Class 12 ISC term2 Accounts Specimen 2022

BOARD -

CLASS -

SUBJECT -

ISC

12th

ACCOUNTS

Paper Pattern for Written Term-II

TIME -

MARKS -

1 Hour 30 Minutes

40

Visit CISCE OFFICIAL PAGE for Regulations and Syllabus of Class 12th ISC

Solved Specimen Paper Semester-2 2022

Q1

Select the correct option for each of the following questions

Q(i)

Relay Ltd. (an unlisted Non NBFC) redeems its 8,000, 10% Debentures of ₹ 100 each

in instalments as follows:

On the basis of the above details, what will be the amount of Debenture Redemption Reserve which the company will transfer to General Reserve on 31st March, 2021?

solutions.jpg)

| Date of Redemption | Debentures to be redeemed |

|---|---|

| 31st March, 2019 | 2,000 |

| 31st March, 2020 | 5,000 |

| 31st March, 2021 | 1,000 |

On the basis of the above details, what will be the amount of Debenture Redemption Reserve which the company will transfer to General Reserve on 31st March, 2021?

- ₹ 20,000

- ₹ 50,000

- ₹ 10,000

- ₹ 80,000

solutions

.jpg)

Q(ii)

Which of the following transactions is debited to Revaluation Account?

solutions.jpg)

-1.jpg)

- Increase in the value of Furniture

- Increase in Provision for Doubtful Debts

- Creditors discharged at a discount

- Loss on revaluation of all assets and reassessment of all liabilities

solutions

.jpg)

-1.jpg)

Q(iii)

Orange Ltd. took over assets of ₹ 7,00,000 and liabilities of ₹ 60,000 of Purple Ltd. for

a purchase consideration of ₹ 6,30,000 payable by the issue of 10% Debentures of ₹100

each at a premium of 10% and if need be, a part of the purchase consideration in cash.

How will the company meet the purchase consideration?

solutions.jpg)

How will the company meet the purchase consideration?

- By the issue of ₹ 5,72,727, 10% Debentures at a premium of ₹ 57,272 with no cash.

- By the issue of ₹ 5,72,000, 10% Debentures at a premium of ₹ 57,200 and cash of ₹ 800.

- By the issue of ₹ 5,72,720, 10% Debentures at a premium of ₹ 57,272 and cash of ₹ 8.

- By the issue of ₹ 5,72,700, 10% Debentures at a premium of ₹ 57,270 and cash of ₹ 30.

solutions

.jpg)

Q(iv)

Anita and Binita are partners in a firm. Anita had taken a loan of ₹ 15,000 from the

firm. How will Anita’s loan be closed in the event of dissolution of the firm?

solutions.jpg)

- By crediting it to Anita’s Capital Account

- By debiting it to Anita’s Capital Account

- By crediting it to Realisation Account

- By debiting it to Cash Account

solutions

.jpg)

Q2(i)

What is the maximum amount of debentures which an unlisted company, other than a

NBFC and HFC, can redeem out of its capital?

solutions.jpg)

solutions

.jpg)

Q2(ii)

At the time of dissolution of a partnership firm, its Balance Sheet showed stock of

₹ 30,000 comprising easily marketable items, obsolete items and a few miscellaneous

other items. These items were realized as:

solutions.jpg)

.jpg)

- Easily Marketable Items: 65% of the total inventory in full.

- Obsolete items: 20% of the total inventory had to be discarded.

- The miscellaneous other items in the stock at 40% of their book value.

solutions

.jpg)

.jpg)

