This Question Paper contains three sections.

Section A is compulsory for all candidates.

Candidates have to attempt all questions from either Section B or Section C.

There are internal choices provided in each section.

The intended marks for questions or parts of questions are given in the brackets [].

All calculations should be shown clearly.

All working, including rough work, should be done on the same page as, and adjacent to, the rest of

the answer.

SECTION A

Answer all Questions

(i) On the date of Som’s admission as a partner, it is decided that:

• Furniture (book value ₹ 2,50,000) be reduced by 40%

• Machinery (book value ₹ 1,50,000) be reduced to 40%

What is the net decrease in the value of the assets?

(a) ₹ 2,10,000

(b) ₹ 1,90,000

(c) ₹ 1,60,000

(d) ₹ 2,40,000

View Solution

(ii) Anita, Benu and Chitra dissolve their partnership firm. Anita had taken a loan of ₹ 10,000 from the firm.

What will be the entry to settle Anita’s Loan on the dissolution of the firm?

(a) Debit Realisation A/c; Credit Anita’s Loan A/c

(b) Debit Anita’s Loan A/c; Credit Realisation A/c

(c) Debit Anita’s Capital A/c; Credit Anita’s Loan A/c

(d) Debit Bank A/c; Credit Anita’s Loan A/c

View Solution

(iii) A company issued 5,000, 10% Debentures of ₹ 100 each at a discount of 5%. To write off the capital loss, it has to use its profits in a certain order. Chose the correct order in which the profits are used by the company to write off the capital loss:

P Statement of Profit & Loss

Q Capital Reserve

R Securities Premium

(a) P, Q, R

(b) R, P, Q

(c) R, Q, P

(d) Q, P, R

View Solution

(iv) The Subscribed Capital of a company refers to:

(a) The paid-up value of the shares allotted on the date of the balance sheet.

(b) The called-up value of all shares allotted on the date of the balance sheet.

(c) The nominal value of all shares allotted on the date of the balance sheet.

(d) The paid-up value of all shares allotted on the date of the balance sheet and the balance of shares forfeited account, if any.

View Solution

(v) Jia, Tia, Sia and Bashir are partners sharing profits in the ratio of 3:3:2:1. Tia retires from the firm.

Bashir retains his original share in the reconstituted firm.

Jia takes over 2/3 of Tia’s share and the balance is taken up by Sia.

What is the new profit-sharing ratio of the remaining partners in the reconstituted firm?

View Solution

(vi) Assertion : Goodwill is a fictitious asset.

Reason : Goodwill has a realisable value.

Which one of the following is correct?

(a) Both Assertion and Reason are correct, and Reason is the correct explanation for Assertion.

(b) Both Assertion and Reason are correct, but Reason is not the correct explanation for Assertion.

(c) Assertion is false and Reason is true.

(d) Assertion is true and Reason is false.

View Solution

(vii) At the time of dissolution of a partnership firm, its Balance Sheet showed stock of ₹ 40,000 comprising of easily marketable items, obsolete items and a few miscellaneous other items. These items were realised as:

• Easily marketable items: 70% of the total inventory - in full.

• Obsolete items: 10% of the remaining inventory - discarded.

• The miscellaneous other items in the stock - 20% of their book value.

You are required to calculate the amount realised from the sale of stock.

View Solution

(viii) As a result of the measure taken by the government in the year 2019-20 of non-creation of Debenture Redemption Reserve by listed companies / NBFCs or HFCs, the investments in the debenture issues from these companies have become riskier.

Source (edited): The Hindu, August, 2019

State the adverse impact of this measure on the investors?

View Solution

(ix) Give any one difference between a company’s balance sheet and a firm’s balance sheet

View Solution

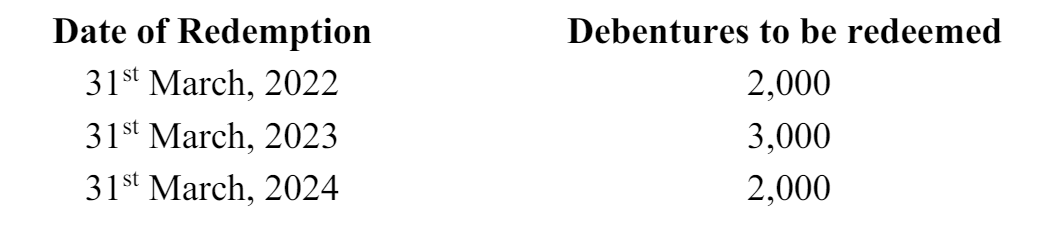

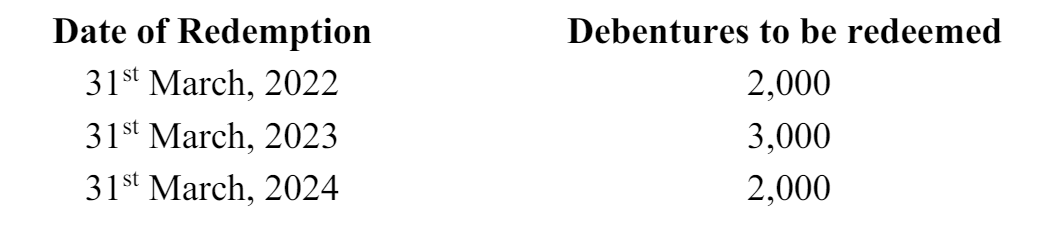

(x) Matrix Ltd. (an unlisted construction company) redeems its 7,000, 10% Debentures of ₹ 100 each in instalments as follows:

How much will the company transfer from Debenture Redemption Reserve to General Reserve on 31st March, 2023?

View Solution

Question 2

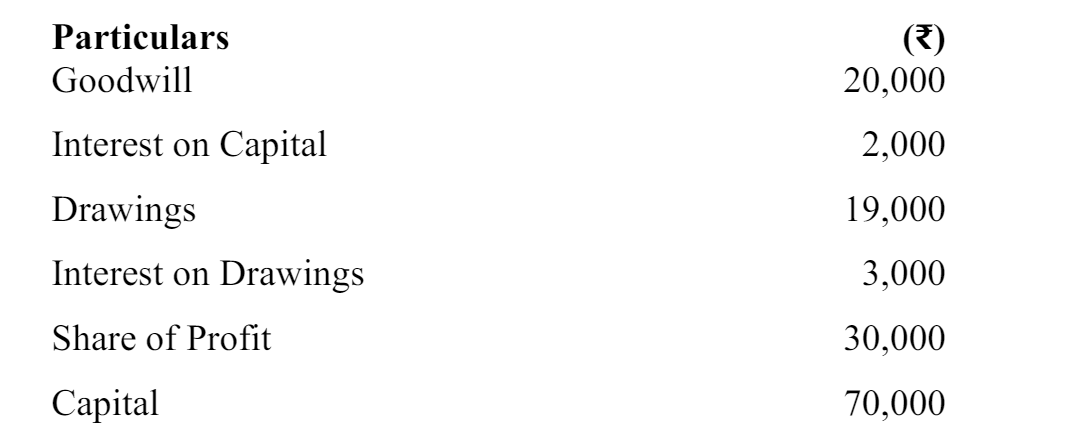

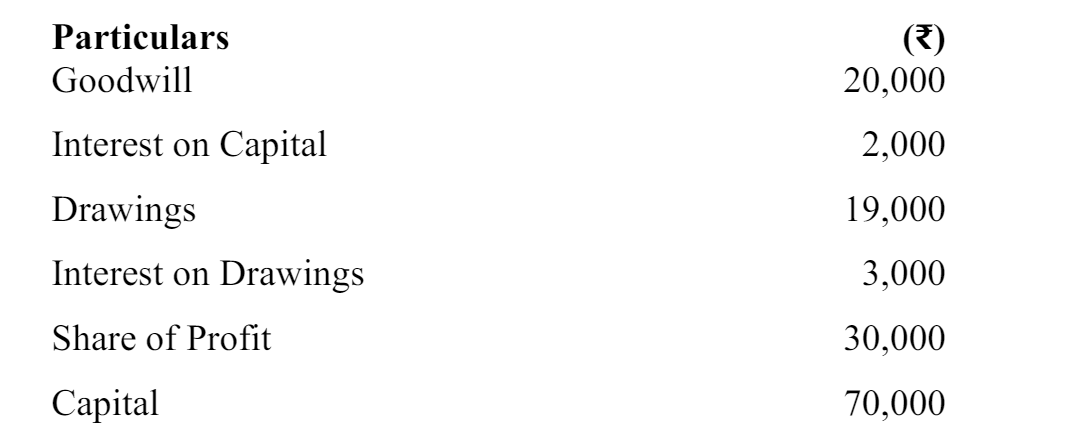

On 31st March, 2023, Parul retired from active partnership and her share of the following was ascertained on the date of her retirement:

The amount due to Parul was kept with the firm as a loan, bearing interest @ 6% per annum. It was to be paid in two equal annual instalments along with interest @ 6 % per annum, the first instalment being paid on 31st March, 2024.

You are required to prepare Parul’s Loan Account until the payment of the whole amount due to her is made.

OR

Piu and Nina are partners in a firm sharing profits and losses in the ratio of 3:1 respectively. Nina retires and her claim, including her capital and entitlements from the firm including her share of goodwill of the firm, is ₹ 60,000.

After this amount was determined, it was found that there was some unrecorded office equipment valued at ₹ 18,000 which had to be recorded.

Upon recording this office equipment, the revised amount due to Nina was determined and Piu settled it by giving Nina this office equipment and for the balance she drew a promissory note.

You are required to give the necessary journal entries to record the transactions on the date of Nina’s retirement.

View Solution

Question 3

On 1st April, 2021, Kant Ltd. issued 8,000, 12% Debentures of ₹ 100 each, redeemable at par after five years. The issue was fully subscribed.

According to the terms of issue, interest on debentures is payable annually on 31st March. Tax deducted at source is 20%.

You are required to pass journal entries to record the transactions of interest on debentures only for the year 2022-23

View Solution

Question 4

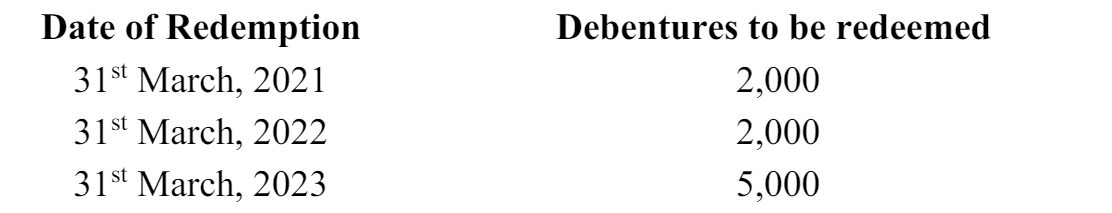

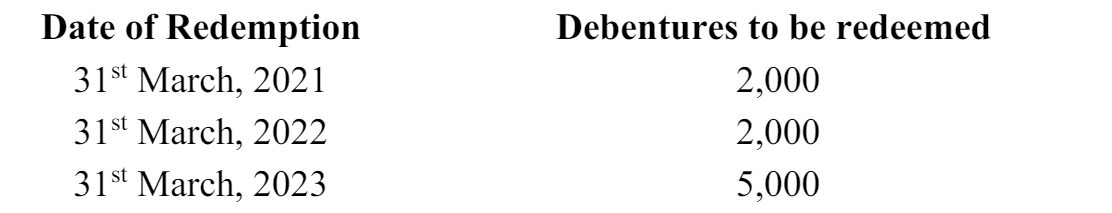

Leo Ltd. (a listed NBFC) redeems its 9,000, 10% Debentures of ₹ 100 each at a premium of 5 % in instalments, as follows:

You are required to prepare:

(i) The Debenture Redemption Investment Account for the years 2021-22 and 2022-23.

(ii) 10% Debentures Account for the year 2021-22.

OR

Honesty Ltd., an unlisted manufacturing company, had 30,000, 6% Debentures of ₹ 100 each due for redemption at par on 31st March, 2023. On this date the company had the required amount of ₹ 3,00,000 in its Debenture Redemption Reserve. The Debenture Redemption Investment, which was purchased on 30th April, 2022, was realized at 101% on the date of redemption of the debentures and the debentures were redeemed. You are required to pass journal entries in the books of the company for the year 2022-23. (Ignore interest on debentures)

View Solution

Question 5

From the information given below, find the average profits of the partnership firm of Sudhir and Sana.

(a) The firm has total assets of ₹ 4,80,000.

(b) The partners’ capital accounts show a balance of ₹ 4,00,000.

(c) The firm has reserves of ₹ 30,000 and creditors of ₹ 50,000.

(d) The normal rate of return from the capital invested in the same class of business is 10%.

(e) The self-generated goodwill of the firm is valued at ₹ 1,80,000 at 3 years’ purchase of super profits.

View Solution

Question 6

On 1st April, 2021, Vintage Ltd. was registered with a capital of ₹ 40,00,000 divided into equity shares of ₹ 100 each.

It offered 12,000 shares to the public which were all subscribed for and allotted and were fully paid.

During the year 2022-23, the company:

• Issued 5,500 equity shares to the public on which, till the date of the Balance Sheet as at 31st March, 2023, ₹ 70 had been called.

• Issued equity shares of ₹ 100 each at a premium of ₹ 25 to Style Ltd. from whom it purchased land at a purchase consideration of ₹ 4,50,000.

• Paid underwriting commission of ₹ 40,000 to the underwriters.

• Suffered a net loss of ₹ 4,00,000.

As per Schedule III of the Companies Act, 2013, you are required to:

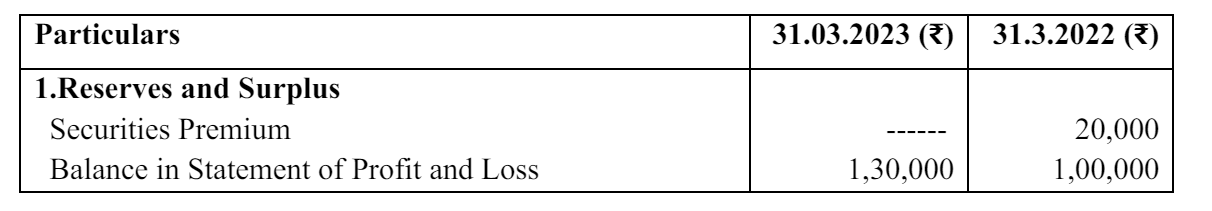

(i) Show the Reserves and Surplus in the Notes to Accounts.

(ii) Mention the heading and sub-heading under which Land is shown in the Balance Sheet of the company.

