,000

per

annum and any shortfall in these profits would be personally met by him.

The capitals of the partners on 1st April, 2021, were:

Rohit – ₹ 1,20,000; Ali- ₹ 1,00,000; Sneh- ₹ 1,00,000.

All the three partners withdrew ₹1,000 each at the beginning of every month.

The net profit for the year 2021-22 was ₹ 70,000.

You are required to prepare for the year 2021- 2022:

(i) Profit and Loss Appropriation Account.

(ii) Ali’s Capital Account.

In the year 2021-22, Yamuna Limited Co. was registered with an authorized capital of

₹ 1,00,000 in ₹ 10 per Equity share.

Of these, 4,000 equity shares were issued as fully paid to vendor for the purchase of Plant

and Machinery and 6,000 shares were subscribed for by the public.

During the first year, ₹ 6 per Equity share was called up, payable:

₹ 3 on Application

₹ 1 on Allotment

₹ 2 on the First Call

The amounts received in respect of these shares were as follows:

On 5,000 shares the full amount called

On 600 shares ₹ 4 per Equity share

On 400 shares ₹ 3 per Equity share.

The company forfeited all those shares on which only ₹ 3 had been received and reissued

them at ₹ 4 per share.

You are required to:

(i) Pass journal entries to record the above transactions in the books of the

company.

(ii) Prepare the Calls-in Arrears Account.

OR

Tapsi Ltd. invited applications from the public for the issue of 55,000 Equity shares of ₹

10

each payable as:

₹ 3 on Application

₹ 5 on Allotment

Balance on Call

The public applied for 50,000 shares which were duly allotted by the company.

₹ 2,49,000 were received by the company on allotment and ₹ 99,400 on call.

The company forfeited those shares on which both, allotment and call money was not

received.

70% of the forfeited shares were reissued at ₹ 7 per share, fully called up.

The company paid share issue expenses of ₹ 20,000 which were completely written off at

the end of the year.

The company had ₹ 15,000 in its Securities Premium Reserve Account.

You are required to pass journal entries to record the above transactions in the

books of the company.

Section-B

In subparts (i) and (ii) chose the correct option and in subparts (iii) to (v) answer the

questions

as instructed.

(i) What will be the Operating Ratio of Zenia Ltd. from the particulars given below?

Revenue from Operations: ₹ 9,00,000

Gross Profit: 20% on cost

Operating Expenses: ₹ 60,000

(a) 86·67%

(b) 90%

(c) 76·67%

(d) 20%

(ii) How is interest paid on debentures considered in a Cash Flow Statement?

(a) As an Operating Activity

(b) As a Financing Activity

(c) As an Investing Activity

(d) Both as an Operating Activity and a Financing Activity

(iii) State the objective of calculating Liquidity Ratios.

(iv) Mention the accounting basis on which a Cash Flow Statement is prepared.

(v) What is Gross Profit + Cost of Materials consumed?

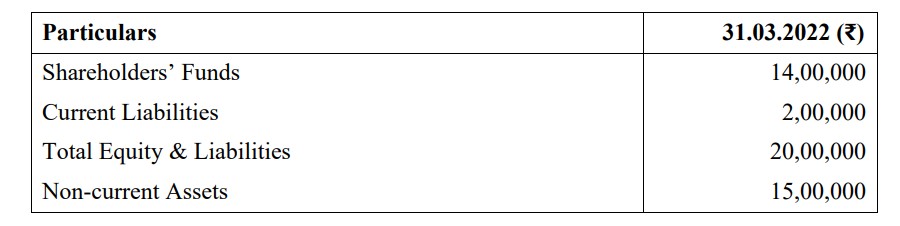

From the following particulars of Bharti Ltd., you are required to prepare a

Common-size Balance Sheet as at 31st March, 2022.

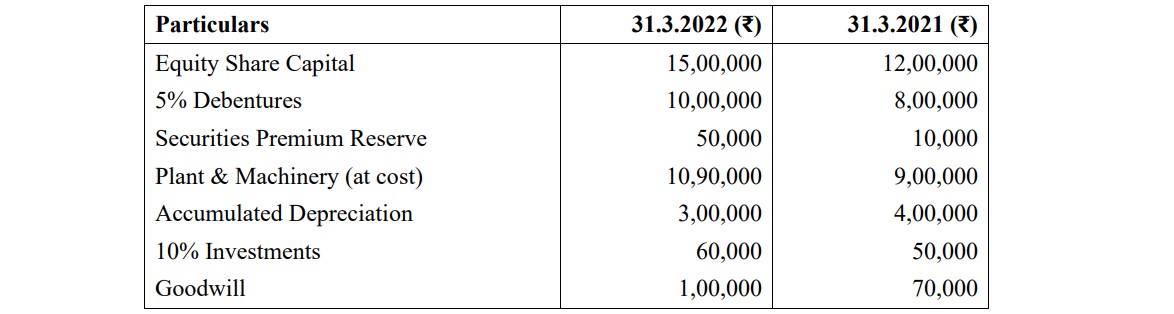

From the following extracts of a company’s Balance Sheets, you are required to

calculate:

(i) Cash from Investing Activities.