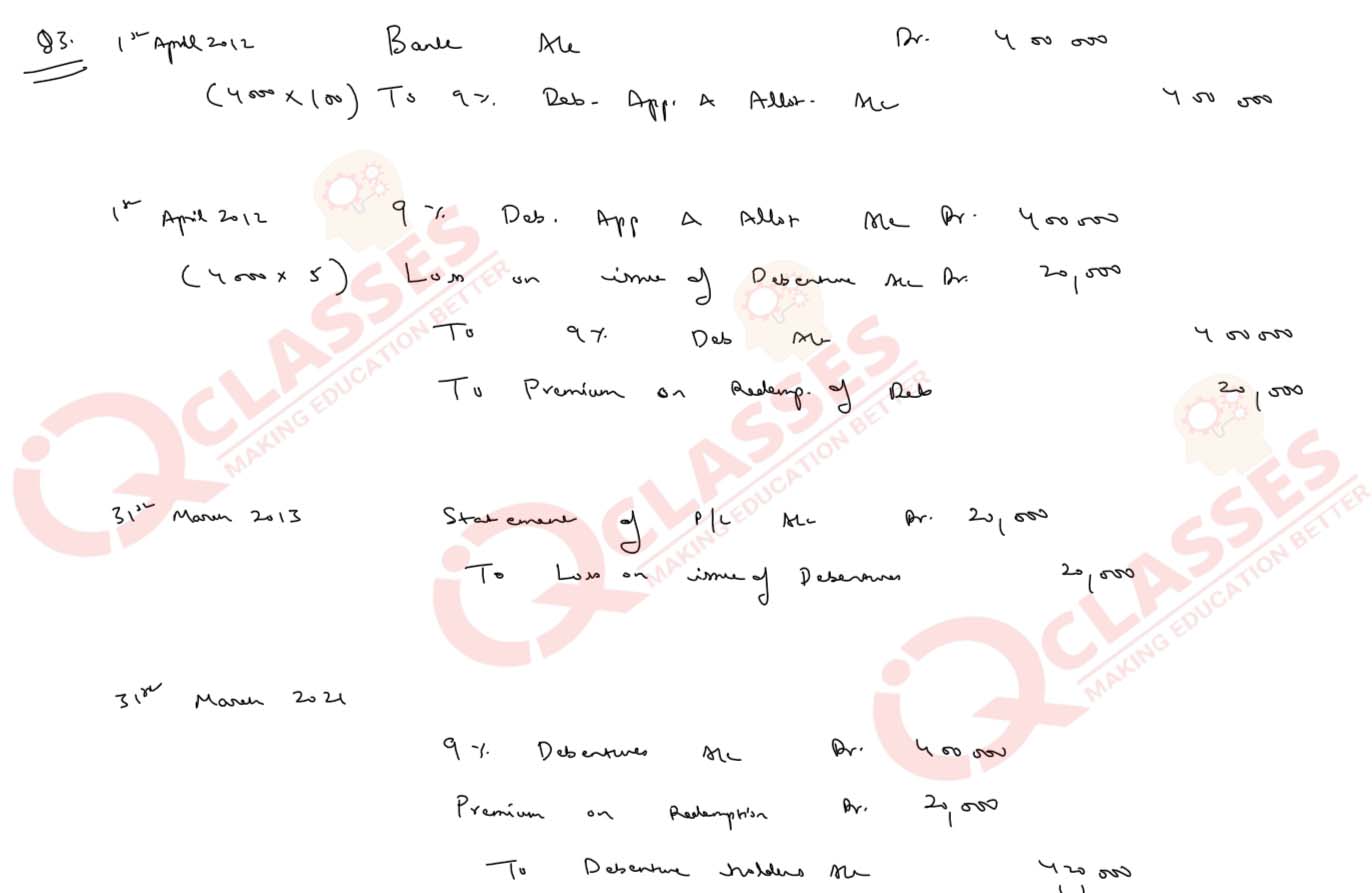

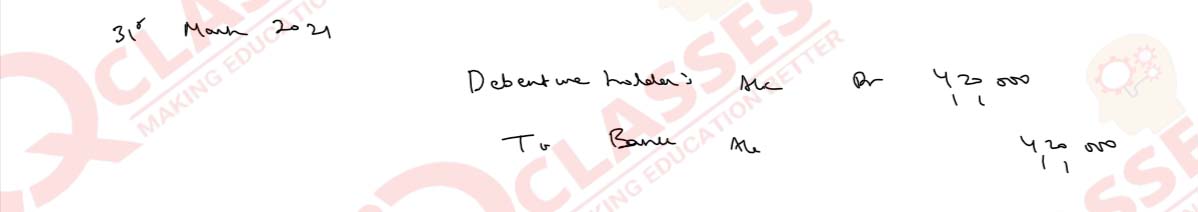

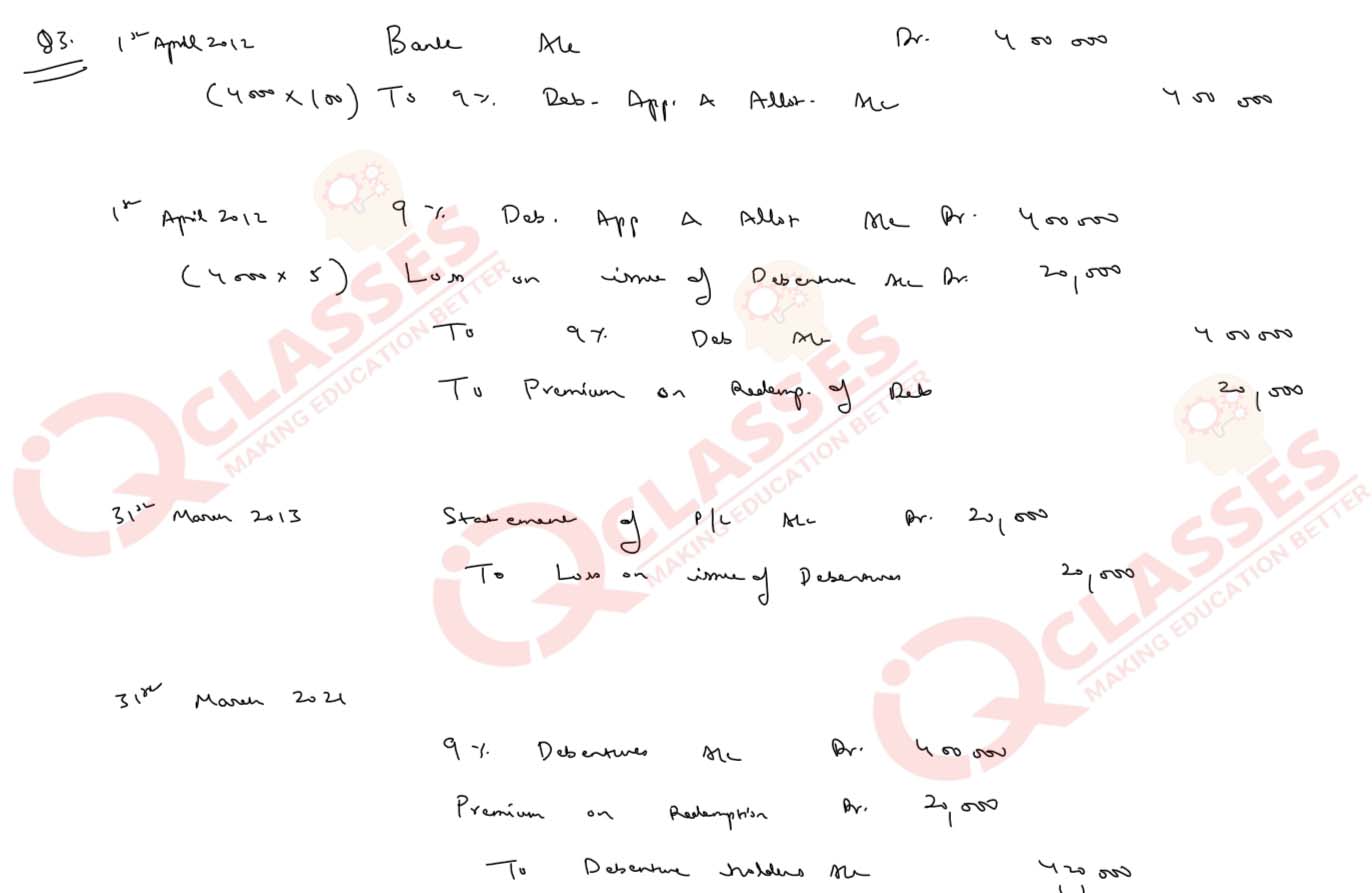

Q3

On 1st April, 2012, Neptune Finance Company (a listed NBFC) issued 4,000, 9 % Debentures

of ₹ 100 each to be redeemed at a premium of 5% on 31st March, 2021.

You are required to pass necessary journal entries for the issue and redemption of debentures.

solutions

You are required to pass necessary journal entries for the issue and redemption of debentures.