(iii) Give the amount of Share Capital in the Balance Sheet of the company prepared as at 31st March, 2023. (Ignore Notes to Accounts)

View Solution

Question 7

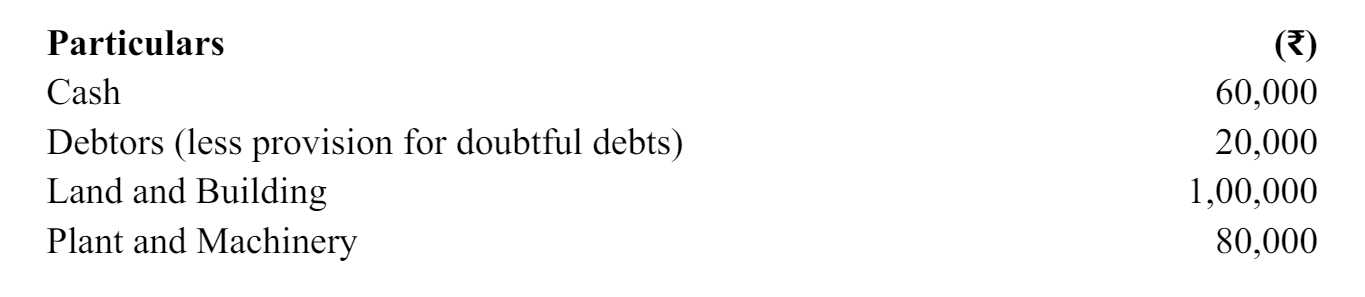

Sharan and Angad are partners in a firm sharing profits and losses in the ratio of 3:2. On 1st April, 2022, they admit Akhil as a partner for 1/5 share in the profits. Akhil acquires 1/5 of his share from Sharan and the balance from Angad.

On the date of Akhil’s admission, the goodwill of the firm was valued at ₹ 90,000.

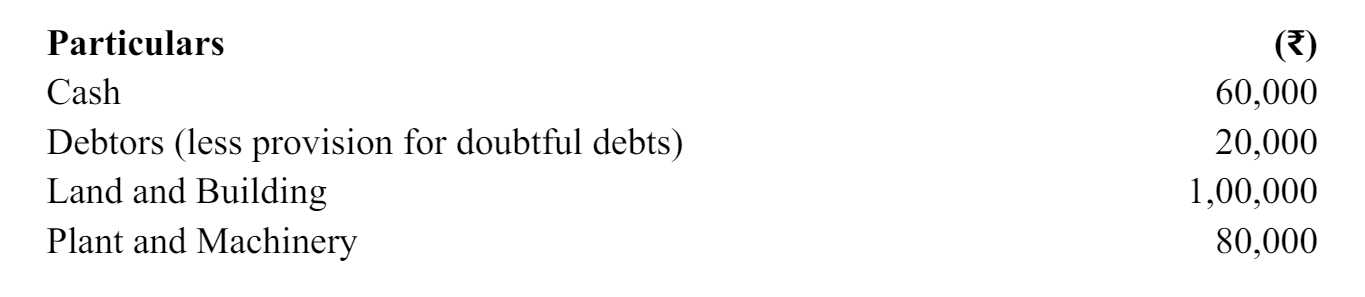

Akhil contributed the following assets towards his capital and his share of goodwill.

You are required to:

(i) Calculate the sacrificing ratio of the partners

(ii) Pass the necessary journal entries on Akhil’s admission, ascertaining Akhil’s capital contribution and assuming that he brings into the firm his share of goodwill in cash/ kind.

OR

Amit and Pavan are partners in a firm with capitals of ₹ 35,000 each. They shared profits and losses in the ratio of 3:1.

On 1st April, 2023, they admit Charu as a new partner for 1/5 share in the profits. Charu brings in ₹ 40,000 as her share of capital.

Goodwill of the firm is based on Charu’s share in the profits and the capital contributed by her. Charu brings her share of goodwill in cash.

At the time of Charu’s admission:

(a) The firm had a General Reserve of ₹ 60,000 from which ₹ 20,000 is to be set aside as provision for doubtful debts.

(b) Creditors of ₹ 8,000 are paid by Amit privately for which he is not to be reimbursed.

(c) There is no change in the value of other assets and liabilities.

You are required to pass necessary journal entries on Charu’s admission.

View Solution

Question 8

Mitesh, Samir and Ajay were partners sharing profits and losses in proportion to their capitals, which on 31st March, 2023, stood at:

Mitesh - ₹ 1,50,000

Samir - ₹ 1,00,000

Ajay - ₹ 50,000

The firm’s recorded liabilities on that date amounted to ₹ 1,00,000.

In addition:

• Ajay had given a loan of ₹ 40,000 to the firm on which he was entitled to receive interest @ 6% per annum for the whole year.

• A Bills Receivable of ₹ 40,000 discounted with the bank was dishonoured on 31st March, 2023.

The partners dissolved their partnership firm on 31st March, 2023, and the assets, apart from cash of ₹ 30,000, realised ₹ 6,00,000.

Expenses of dissolution amounting to ₹ 12,500 were to be borne by Samir. These were paid by the firm on his behalf.

You are required to prepare:

(i) Realisation Account.

(ii) Ajay’s Loan Account.

View Solution

Question 9

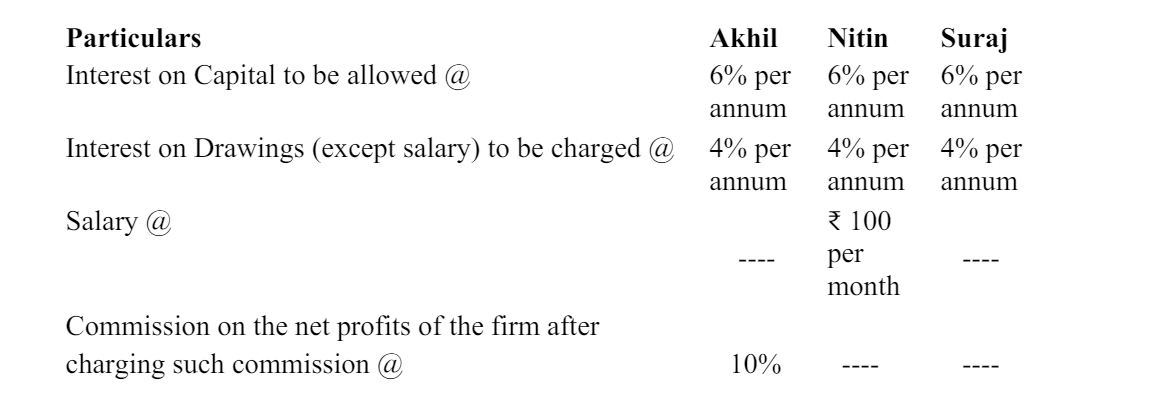

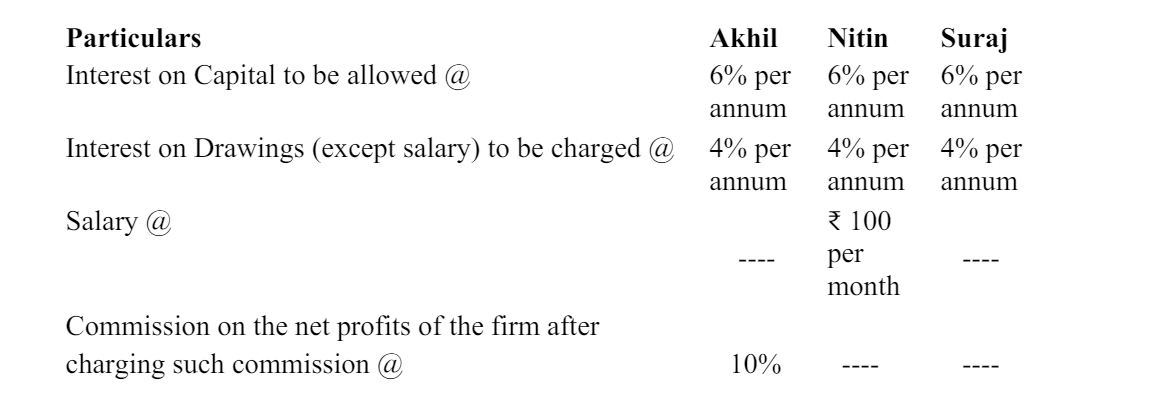

Akhil, Nitin and Suraj are partners in a firm. Their terms of agreement are as follows:

On 1st April, 2022, their capitals were:

Akhil ₹ 15,000

Nitin ₹ 20,000

Suraj ₹ 6,000 (Dr)

On 1st December, 2022, Akhil introduced further capital of ₹ 4,000.