(ii) Cash from Financing Activities

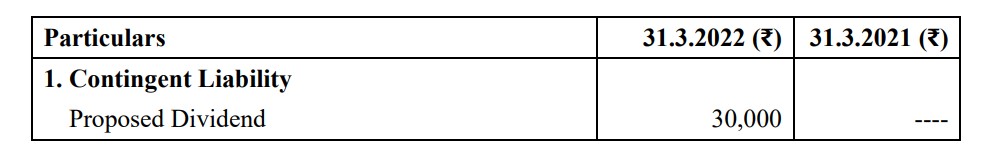

Note: Dividend proposed in the years 2020-21 and 2021-22 were ₹ 42,000 and ₹ 40,000

respectively.

Additional information:

During the year 2021-22, the company:

(i) Issued the 5% Debentures at a discount of 10% on 1st April, 2021. The discount on

issue of Debentures was written off from Securities Premium Reserve.

(ii) Provided depreciation of ₹ 1,00,000 on Plant and Machinery.

(iii) Sold Plant and Machinery, the book value of which was ₹ 5,00,000 for ₹ 4,50,000

OR

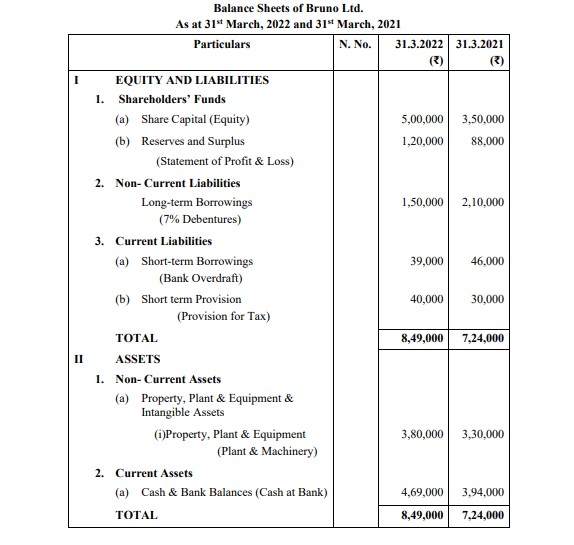

You are required to prepare a Cash Flow Statement of Bruno Ltd. (as per AS 3) for

the year 2021-22 from the following Balance Sheets.

Notes to Accounts:

Additional information:

During the year 2021-22:

(i) Plant & Machinery of ₹ 1,20,000 was purchased and some machinery was sold at a

loss of ₹ 12,000.

(ii) The company charged ₹ 38,000 as depreciation on its Plant and Machinery.

(iii) Interest of ₹ 18,000 was paid on all borrowings

(iv) Tax paid was ₹ 25,000.

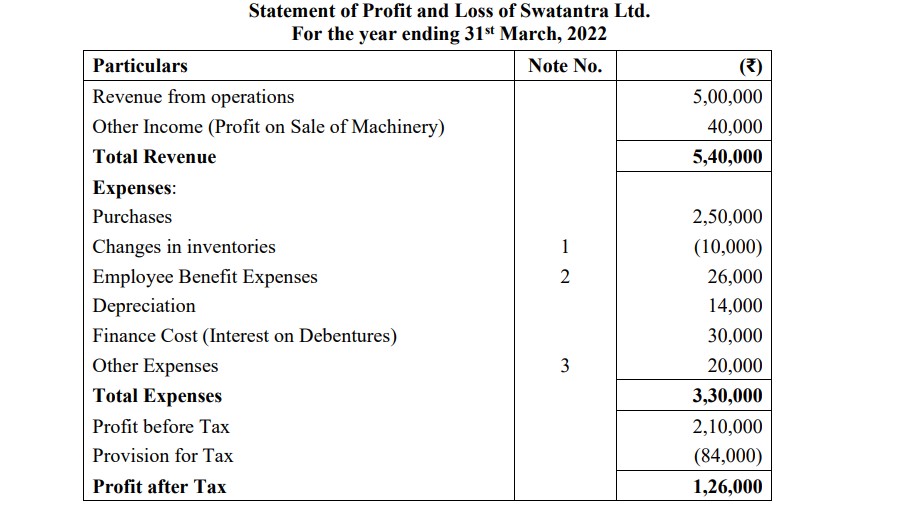

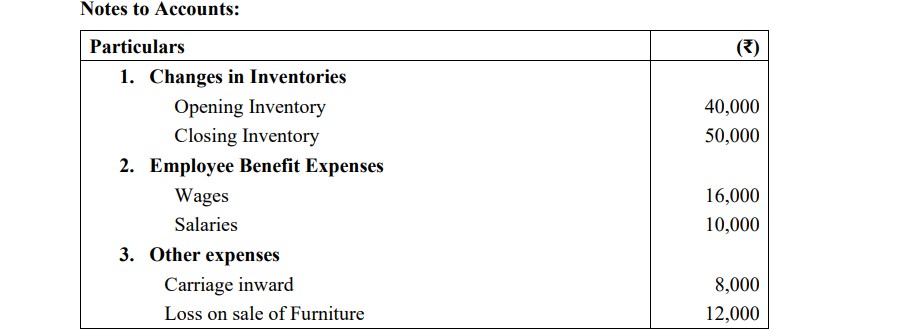

From the following Statement of Profit and Loss of Swatantra Ltd. for the year

2020-21, calculate any three ratios (up-to two decimal places):

(i) Gross Profit Ratio

(ii) Net Profit Ratio

(iii) Operating Profit Ratio

(iv) Inventory Turnover Ratio

Add a comment