solutions

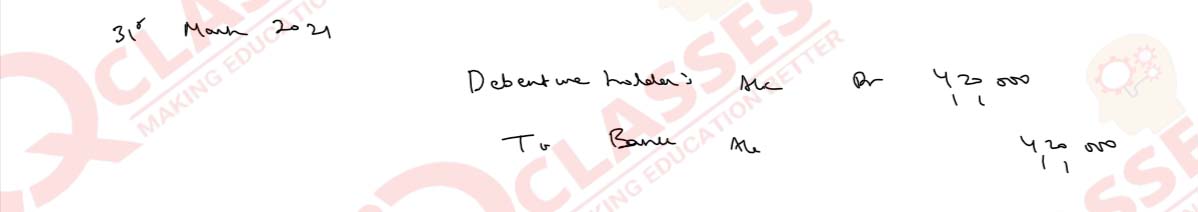

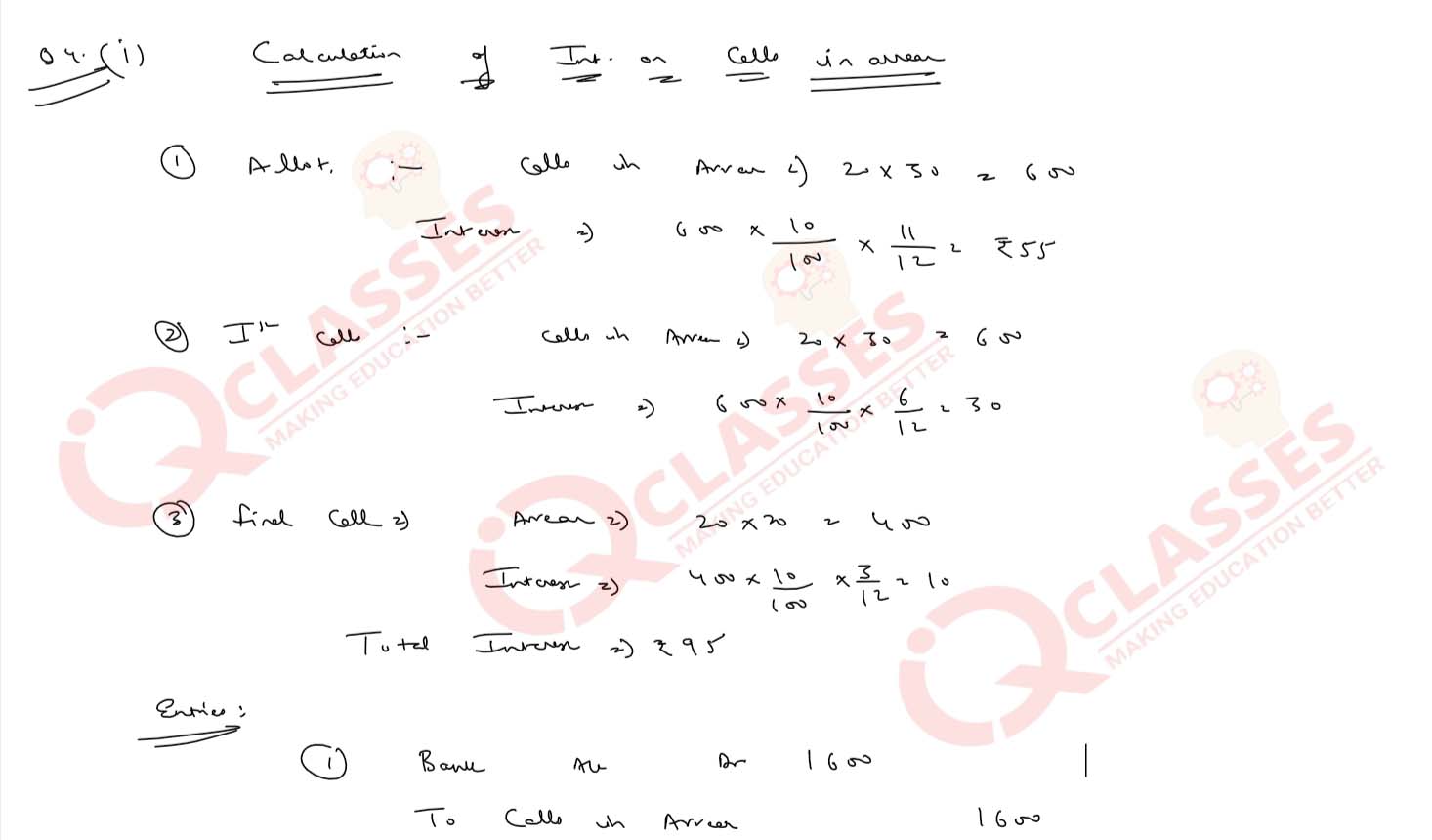

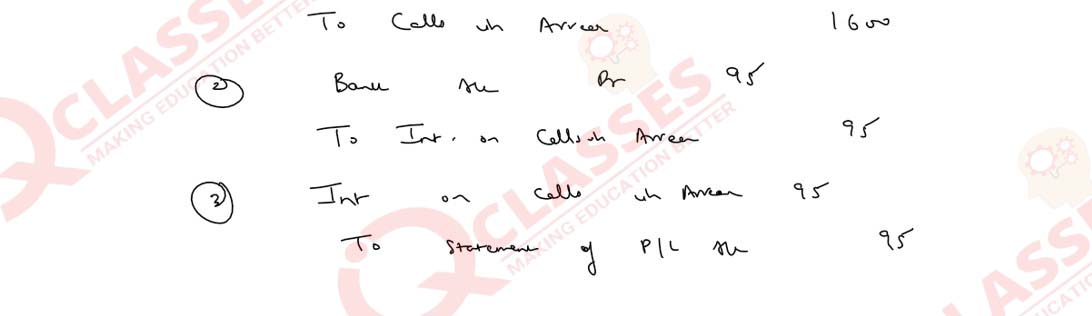

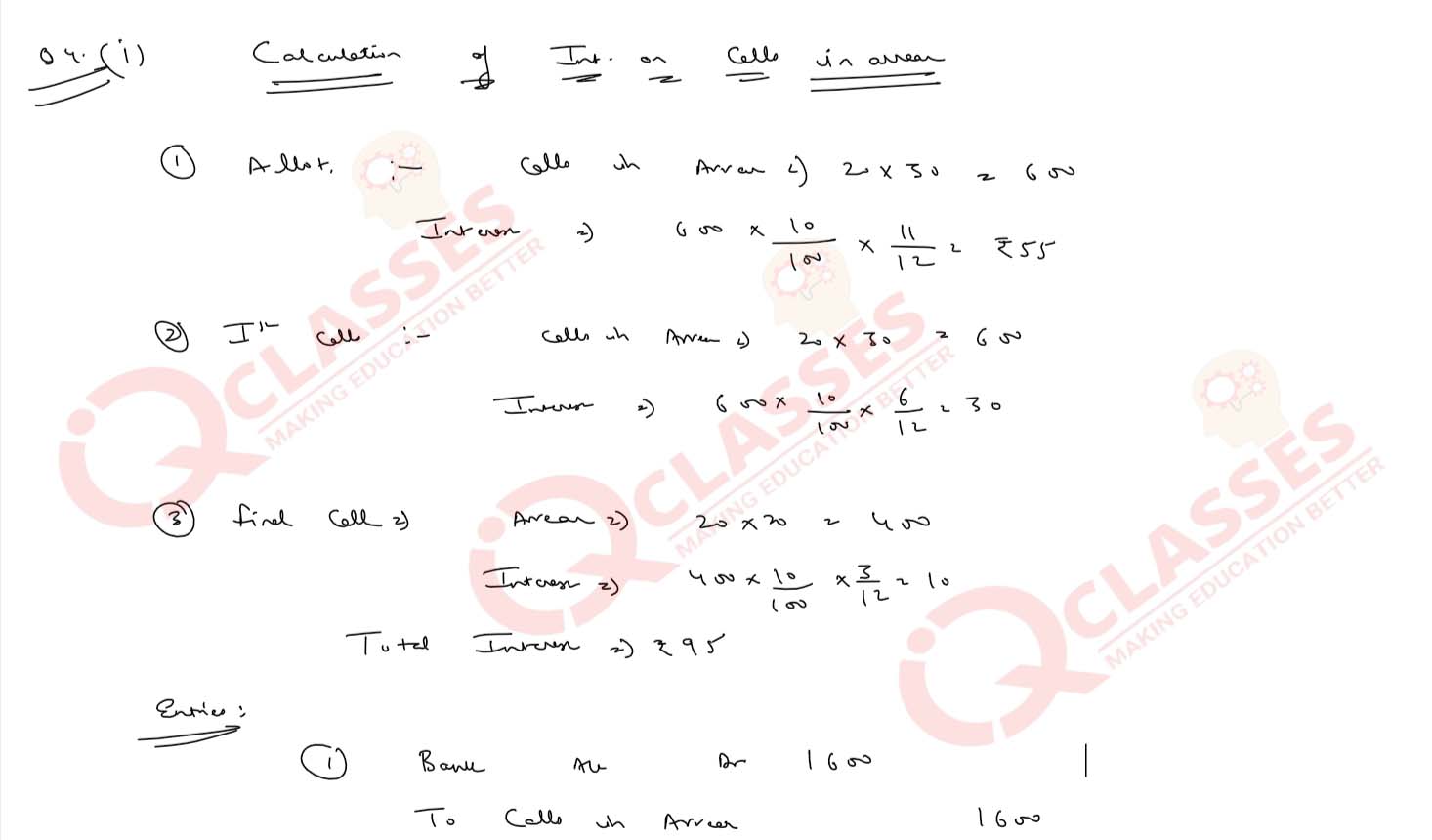

Q4(i)

Suhas Ltd. issued 1,000, 7% Debentures of ₹ 100 each to be redeemed after three

years at a premium of 5%. The face value of the debentures was payable as:

₹ 20 on Application

₹ 30 on Allotment (on 1st May, 2020)

₹ 30 on First call (on 1st October, 2020)

₹ 20 on Final call (on 1st January, 2021)

All the debentures were applied and allotted.

Ali, to whom 20 debentures were allotted, paid the allotment money and the two calls on 31st March, 2021. The Articles of Association of the company provided for interest on calls-in-arrear to be charged @ 10% per annum, which Ali paid on 31st March, 2021.

You are required to pass journal entries in the books of Suhas Ltd. to record:

solutions

₹ 20 on Application

₹ 30 on Allotment (on 1st May, 2020)

₹ 30 on First call (on 1st October, 2020)

₹ 20 on Final call (on 1st January, 2021)

All the debentures were applied and allotted.

Ali, to whom 20 debentures were allotted, paid the allotment money and the two calls on 31st March, 2021. The Articles of Association of the company provided for interest on calls-in-arrear to be charged @ 10% per annum, which Ali paid on 31st March, 2021.

You are required to pass journal entries in the books of Suhas Ltd. to record:

- The adjustment and receipt of interest on calls in arrears

- The entry to close the interest on calls in arrears account

solutions

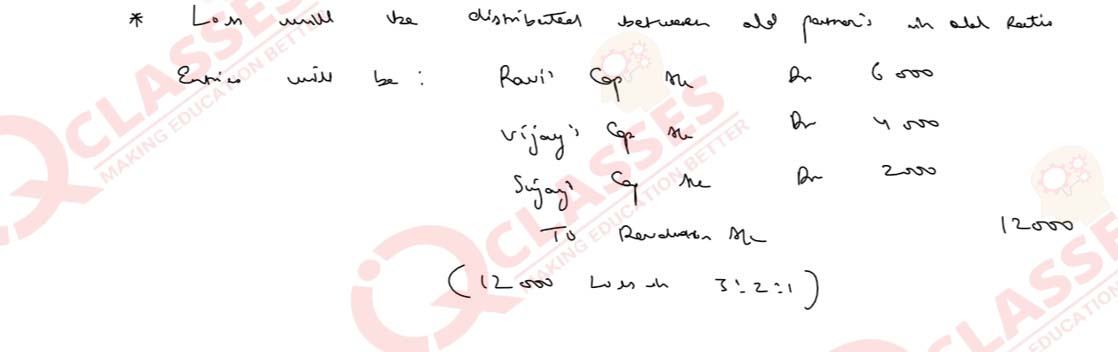

Q4(ii)

Naresh, Dhruv and Azeem are partners sharing profits in the ratio of 5:3:7.

Naresh retires from the firm. Dhruv and Azeem decided to share profits in the ratio of 2:3.

The adjusted capital accounts of Dhruv and Azeem at the time of Naresh’s retirement showed the balances of ₹ 33,000 and ₹ 70,500 respectively.

The total amount to be paid to Naresh is ₹ 90,500 which is paid in cash immediately by the firm, the cash being contributed by Dhruv and Azeem in such a way that their capitals become proportionate to their new profit-sharing ratio and the firm maintains a minimum cash balance of ₹ 5,000 from its existing balance of ₹ 20,000.

You are required to pass journal entries to record:

solutions.jpg)

-1.jpg)

-2.jpg)

Naresh retires from the firm. Dhruv and Azeem decided to share profits in the ratio of 2:3.

The adjusted capital accounts of Dhruv and Azeem at the time of Naresh’s retirement showed the balances of ₹ 33,000 and ₹ 70,500 respectively.

The total amount to be paid to Naresh is ₹ 90,500 which is paid in cash immediately by the firm, the cash being contributed by Dhruv and Azeem in such a way that their capitals become proportionate to their new profit-sharing ratio and the firm maintains a minimum cash balance of ₹ 5,000 from its existing balance of ₹ 20,000.

You are required to pass journal entries to record:

- Payment made to the retiring partner

- Cash brought in by the remaining partners to pay off the retiring partner

solutions

.jpg)

-1.jpg)

-2.jpg)