The drawings of the partners were:

• Suraj withdrew ₹ 300 on 1st August, 2022

₹ 600 on 1st December, 2022

• Nitin withdrew only his salary

Akhil withdrew a certain fixed amount at the beginning of every month on which he was charged an interest of ₹ 52 at the end of the year, at the rate mentioned in the deed.

The profits of the firm for the financial year 2022-23, before any of the above adjustments, were ₹ 27,500.

You are required to:

(i) Calculate the drawings made by Akhil every month.

(ii) Pass the journal entry for capital introduced by Akhil.

(iii) Prepare the Profit and Loss Appropriation Account of the firm for the year 2022-23.

OR

Krish and Shail entered into a partnership on 1st October, 2022, with capital contributions of ₹ 48,000 and ₹ 36,000 respectively.

On 1st January, 2023, Shail advanced a loan of ₹ 12,000 to the firm.

The terms of the partnership agreement are as follows:

(a) Interest on Capital to be allowed at 12% per annum.

(b) Interest on Drawings to be charged @ 10% per annum.

(c) Krish to be entitled to a commission of 2% on the turnover.

(d) Each partner to get a salary of ₹ 1,200 per month.

(v) Profits and losses to be shared in the ratio of 4:3.

The turnover for the period under consideration was ₹ 2,00,000.

The drawings of the partners were: Krish ₹ 4,000; Shail ₹ 2,000.

The profit of the firm for the year ended 31st March, 2023, before providing for any interest was ₹ 1,10,000.

You are required to prepare for the year 2022-23:

(i) Profit and Loss Appropriation Account.

(ii) Shail’s Loan Account.

View Solution

Question 10

In the year 2022-23, Paresh Ltd. invited applications for 25,000 equity shares of ₹10 each payable as follows:

On application ₹ 5 per share

On allotment ₹ 3 per share

On call ₹ 2 per share

Applications were received for 50,000 shares. It was decided:

(i) To allot 50% to Shyam who had applied for 10,000 shares.

(ii) To allot in full to Kevin who had applied for 10,000 shares.

(iii) To allot the balance of the available shares on pro rata basis among the other applicants.

(iv) To utilise the excess application money in part payment of allotment and final call.

Till the Balance Sheet as at 31st March, 2023, the company had asked the shareholders to pay up to the allotment stage.

The amount due on the allotment was received from all shareholders except from Kevin, whose shares were immediately forfeited by the company.

You are required to pass journal entries in the books of the company to record the above transactions

OR

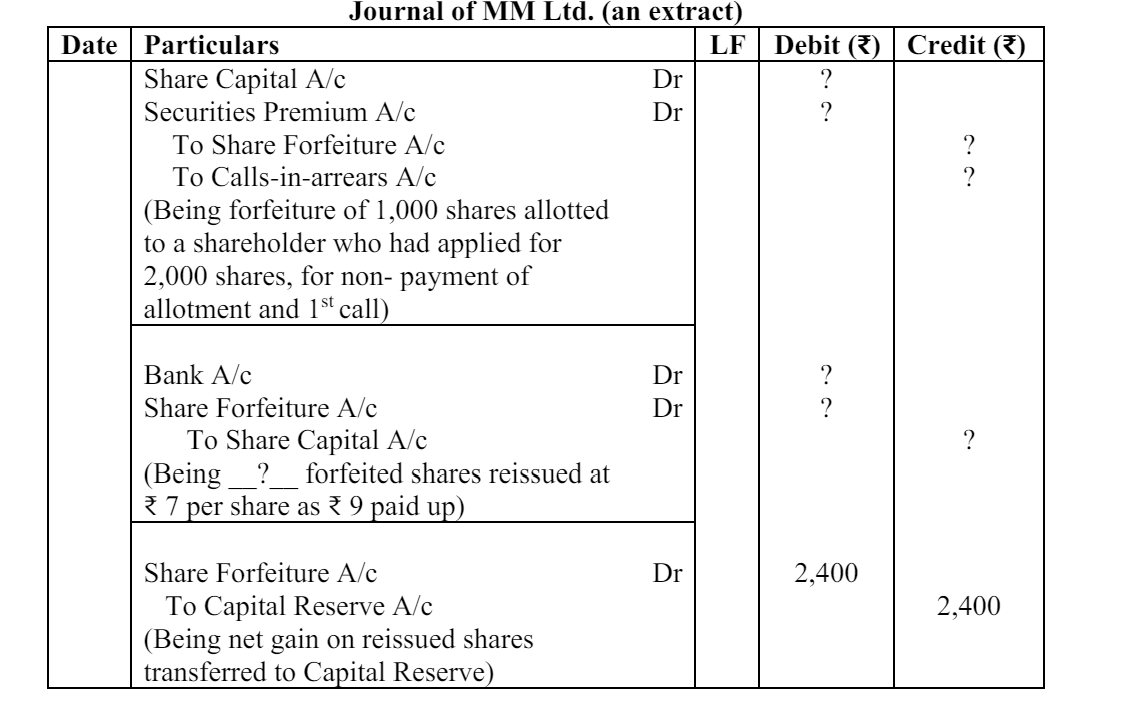

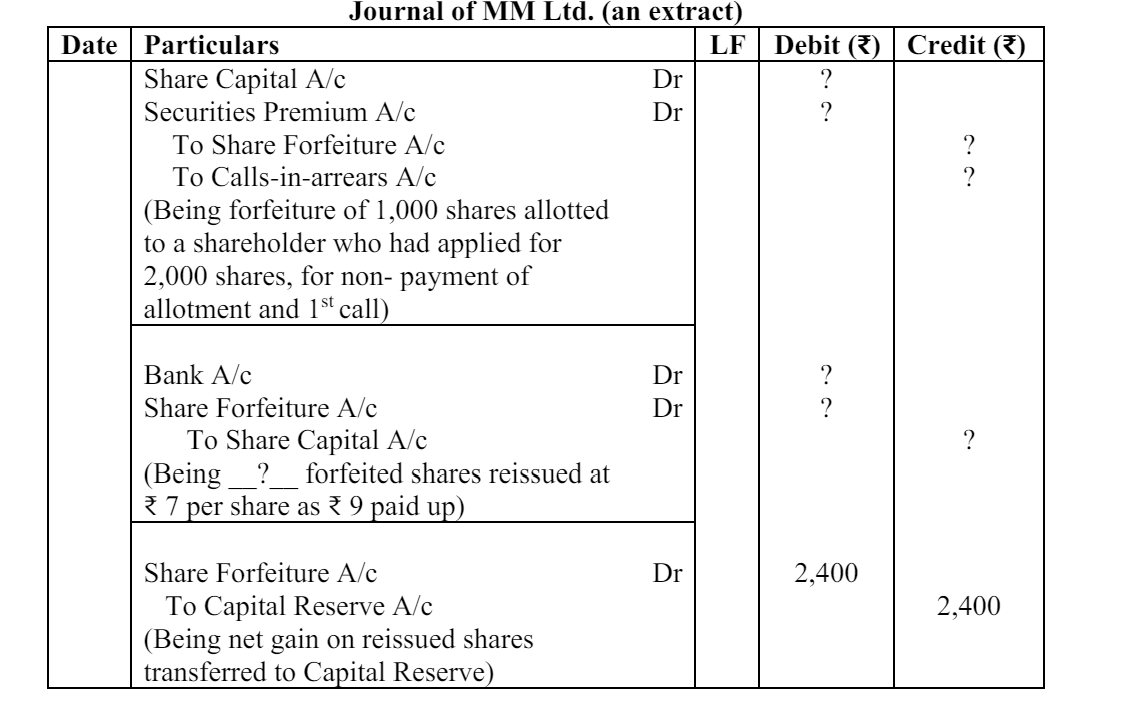

(A) Following is an extract from the Journal of MM Ltd. You are required to complete the journal entries filling up the information represented by ‘?’ which is missing from these journal entries

Additional information:

MM Ltd. issued 20,000 Equity shares of the face value of ₹ 10 each at a premium of

₹ 5 per share, payable:

₹ 5 on application;

₹ 6 on allotment (including premium);

₹ 3 on first call;

The balance as and when due

You are required to complete:

• The journal entry for forfeiture of shares.

