GST Chapter Important Questions Class 10 ICSE

Here we provide Class 10 Maths important notes,board questions and predicted questions with Answers for chapter GST. These important notes,board questions and predicted questions are based on ICSE board curriculum and correspond to the most recent Class 10 Maths syllabus. By practising these Class 10 materials, students will be able to quickly review all of the ideas covered in the chapter and prepare for the Class 10 Board examinations.

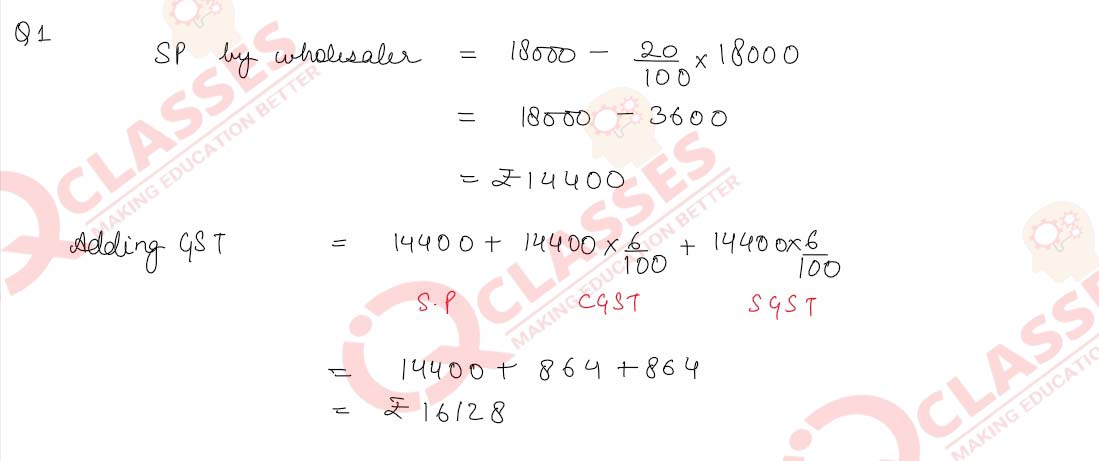

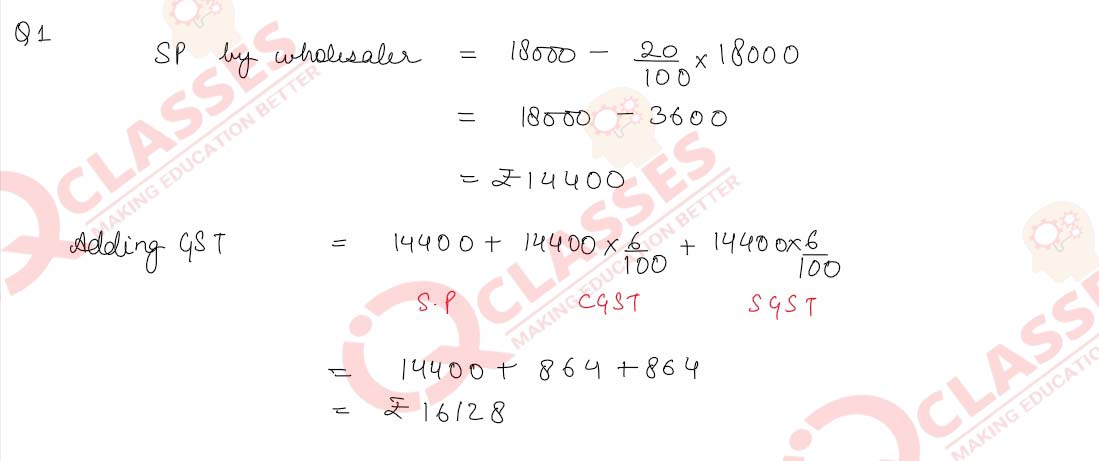

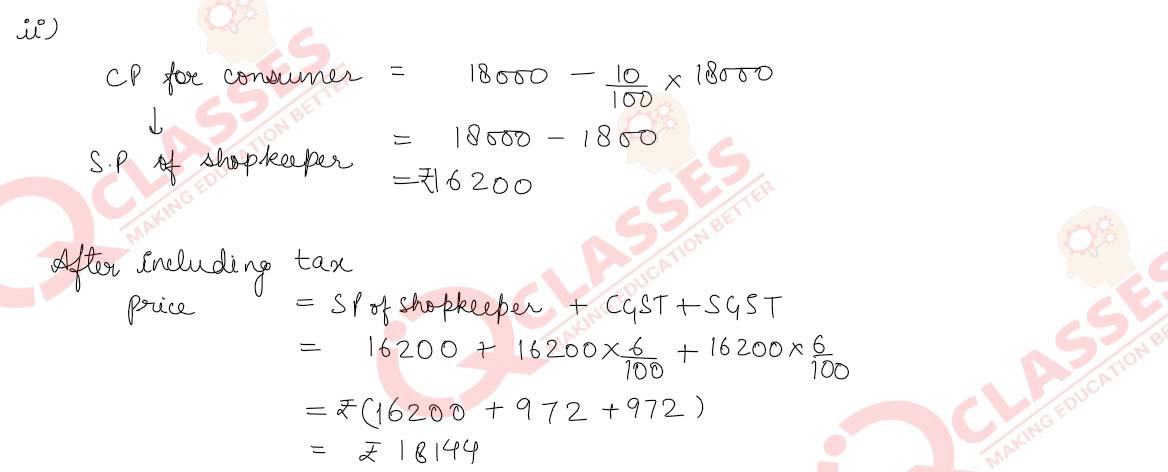