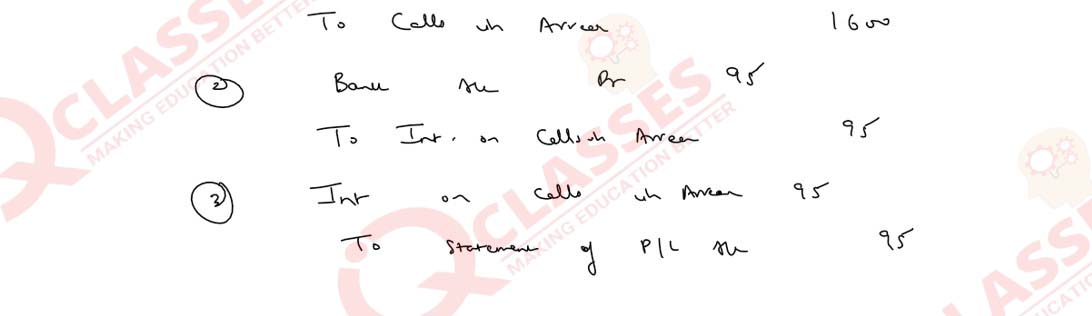

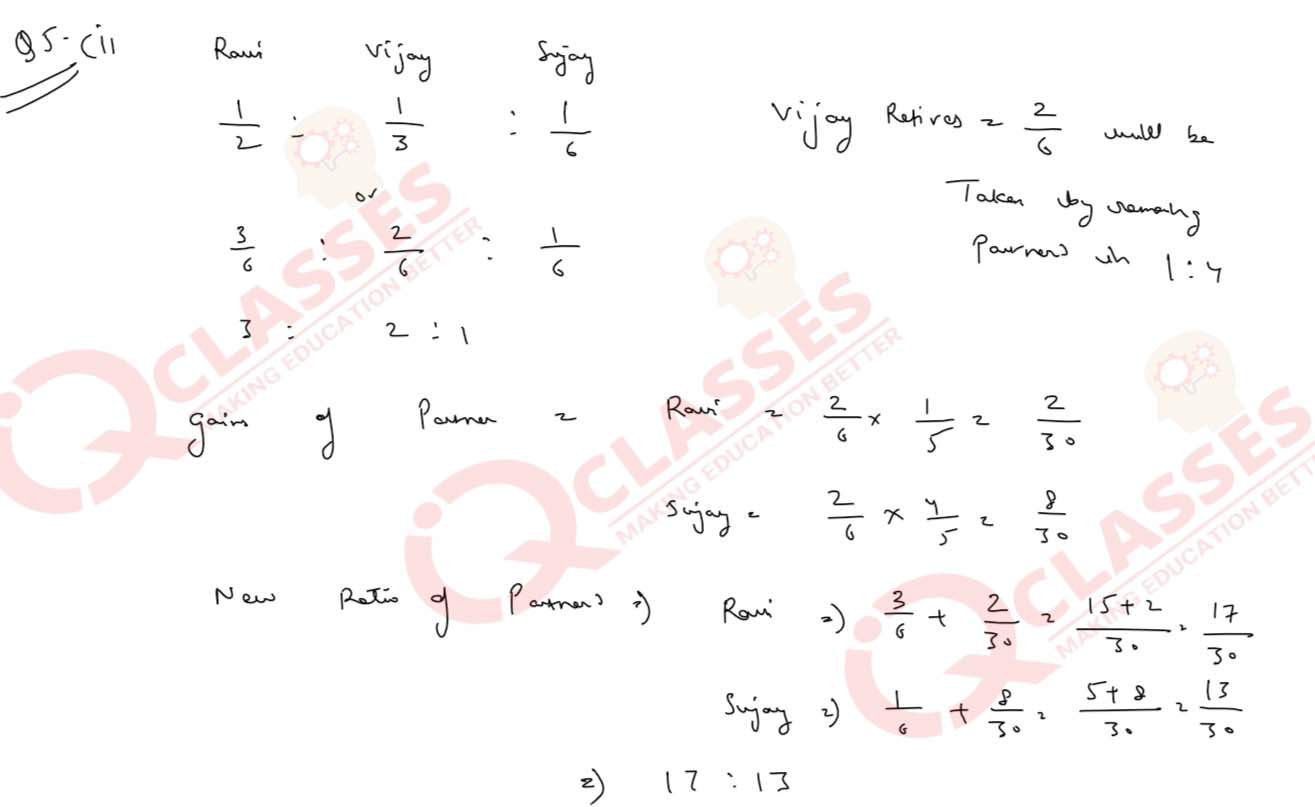

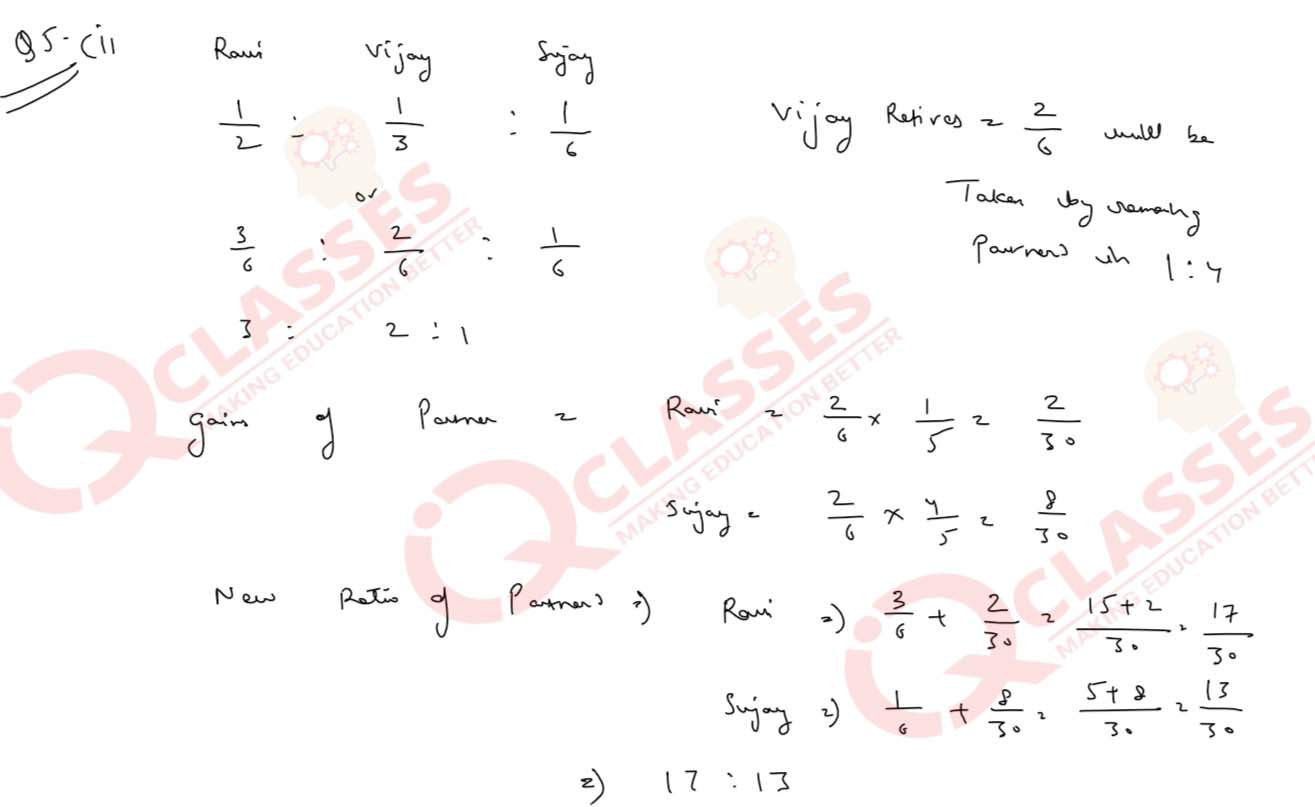

Q5(i)

Ravi, Vijay and Sujay were partners sharing profits in the ratio of 1/2:1/3:1/6.

Vijay decided to retire, his share being taken up by the remaining partners in the ratio 1:4.

On Vijay’s retirement, a loss of ₹ 12,000 was determined upon revaluation of assets and liabilities. You are required to:

solutions

Vijay decided to retire, his share being taken up by the remaining partners in the ratio 1:4.

On Vijay’s retirement, a loss of ₹ 12,000 was determined upon revaluation of assets and liabilities. You are required to:

- Calculate the new profit-sharing ratio of the remaining partners.

- Pass the journal entry to write off the loss on revaluation of assets and liabilities

solutions

Q5(ii)

On 1

st April, 2017, Prasad and Company Limited issued 1,000, 10% Debentures of

₹ 1,000 each at ₹ 980. Under the terms of issue, 1

5

⁄ of the debentures is annually

redeemable by drawings, the first redemption occurring on 31st March, 2019.

On 31st March, 2018, the company had a balance of ₹ 4,000 in its Capital Reserve A/c.

The company wrote off the discount on issue of debentures over the life-time of the

debentures.

You are required to prepare the Discount on issue of Debentures Account for the first three years.

solutions.jpg)

-1.jpg)

-2.jpg)

-3.jpg)

You are required to prepare the Discount on issue of Debentures Account for the first three years.

solutions

.jpg)

-1.jpg)

-2.jpg)

-3.jpg)

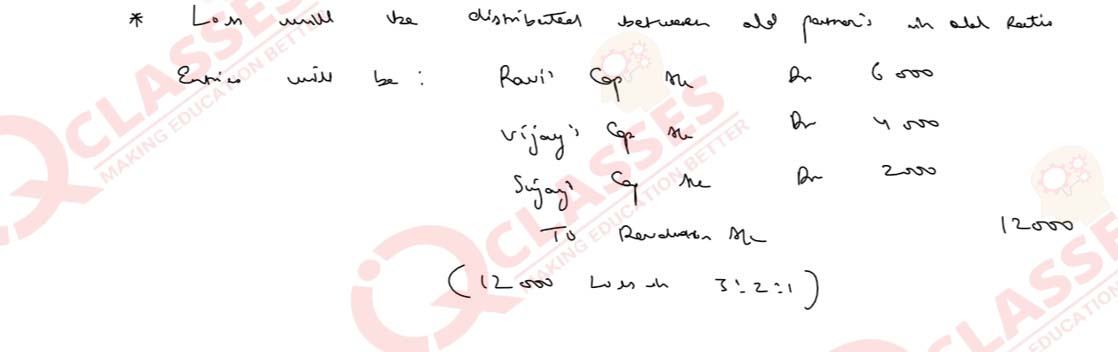

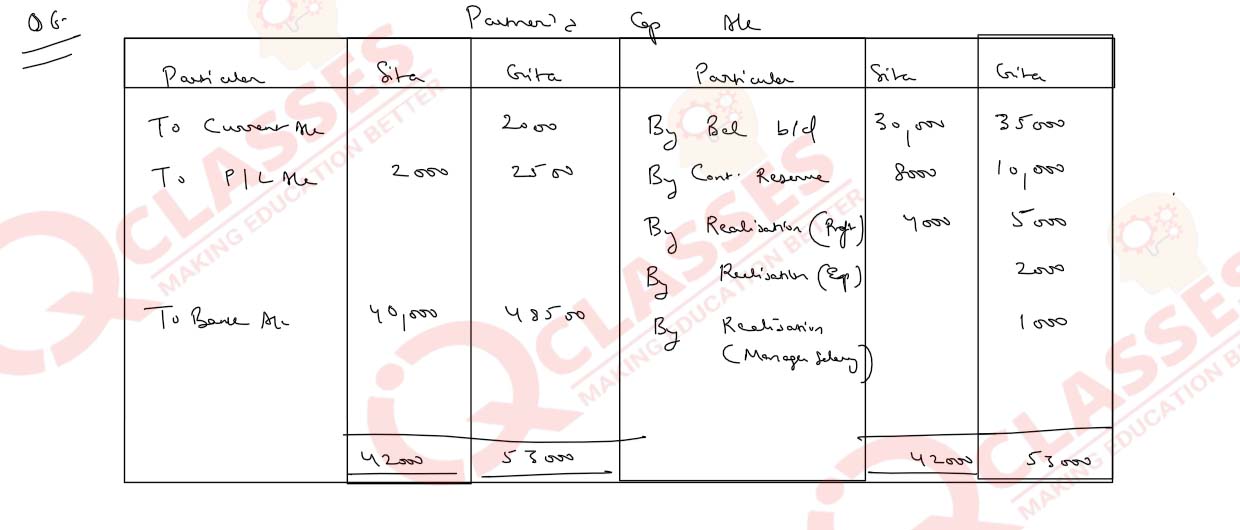

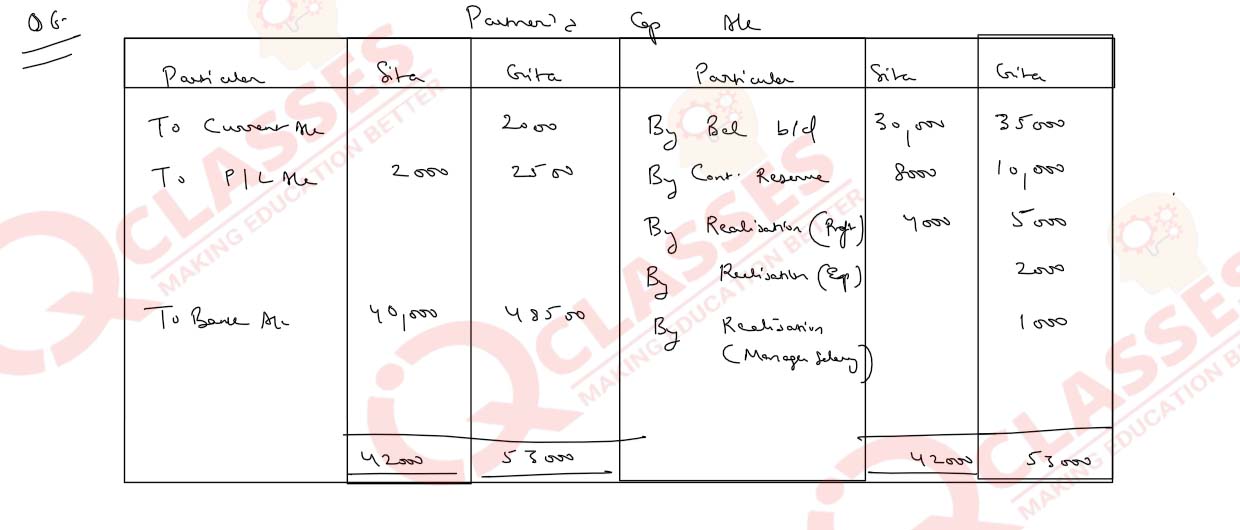

Q6

Sita and Gita were partners sharing profits and losses in the ratio of 4:5. They dissolved

their partnership on 31st March, 2021, when their Balance Sheet showed the following

balances:

On the date of dissolution:

You are required to prepare the Partners’ Capital Accounts

solutions

| Particulars | (₹) |

|---|---|

| Sita’s Capital | 30,000 |

| Gita’s Capital | 35,000 |

| Gita’s Current A/c (Dr) | 2,000 |

| Contingency Reserve | 18,000 |

| P/L A/c (Dr) | 4,500 |

On the date of dissolution:

- The firm, upon realisation of assets and settlement of liabilities, made a profit of ₹ 9,000

- Gita paid the realisation expenses of ₹ 2,000.

- Gita discharged the outstanding salary of the manager of the firm of ₹ 1,000 which was unrecorded in the books

You are required to prepare the Partners’ Capital Accounts

solutions

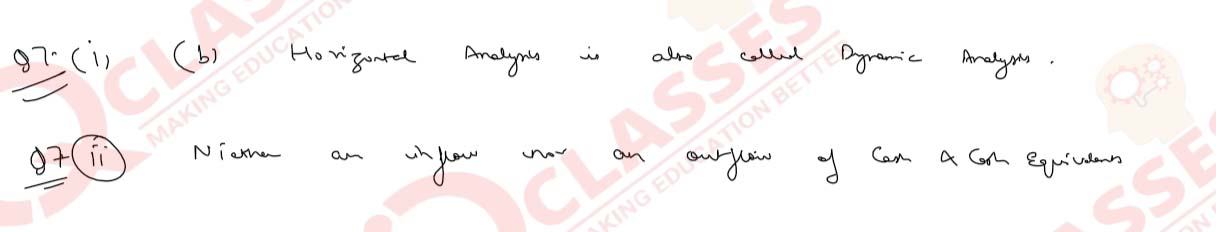

Q7

solutions

-

Select the correct option in the following question:

Which one of the following analysis is considered as a dynamic analysis?- Vertical analysis

- Horizontal analysis

- Internal analysis

- External analysis

- State with reason whether old furniture written off would lead to inflow, outflow or no flow of Cash and Cash Equivalents.