• The journal entry for reissue of shares, clearly mentioning the number of forfeited shares reissued by the company.

(B) Shiv, the holder of 100 shares paid his first call of ₹ 4 per share, due on 1st May, 2023, along with his allotment money, on 1st September, 2023.

Interest is allowed by the company on calls-in-advance as per the provisions of Table F of the Companies Act, 2013.

You are required to give the adjusting entry and closing entry for interest on calls- in-advance.

View Solution

Question 11

In subparts (i) and (ii) choose the correct options and in subparts (iii) to (v) answer the

questions as instructed.

(i) Read the extract given below and answer the question that follows:

Unilever Plc (ULVR.L) said on Thursday (Feb. 9, 2023): It would continue to raise prices for its detergents, soaps and packaged food to offset rising input costs, and ease up those hikes in the second half of 2023.

Which one of the following is the reason for the decision taken by Unilever Plc?

(a) To repair the company’s Debt-Equity Ratio so that it can derive the benefits of trading on equity.

(b) To repair the company’s Trade Receivables Ratio in order to reduce the risk of bad debts.

(c) To repair the company’s gross margin as the industry has been battling with COVID-era supply chain issues and raw material expenses.

(d) To repair the company’s Inventory Turnover Ratio as the cost of warehousing had increased due to accumulation of stocks.

(ii) While preparing a Cash Flow Statement, which one of the following will be added to the Net Profit for the year to get Net Profit before Tax?

(a) Sale of Plant & Machinery

(b) Interest received on Investments

(c) Increase in Trade Payables

(d) Increase in General Reserve

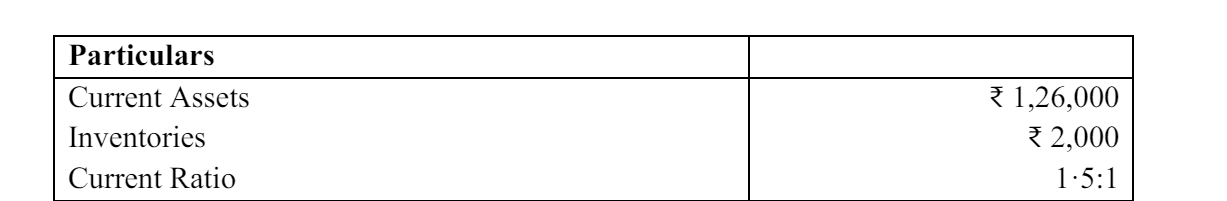

(iii) Sunshine Ltd. had a Current Ratio of 0·7:1; its Current Assets being ₹ 2,00,000 and Current Liabilities being ₹ 2,50,000.

What will be the revised Current Ratio of Sunshine Ltd., after it dishonours one of its Bills Payable of ₹ 30,000?

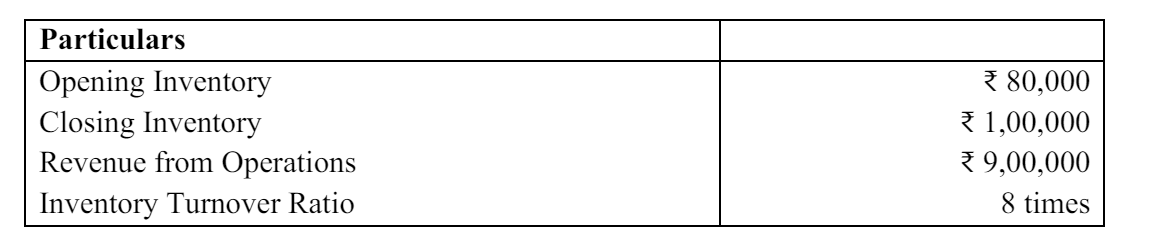

(iv) The books of accounts of Zebra Ltd. showed:

• Change in inventories of raw materials (₹ 70,000).

• Opening inventory of ₹ 2,40,000.

(a) You are required to give the formula used by the company to calculate the change in inventories.

(b) You have been provided with one component for calculating the change in inventories. Calculate the other component.

(v) Mention whether accrued interest on investments would result in inflow, outflow or no flow of cash.

View Solution

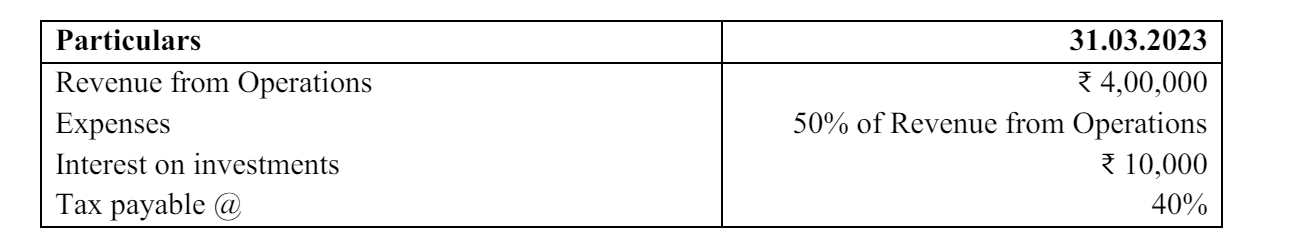

Question 12

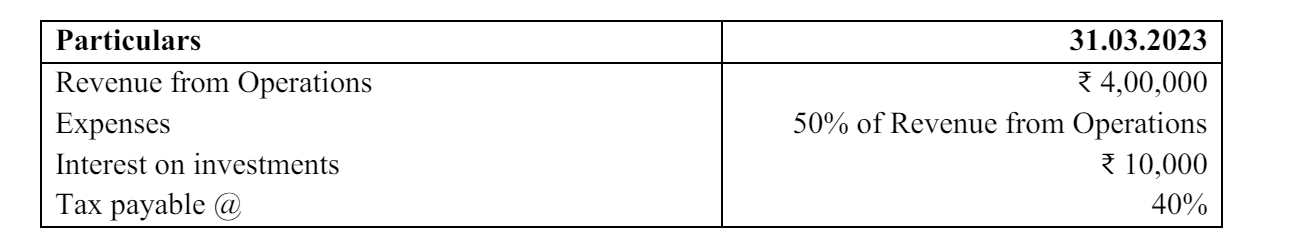

From the following income statement of ZX Ltd, you are required to prepare a Common Size Income Statement.