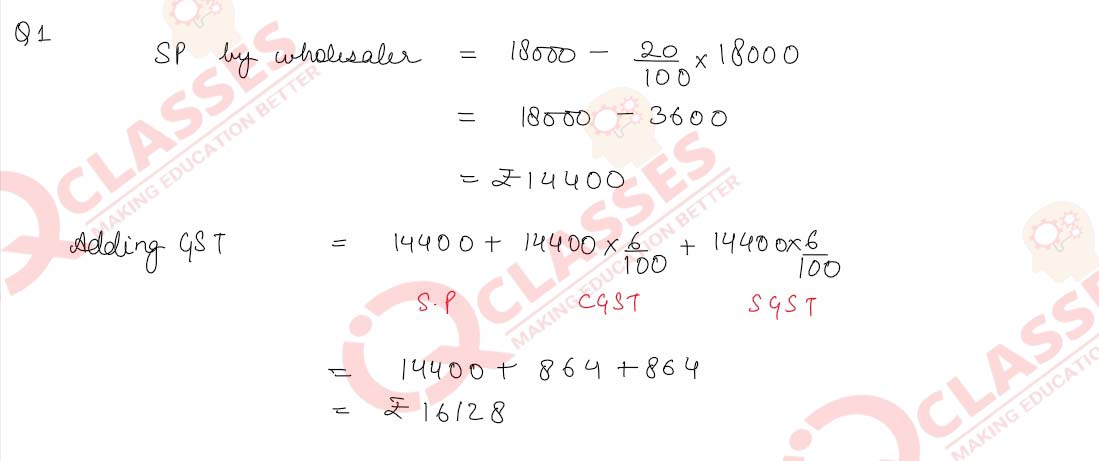

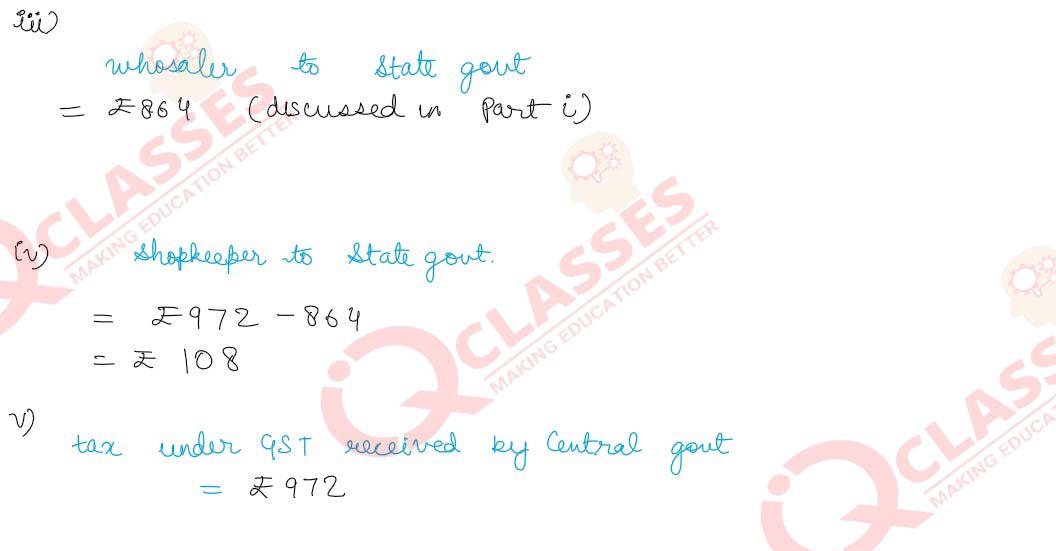

Q1

A shopkeeper bought a washing machine at a discount of 20% from a wholesaler,

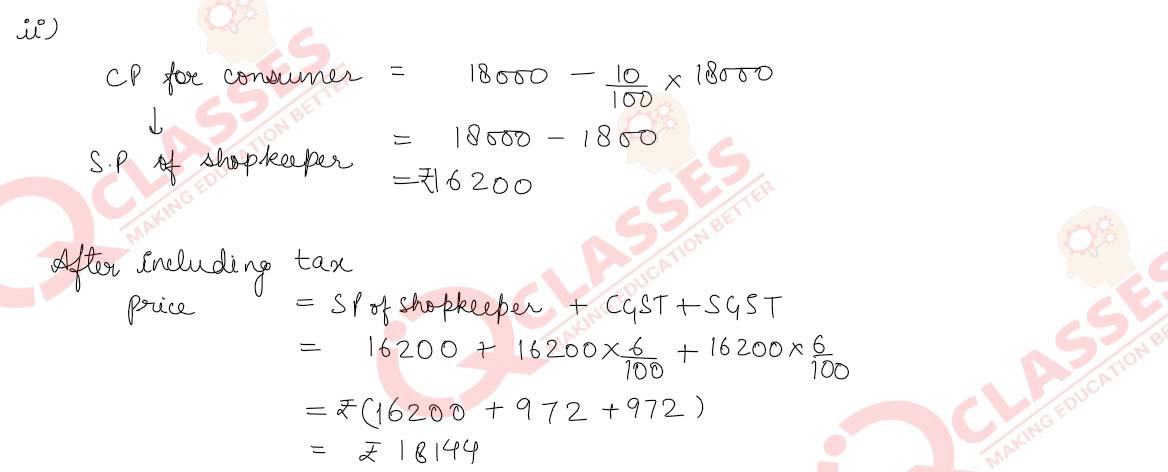

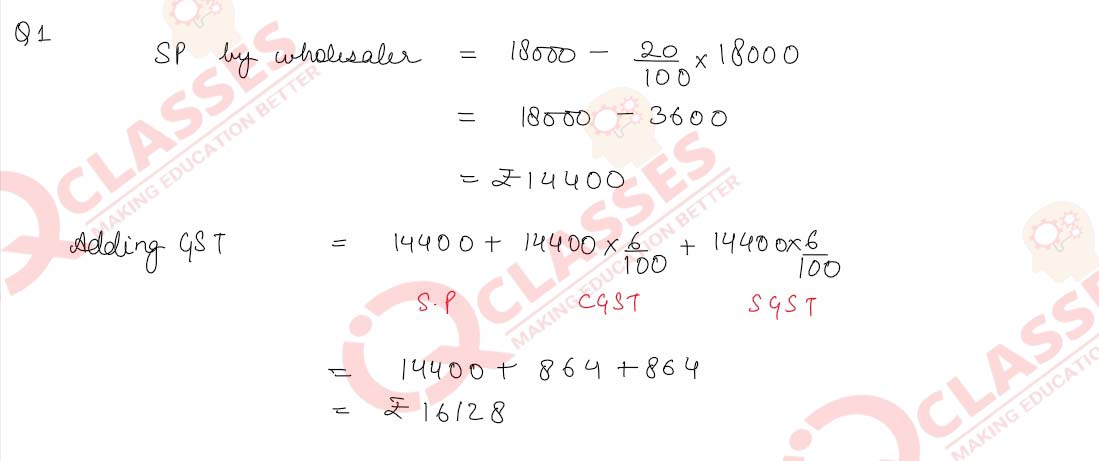

the printed price of the washing machine being ₹18000. The shopkeeper sells it to a