solutions

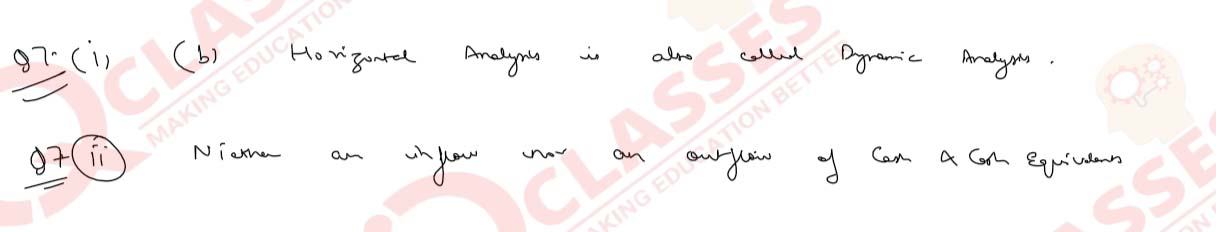

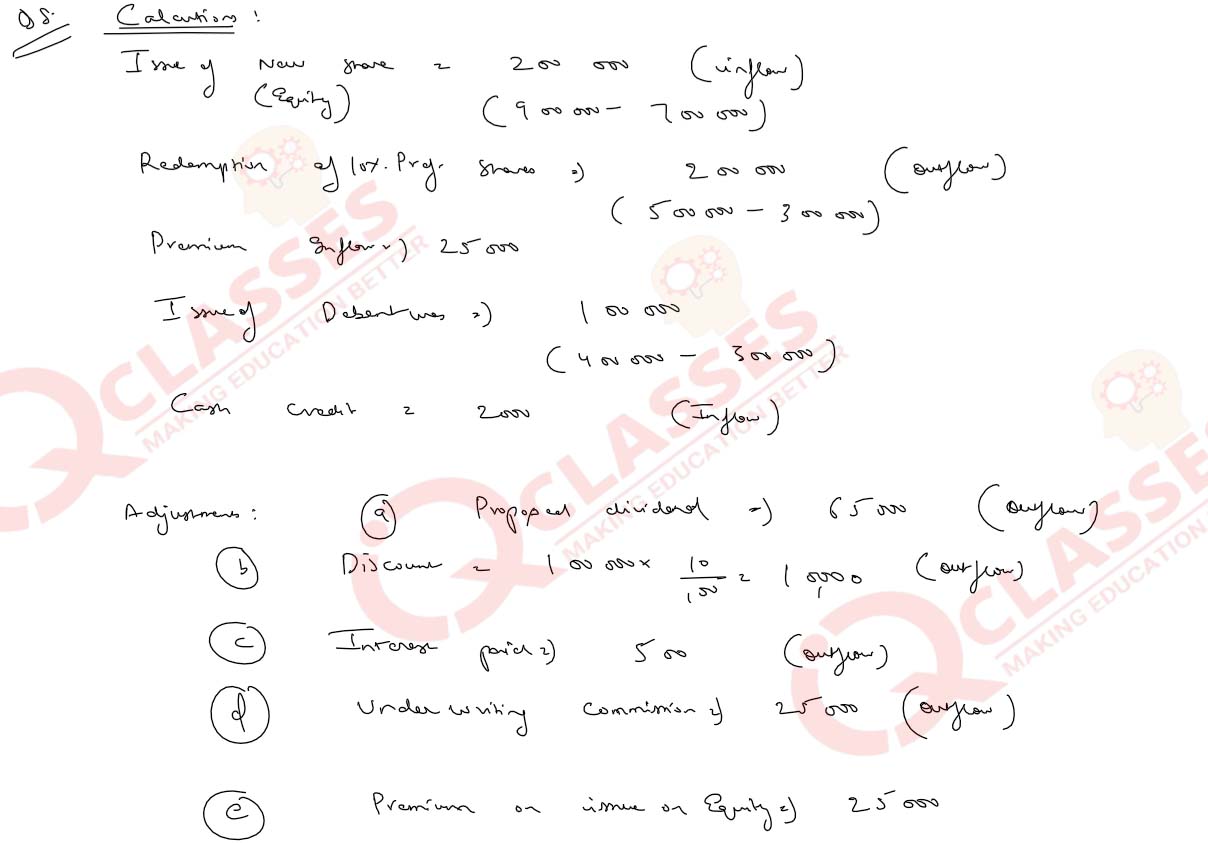

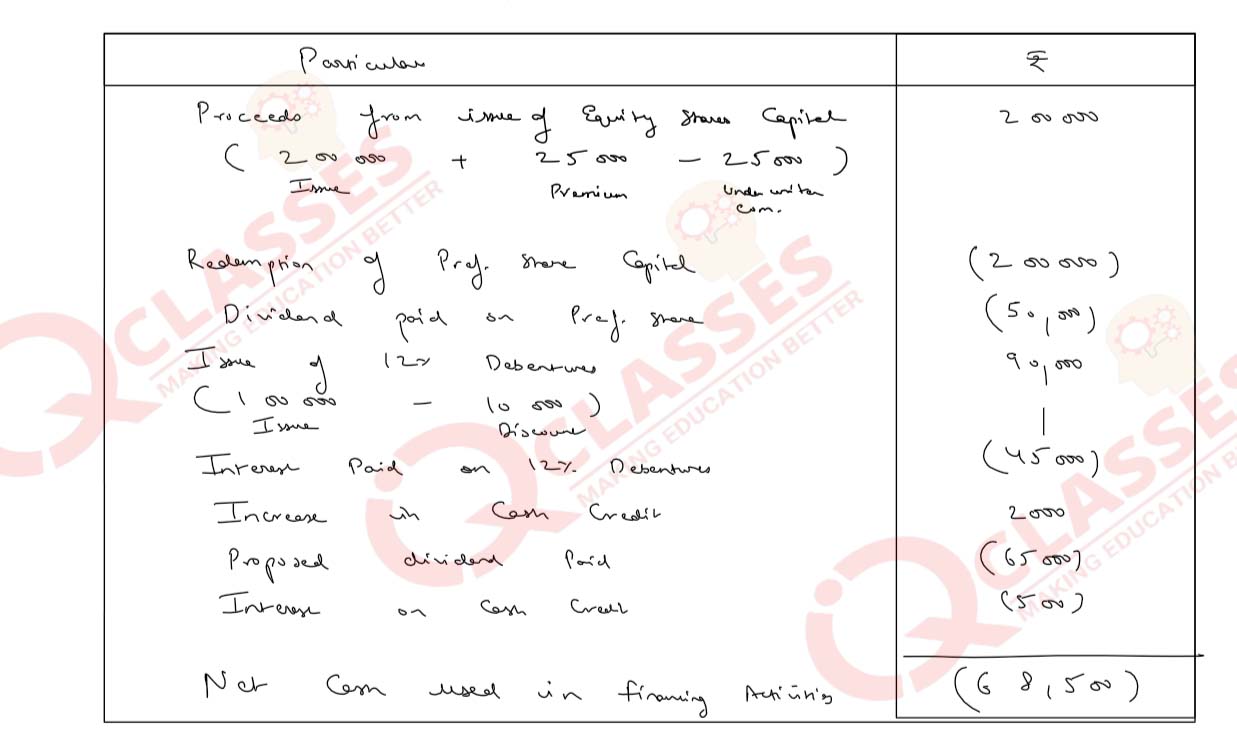

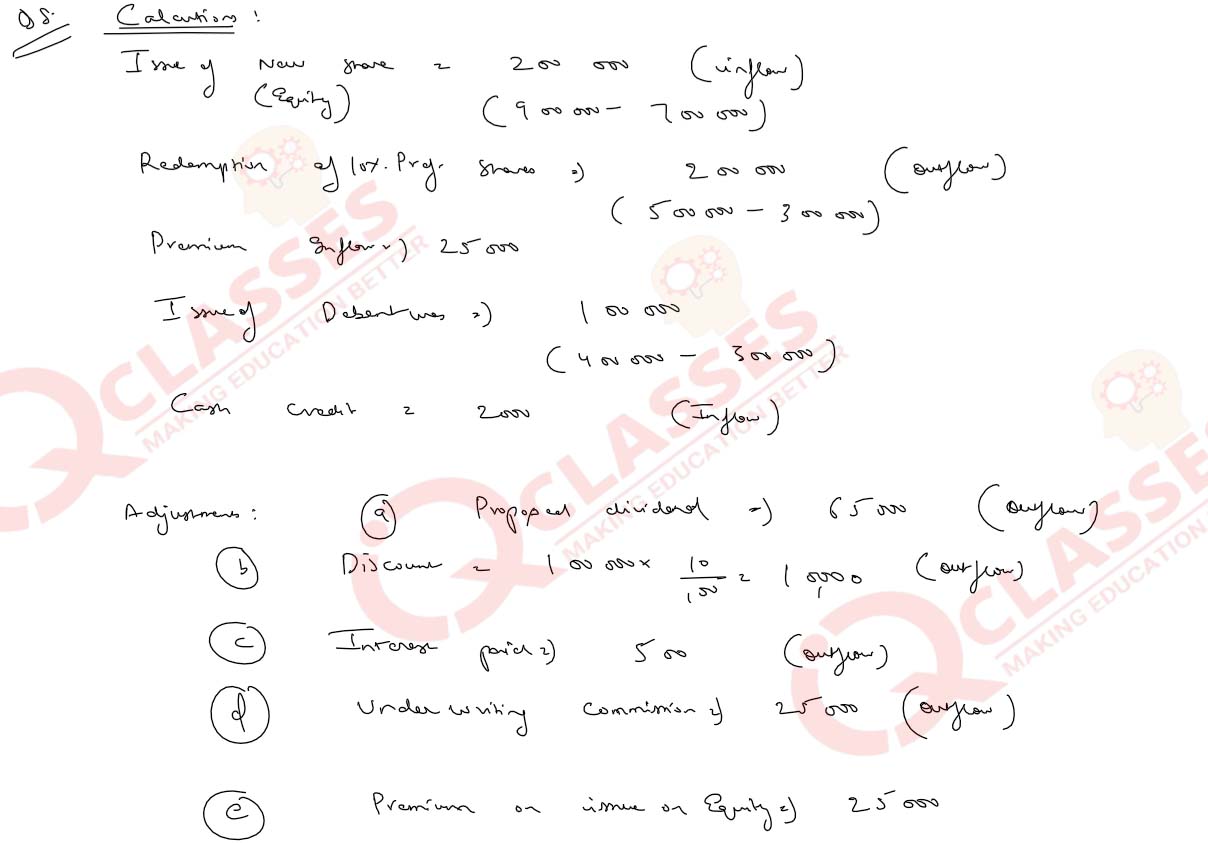

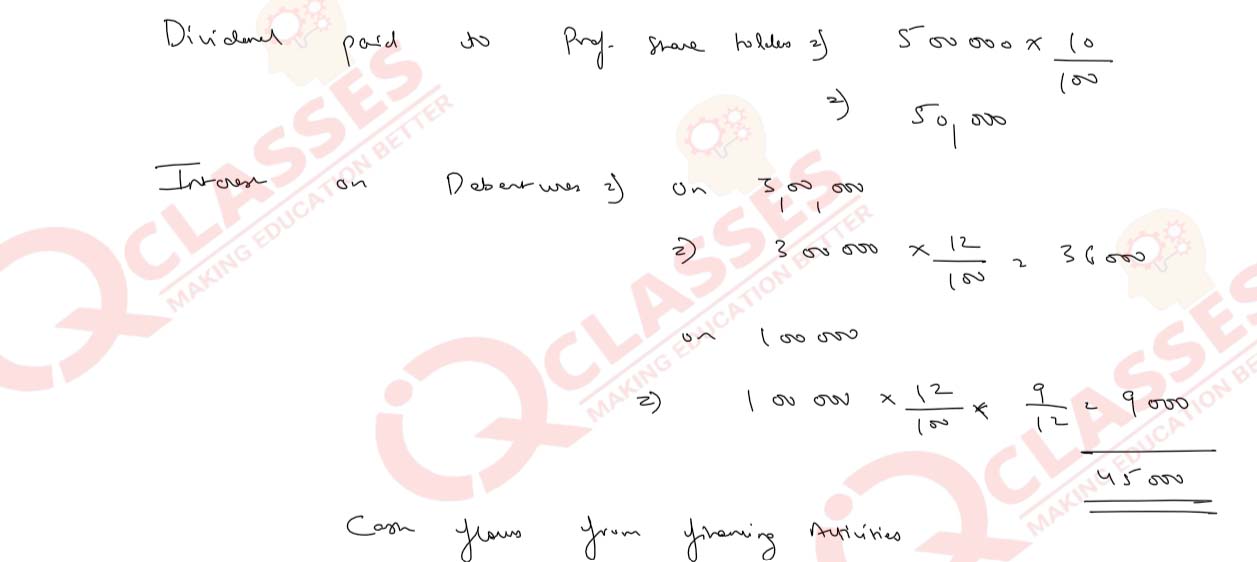

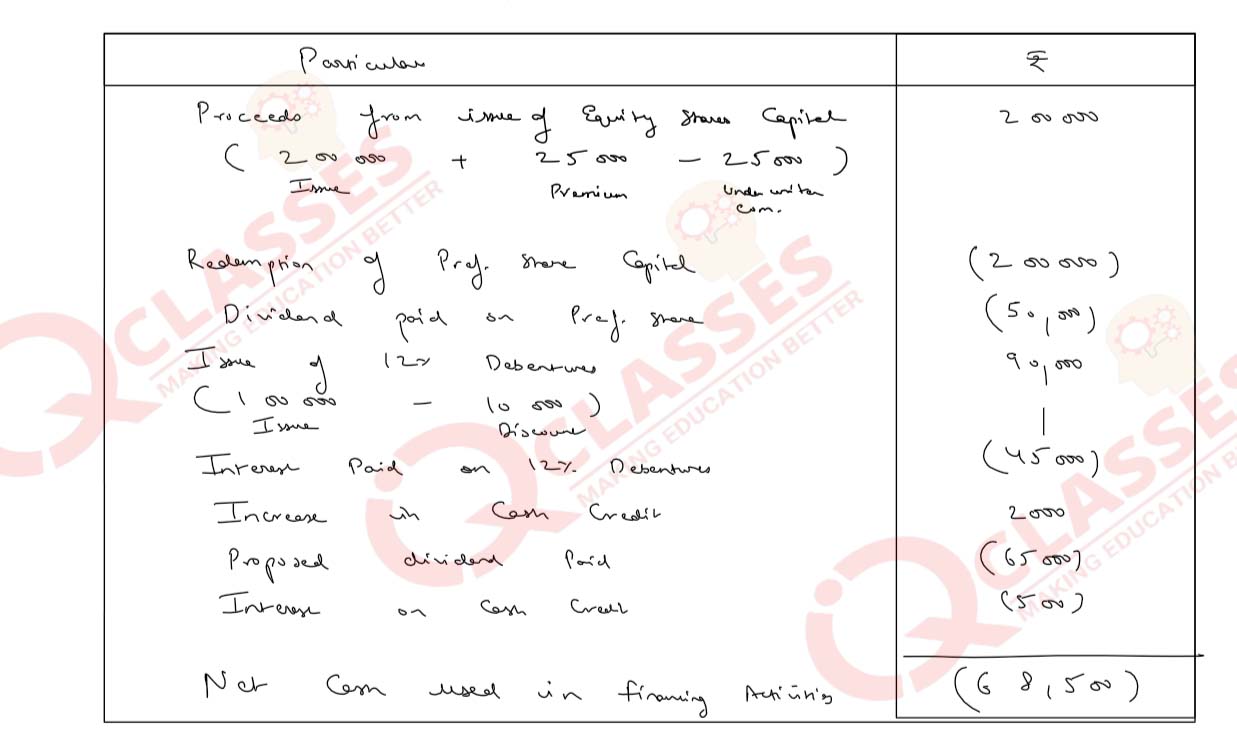

Q8

From the following extracts of a company’s Balance Sheets and the additional

information, you are required to calculate Cash from Financing Activities for the year

ending 31st March, 2021.

Additional information:

solutions

| Particulars | 31.3.2021 (₹) | 31.3.2020 (₹) |

|---|---|---|

| Equity Share Capital | 9,00,000 | 7,00,000 |

| 10% Preference Share Capital | 3,00,000 | 5,00,000 |

| Securities Premium Reserve | 30,000 | 5,000 |

| 12% Debentures | 4,00,000 | 3,00,000 |

| Cash Credit | 12,000 | 10,000 |

Additional information:

-

During the year 2020-21:

- Dividend proposed on Equity Shares in 2019-20 of ₹ 65,000 was declared and paid.

- Debentures were issued on 1st July, 2020, at a discount of 10%

- Interest on cash credit of ₹ 500 was paid.

- Underwriting commission of ₹ 25,000 was paid to the underwriters.