View Solution

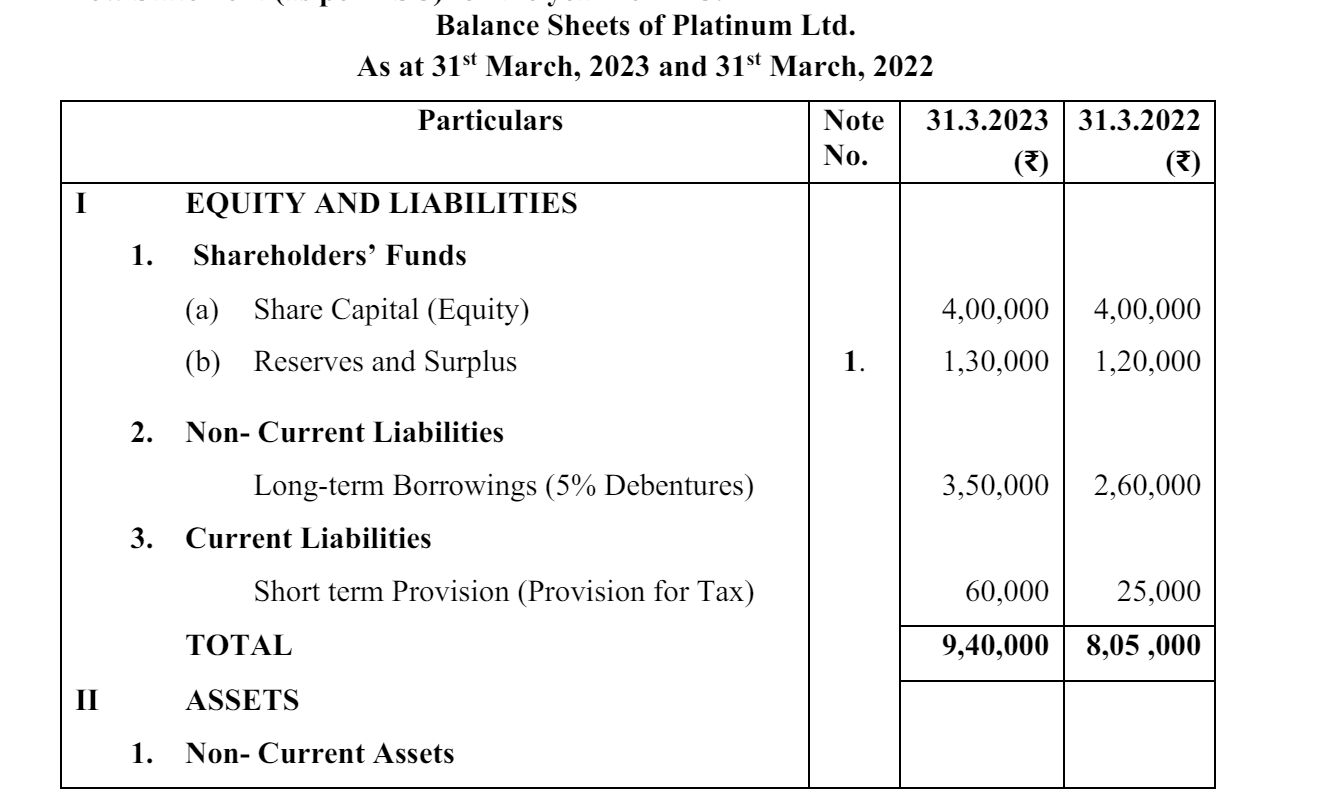

Question 13

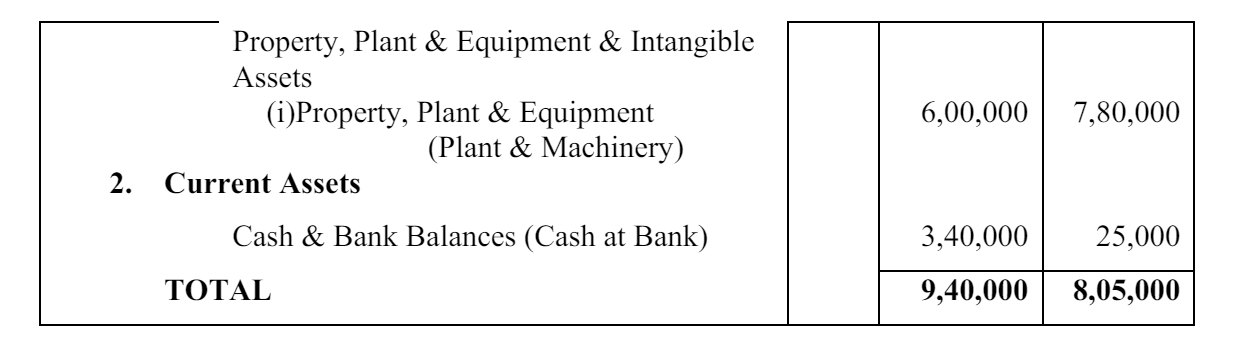

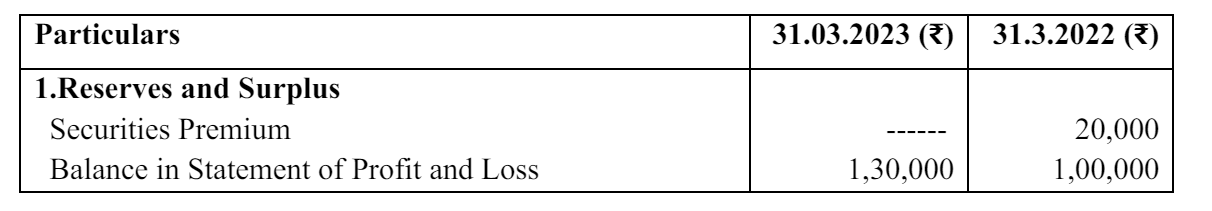

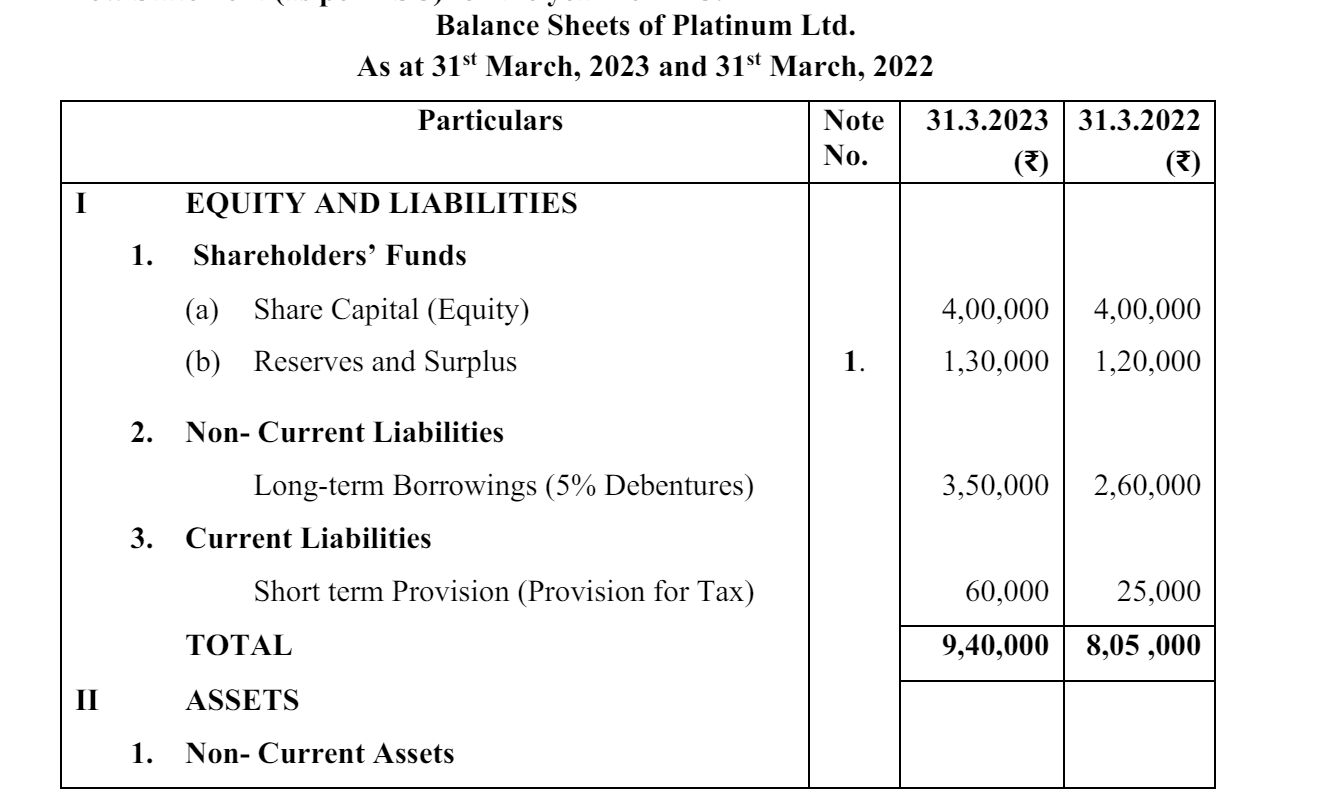

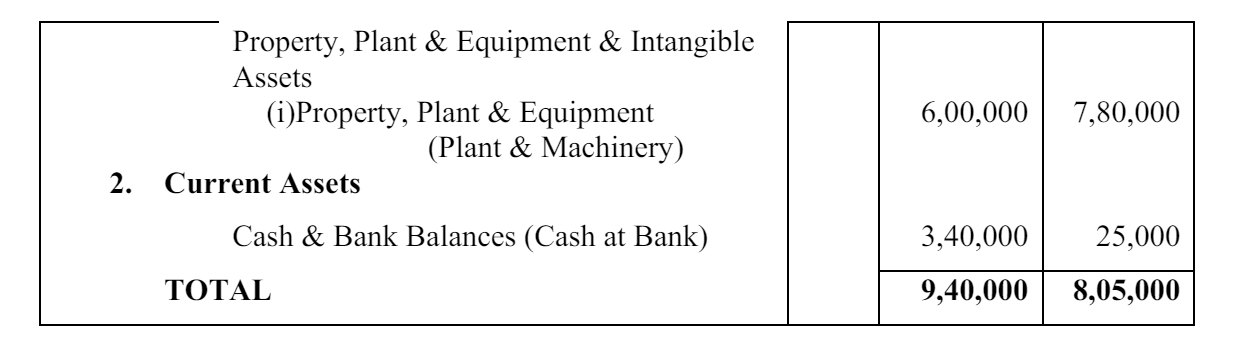

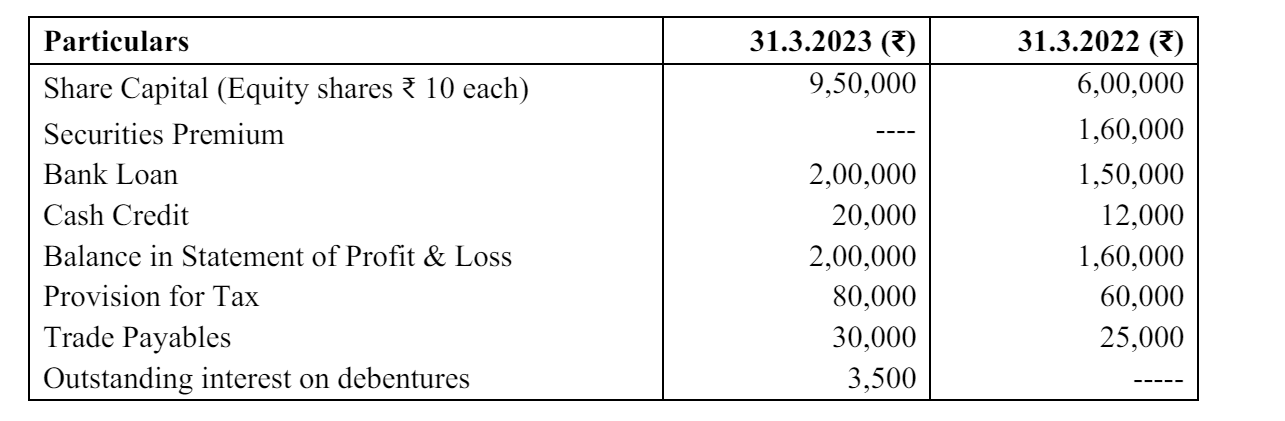

From the following Balance Sheets of Platinum Ltd., you are required to prepare a Cash Flow Statement (as per AS 3) for the year 2022-23.

Notes to Accounts:

Additional information:

During the year 2022-23, the company:

(a) Paid share issue expenses of ₹ 25,000.

(b) Sold a machine for ₹ 90,000 at a profit of ₹ 10,000

OR

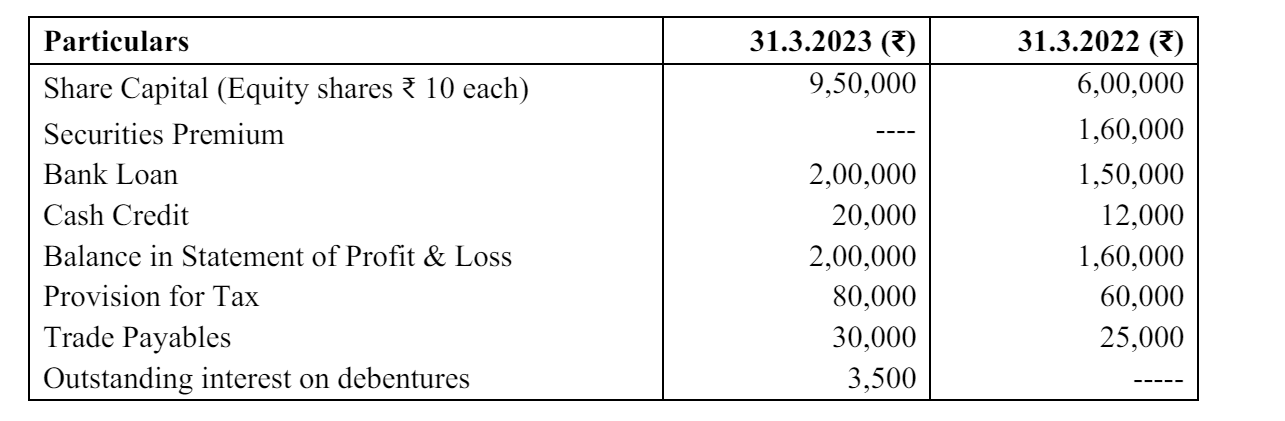

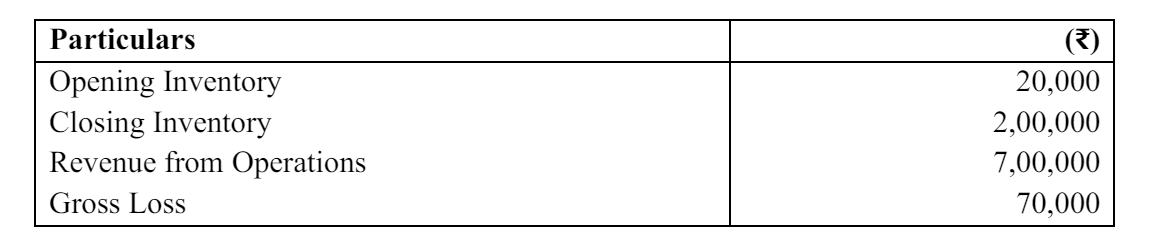

Read the following information of Hydrogen Ltd., and answer the questions that follow:

Additional information:

During the year 2022-23, the company:

(a) Issued bonus shares to the shareholders at the beginning of the year in the ratio of 1:4 (that is 1 bonus share for every 4 shares held) by capitalising the Securities Premium.

(b) Purchased office equipment for ₹ 2,40,000, payment made by issuing 20,000 Equity shares of ₹ 10 each to the vendor and the balance in cash.

(c) Paid ₹ 4,000 for interim dividend.

(d) The interest on all borrowings was ₹ 16,000 out of which the amount paid till the end of the year, was ₹ 12,500.

(e) Dividend of ₹ 15,000 proposed in the year 2021-22 was declared and paid.

(f) Paid underwriting commission of ₹ 10,000.

(i) How many bonus shares have been issued by the company to the shareholders?

(ii) What is the company’s Net Profit before Tax?