consumer at a discount of 10% on the printed price. If the sales are intra-state and the

rate of GST is 12%, find:

solutions

- the price inclusive of tax (under GST) at which the shopkeeper bought the machine

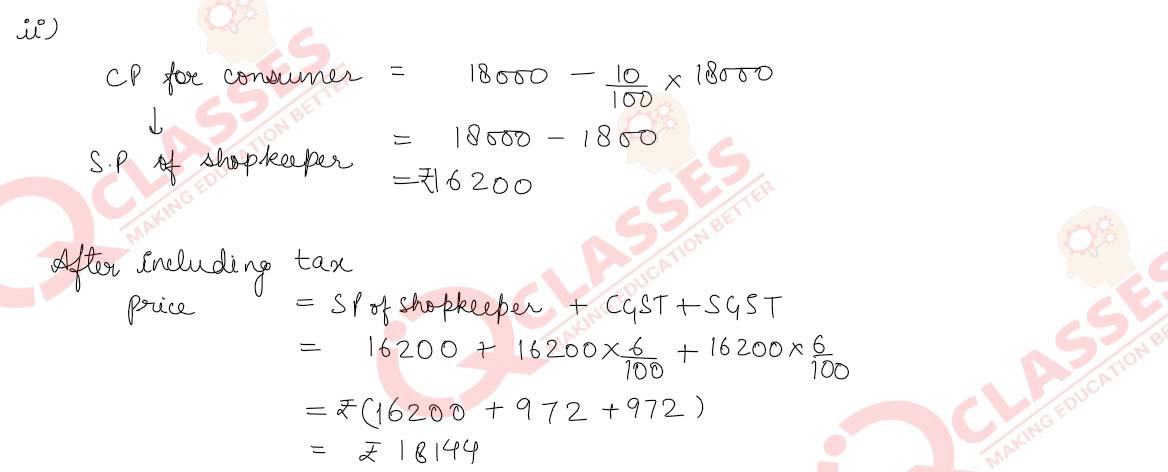

- the price which the consumer pays for the machine.