- The Equity shares were issued at a premium

- The 10% Preference Shares were redeemed on 31st March, 2021.

solutions

Q9

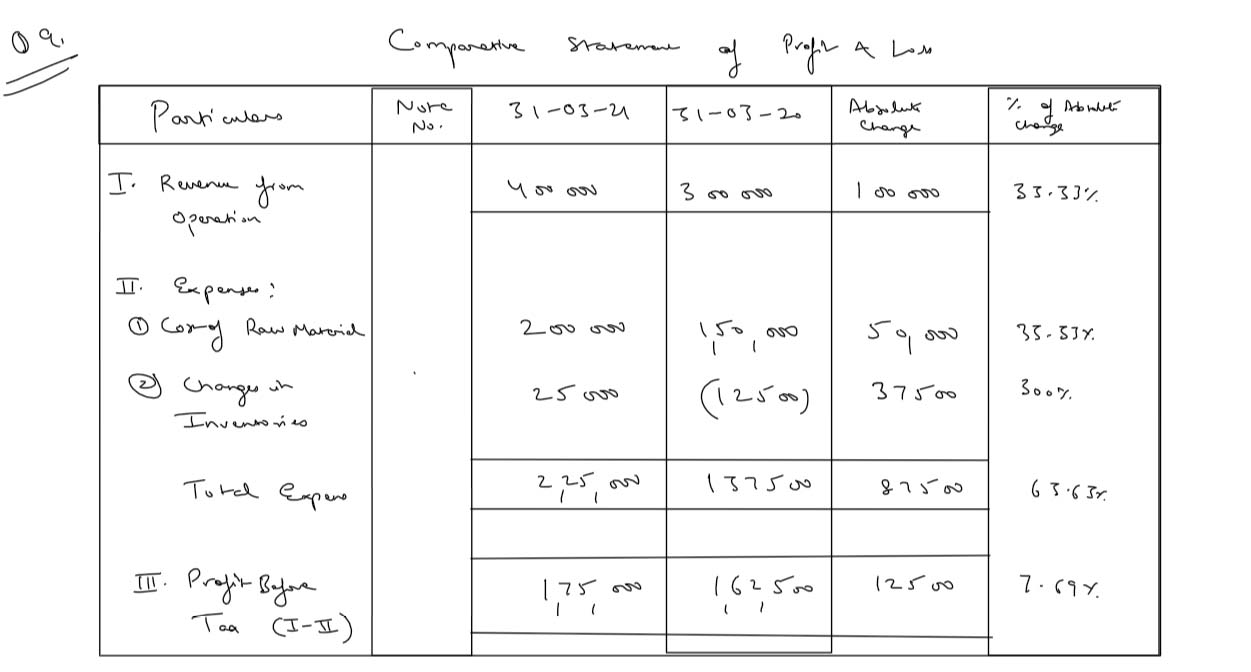

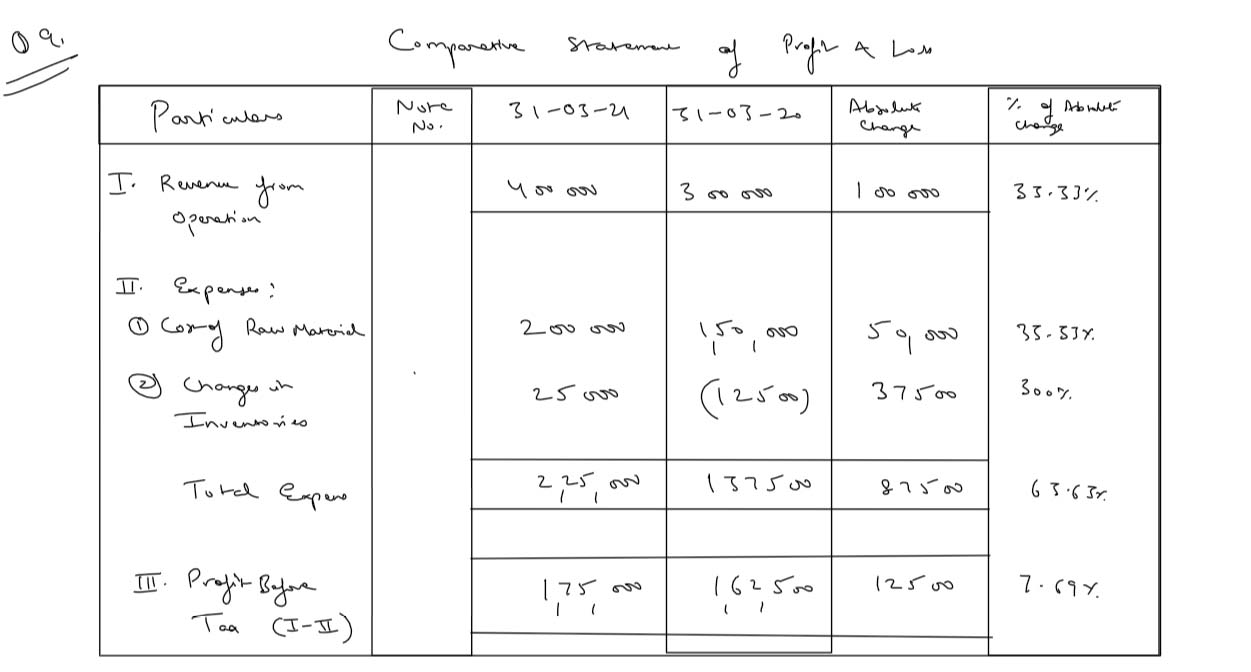

You are required to prepare a Comparative Statement of Profit & Loss from the

following particulars of Nishant Ltd.