(iii) What is the Cash from Operating Activities of the company before tax paid?

(iv) What is Hydrogen Ltd.’s inflow /outflow of cash from Financing Activities?

(v) Give the inflow /outflow of cash from Investing Activities, if any.

(vi) The Board of Directors of Hydrogen Ltd. proposed a dividend of ₹ 30,000 at the end of the year 2022-23.

State with reason, the disclosure / non-disclosure of this dividend proposed in the Cash Flow Statement of the company for the year 2022-23.

View Solution

Question 14

SECTION C

Question 15

In subparts (i) and (ii) choose the correct options and in subparts (iii) to (v) answer the questions as instructed.

(i) When working on an Excel spreadsheet, what does cell B2 refer to?

M Row B, Column 2

N Column B, Row 2

O Row B and Column 2

P Column B and Row 2

(a) Only M

(b) Only M and O

(c) Only N and P

(d) All - M, N, O and P

(ii) Which one of the following terms is NOT related to computerised databases?

(a) Search

(b) Sort

(c) Field names

(d) Record grab

(iii) Which formula will capture the correct number of numerical values from the following range?

A2:A5 & C2:C5

(iv) Give the meaning of the MODE function in Excel with an example.

(v) When editing a cell in Excel, which key or combination of keys is pressed to toggle between relative, absolute and mixed cell references

View Solution

Question 16

(i) What is a Database Transaction in DBMS?

(ii) Give an example of a Database transaction

View Solution

Question 17

Answer any three of the following questions.

(i) Give the meaning of Database design.

(ii) List any two attributes to be stored in Payroll Data base.

(iii) Give any two differences between Generic Software and Specific Software.

(iv) The syntax of the PMT function is

= PMT (rate, nper, pv, [fv], [type])

What do the following stand for in this syntax:

• Rate

• Nper

• Pv

• Type

View Solution

Question 18

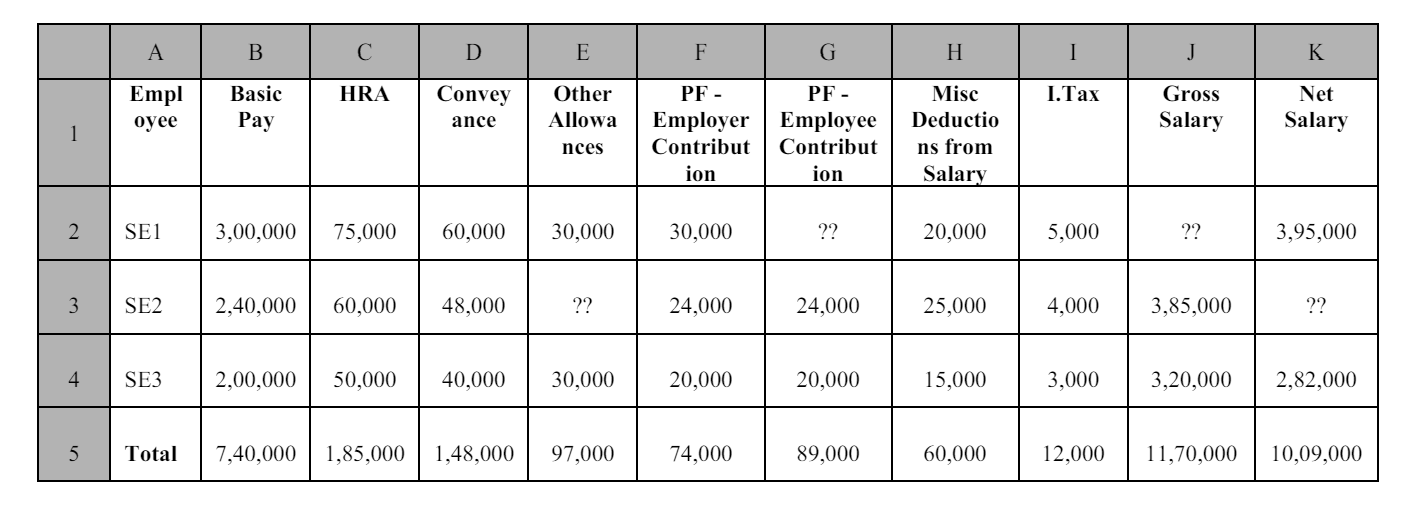

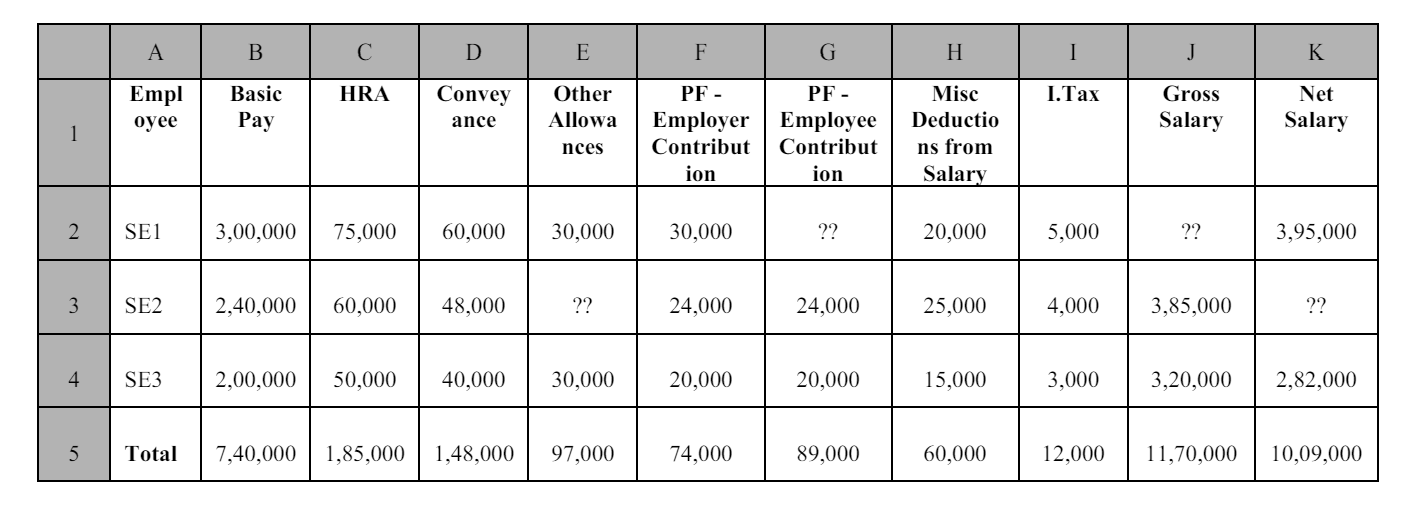

Premier Furniture Ltd. runs a furniture store in city C. The store has three Sales Executives, SE1, SE2 and SE3.

The payroll summary representing the cumulative position for the three executives at the end of the year 2022-23 is as follows:

1. The House Rent Allowance (HRA) is payable @ 25% of the Basic Pay.

2. The Company has a policy of awarding incentives. SE2 was awarded an incentive as from 1st October, 2022, equal to 10% of his monthly Basic Pay. The incentive is clubbed with Other Allowances.

3. An employee can increase his portion of PF contribution from 10% to 15% of the Basic Pay. The contribution of the employer remains the same at 10% of the Basic Pay. SE1 accordingly increased his PF contribution from 1st April, 2022, itself, to 15% of his Basic Pay.

Based on the above transactions and the information given in the spreadsheet, answer any three of the following questions:

(i) Write the formula to calculate PF contribution of SE1 in Cell G2.

(ii) Give the formula to calculate Gross Salary of SE1 in Cell J2.

(iii) Write the formula to calculate Other Allowances (excluding the incentives) earned by SE2 in Cell E3.

(iv) Write the formula to calculate Net Salary of SE2 in Cell K3.

View Solution