GST Chapter Boards Questions Class 10 ICSE

Here we provide Class 10 Maths important notes,board questions and predicted questions with Answers for chapter GST. These important notes,board questions and predicted questions are based on ICSE board curriculum and correspond to the most recent Class 10 Maths syllabus. By practising these Class 10 materials, students will be able to quickly review all of the ideas covered in the chapter and prepare for the Class 10 Board examinations.

2020

Q1

Mr. Bedi visits the market and buys the following articles :

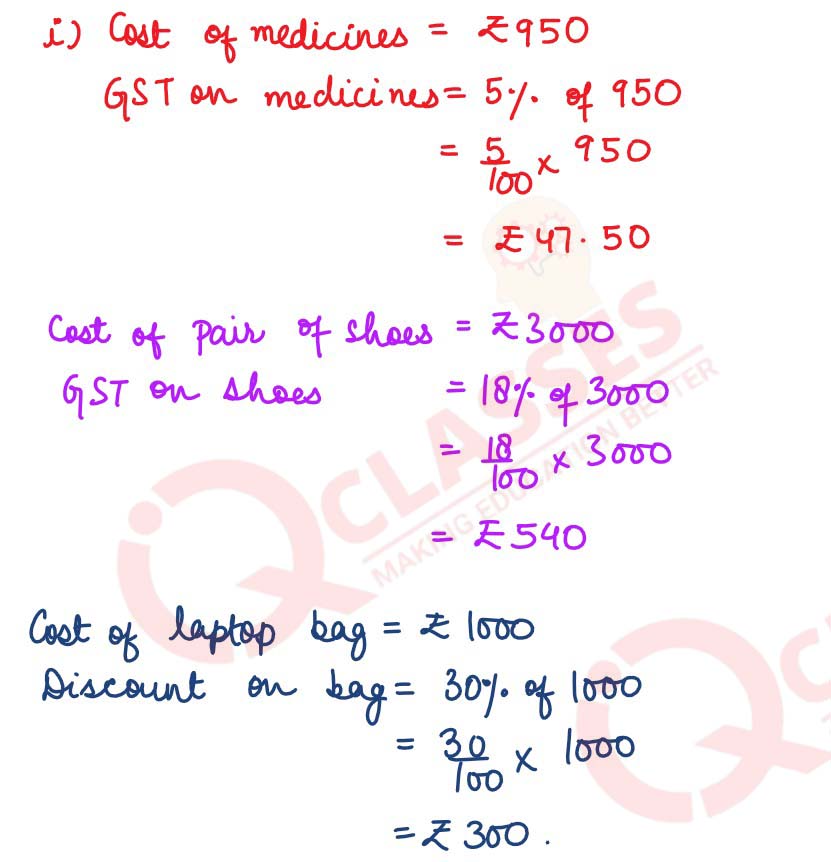

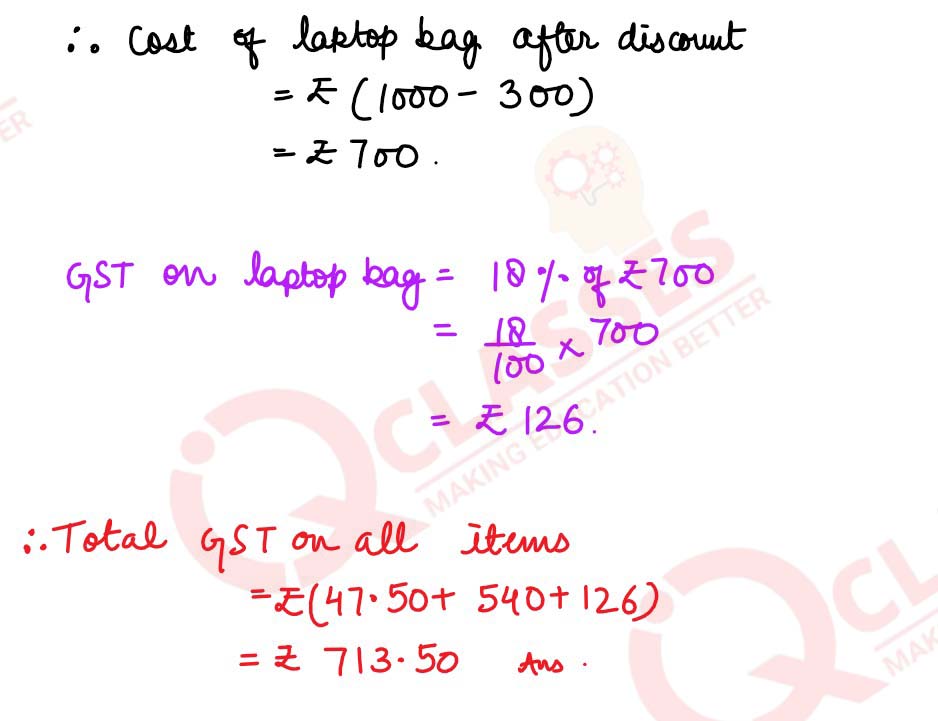

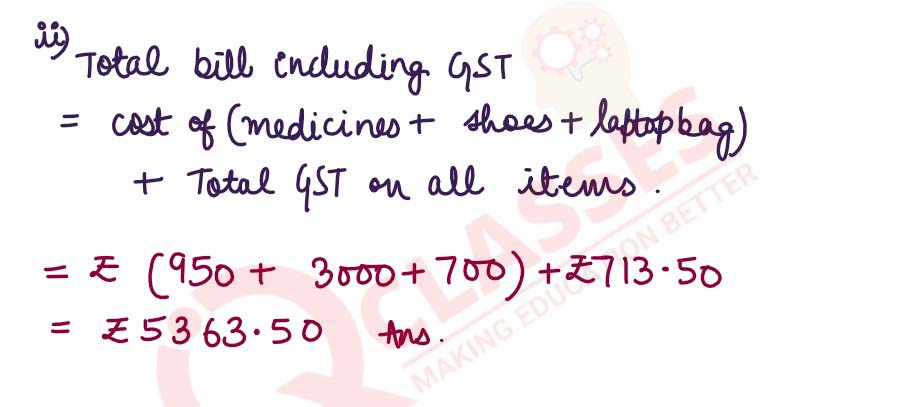

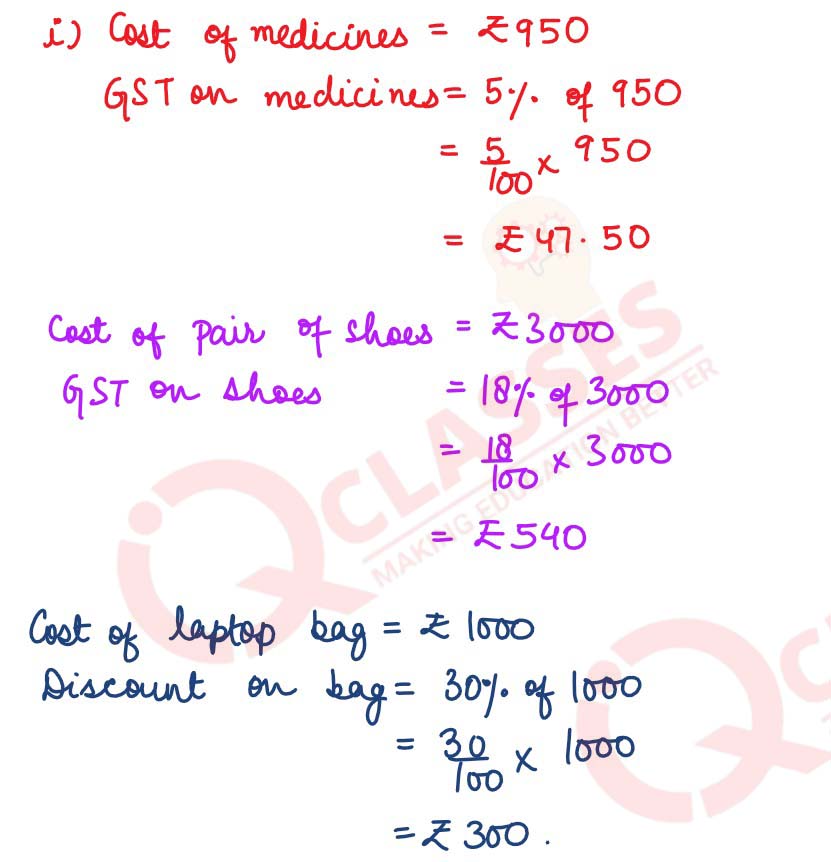

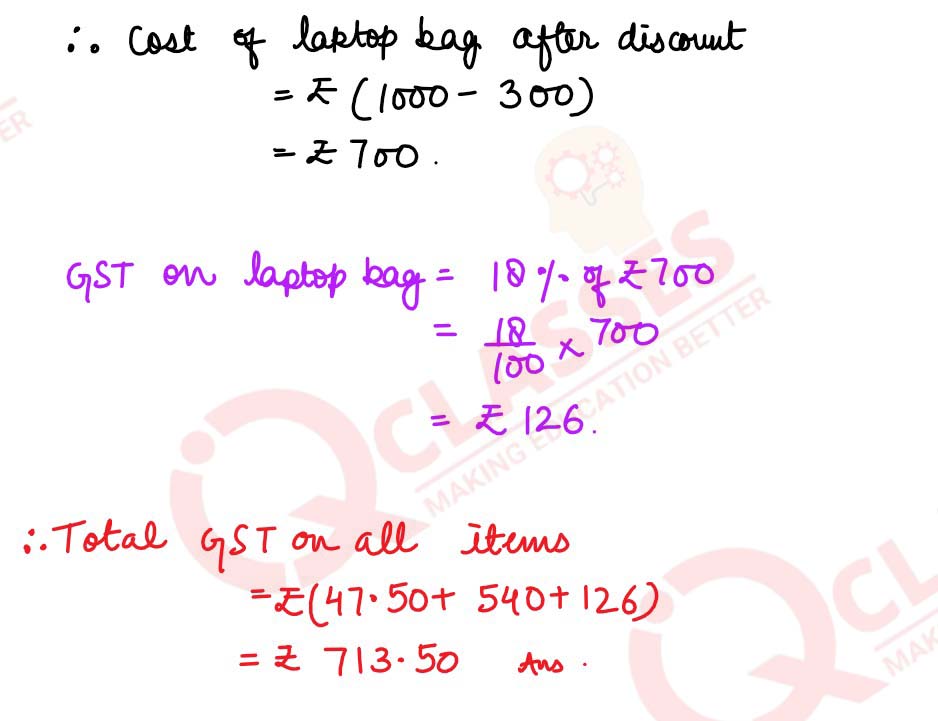

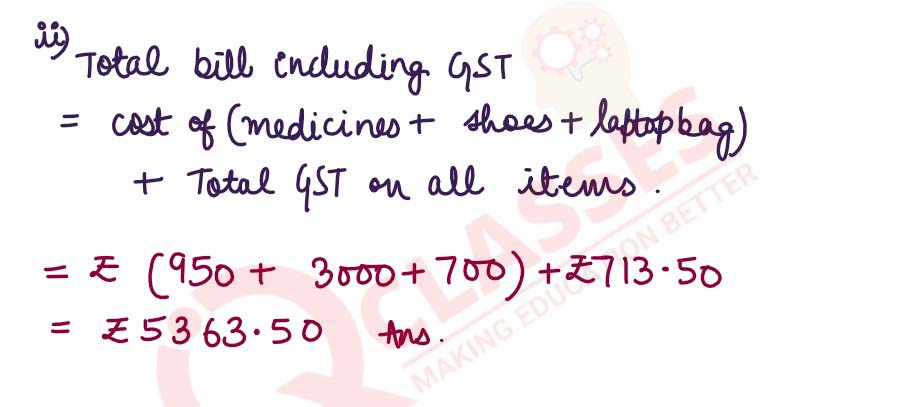

Medicines costing Rs 950, GST @ 5% A pair of shoes costing Rs 3000, GST @ 18% A laptop bag costing Rs 1000 with a discount of 30%, GST @ 18%.

(i) Calculate the total amount of GST paid.

(ii) The total bill amount including GST paid by Mr. Bedi.

solutions

Medicines costing Rs 950, GST @ 5% A pair of shoes costing Rs 3000, GST @ 18% A laptop bag costing Rs 1000 with a discount of 30%, GST @ 18%.

(i) Calculate the total amount of GST paid.

(ii) The total bill amount including GST paid by Mr. Bedi.

solutions

Reach Us

SERVICES

- ACADEMIC

- ON-LINE PREPARATION

- FOUNDATION & CRASH COURSES

CONTACT

B-54, Krishna Bhawan, Parag Narain Road,

Near Butler Palace Colony Lucknow

Contact:+918081967119

Add a comment