solutions

| Particulars | N. No. | 31.03.2021 (₹) | 31.03.2020 (₹) |

|---|---|---|---|

| Revenue from operations | 4,00,000 | 3,00,000 | |

| Cost of raw materials consumed | 2,00,000 | 1,50,000 | |

| Changes in inventories of raw materials | 25,000 | (12,500) |

solutions

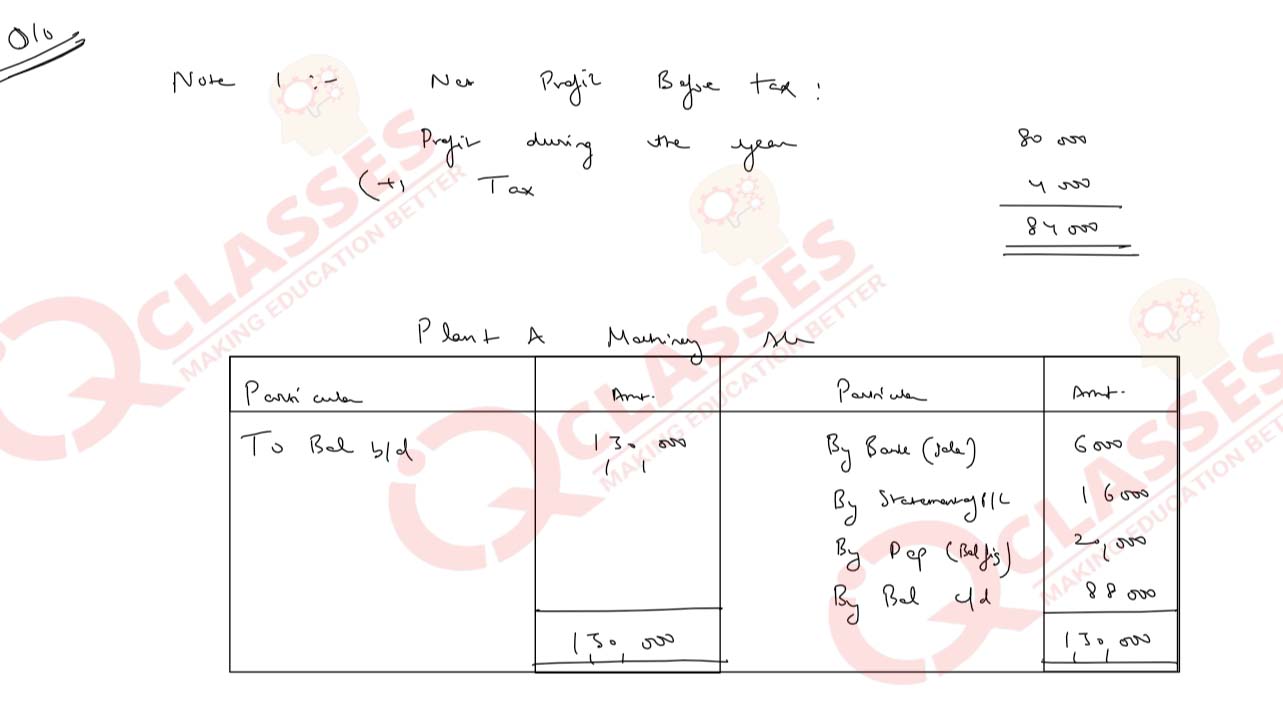

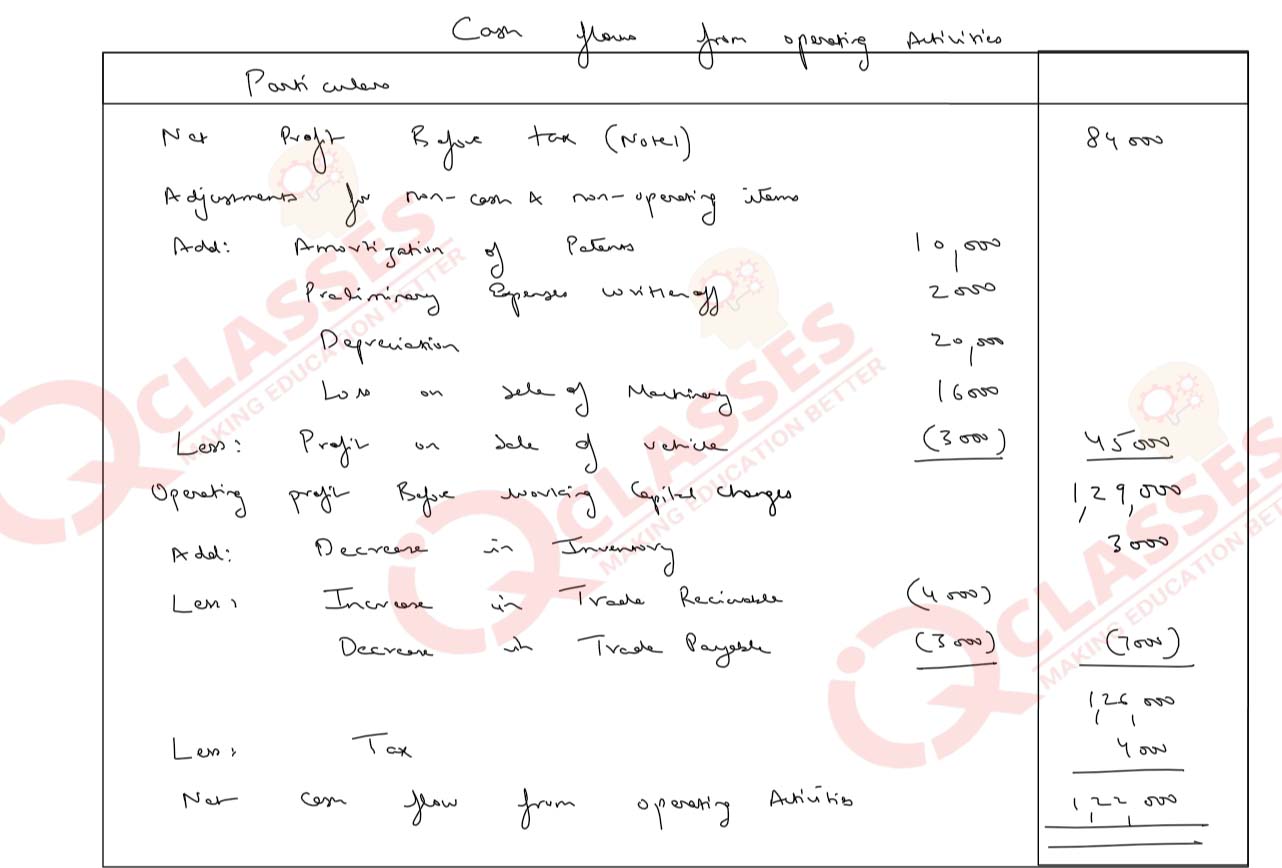

Q10

From the following extracts of a company’s Balance Sheets, and the additional

information, you are required to calculate Cash from Operating Activities for the year

ending 31st March, 2021.

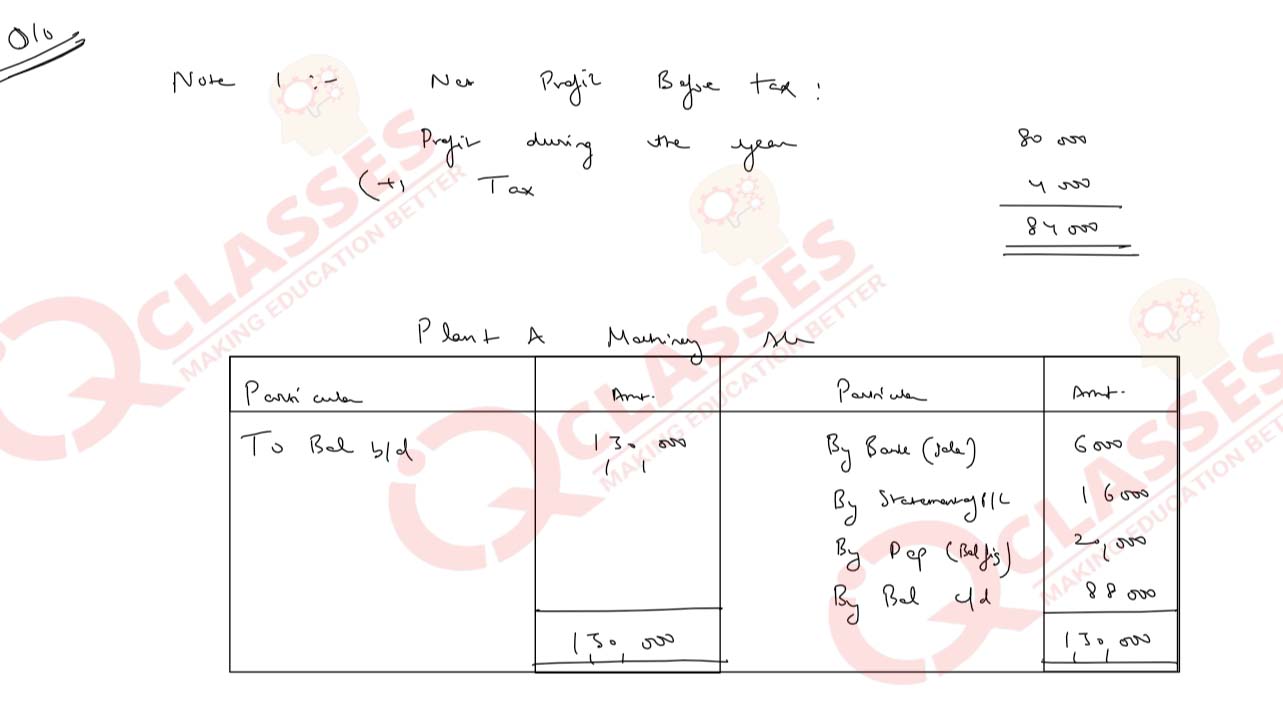

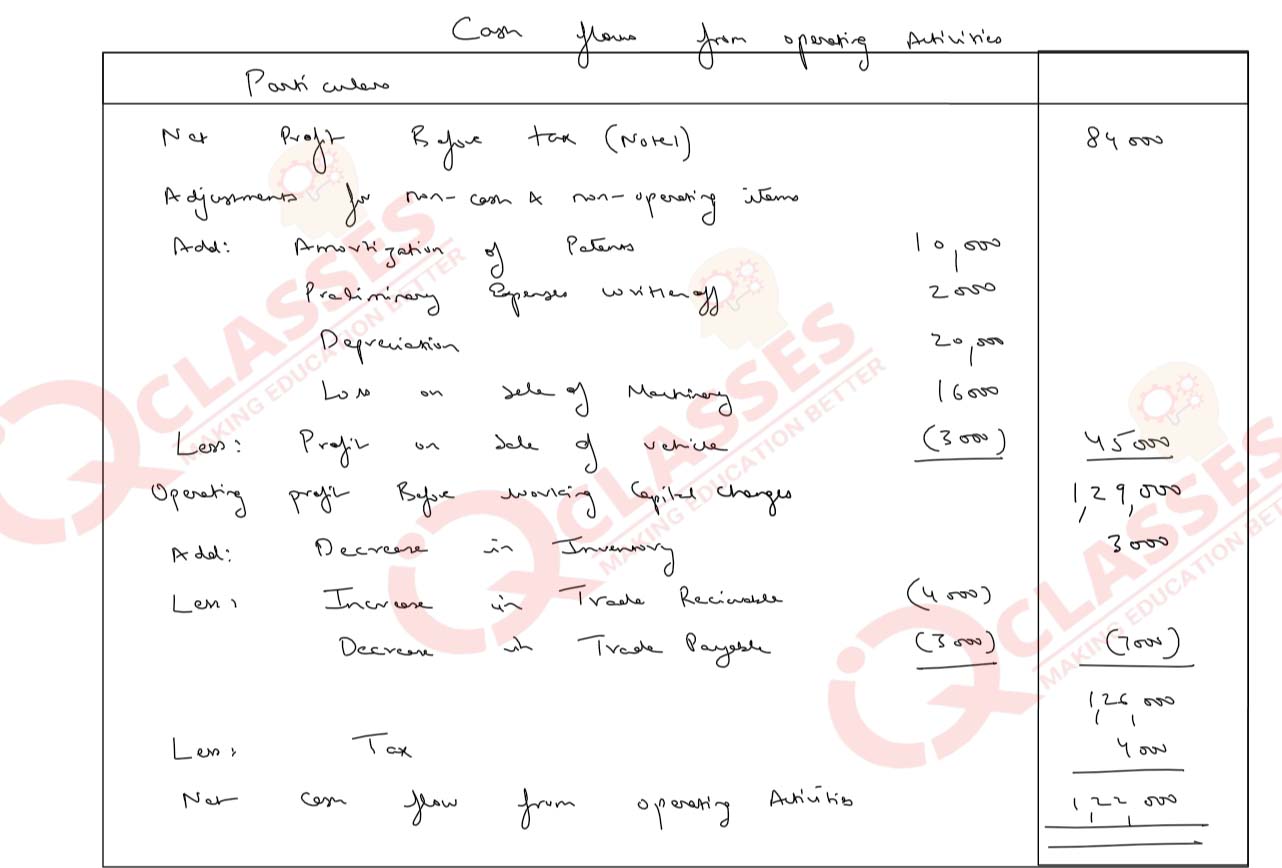

Anjan Ltd. reported a profit of ₹ 80,000 for the year ended 31st March, 2021, after considering the following:

(v) During the year, machinery costing ₹40,000 (accumulated depreciation

thereon being ₹18,000) was sold for ₹6,000.

solutions

Anjan Ltd. reported a profit of ₹ 80,000 for the year ended 31st March, 2021, after considering the following:

| Particulars | (₹) |

|---|---|

| (i) Tax provided during the year | 4,000 |

| (ii) Amortization of Patents | 10,000 |

| (iii) Profit on sale of Vehicle | 3,000 |

| (iv) Writing off Preliminary expenses | 2,000 |

| 31.03.2021 (₹) | 31.03.2020 (₹) | |

|---|---|---|

| Trade Receivable | 20,000 | 16,000 |

| Inventory | 12,000 | 15,000 |

| Cash at Bank | 8,000 | 10,000 |

| Trade Payable | 9,000 | 11,000 |

| Marketable Securities | 5,000 | 2,000 |

| Plant & Machinery | 88,000 | 1,30,00 |

solutions