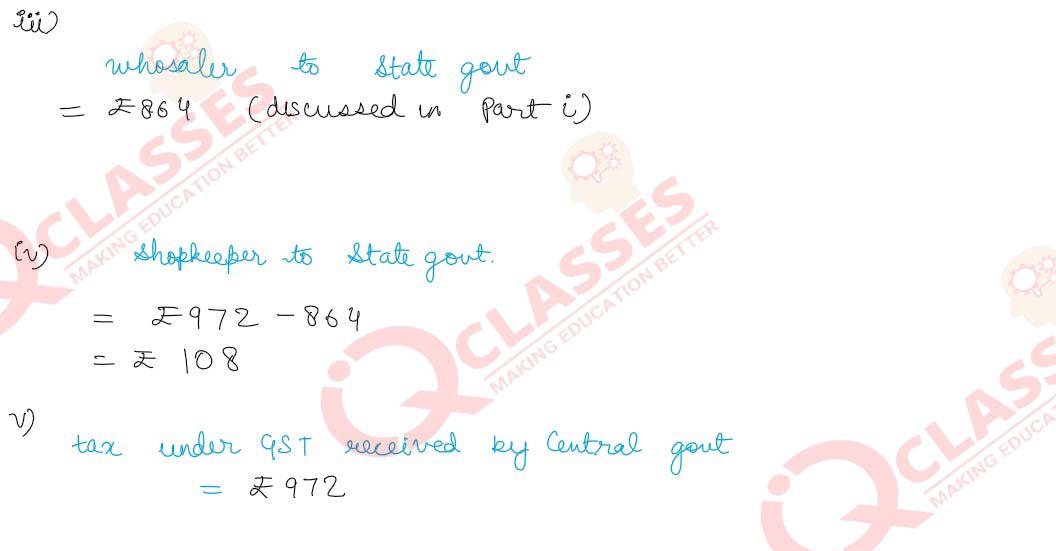

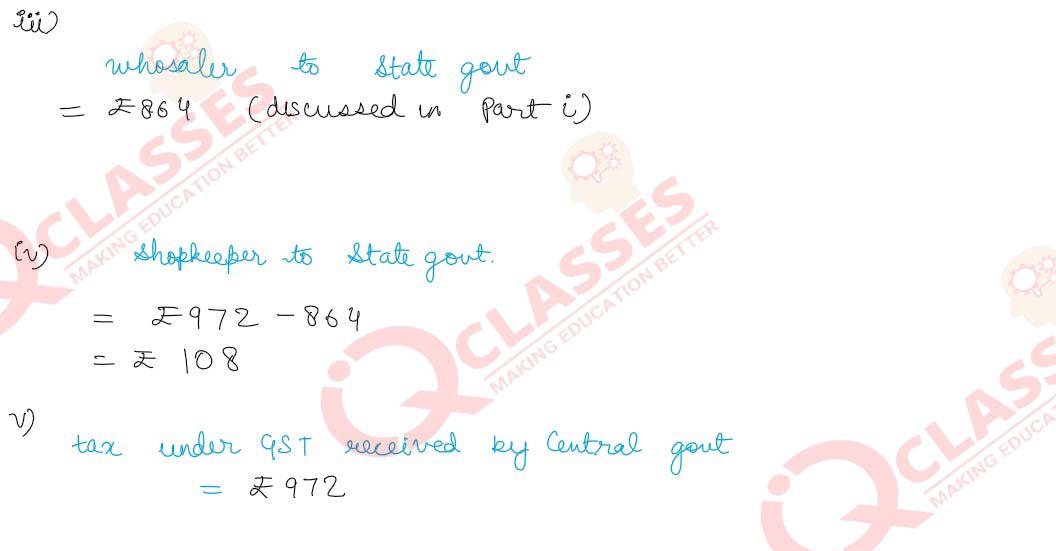

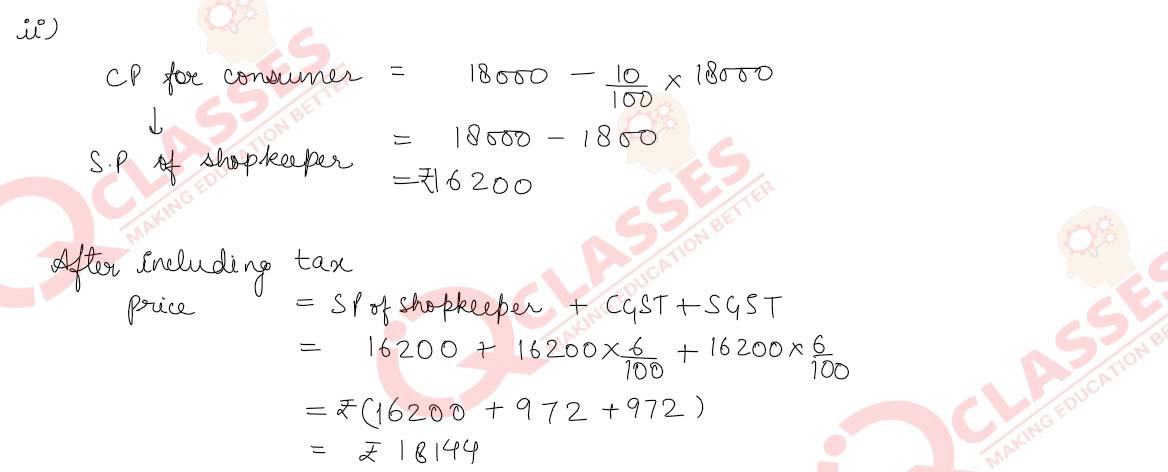

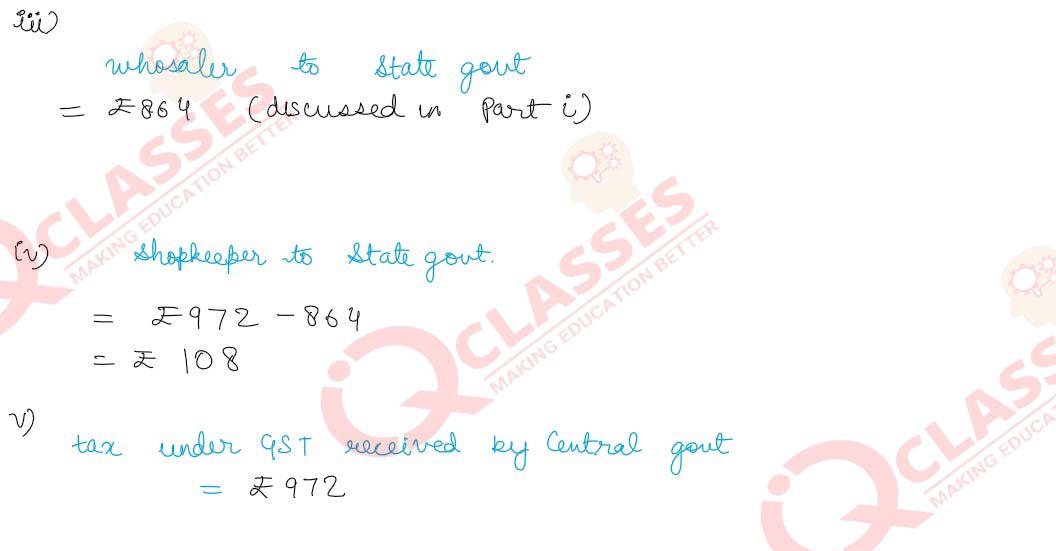

- the tax (under GST) paid by the wholesaler to the State Government

- the tax (under GST) paid by the shopkeeper to the State Government

- the tax (under GST) received by the Central Government.

solutions

Q2

A manufacturer listed the price of his goods at ₹1600 per article. He allowed a discount

of 25% to a wholesaler who in turn allowed a discount of 20% on the listed price to

a retailer. The retailer sells one article to a consumer at a discount of 5% on the listed

price. If all the sales are intra-state and the rate of GST is 5%, find

solutions

- the price per article inclusive of tax (under GST) which the wholesaler pays.

- the price per article inclusive of tax (under GST) which the retailer pays.

- the amount which the consumer pays for the article.

- the tax (under GST) paid by the wholesaler to the State Government for the article.

- the tax (under GST) paid by the retailer to the Central Government for the article.

- the tax (under GST) received by the State Government.

solutions

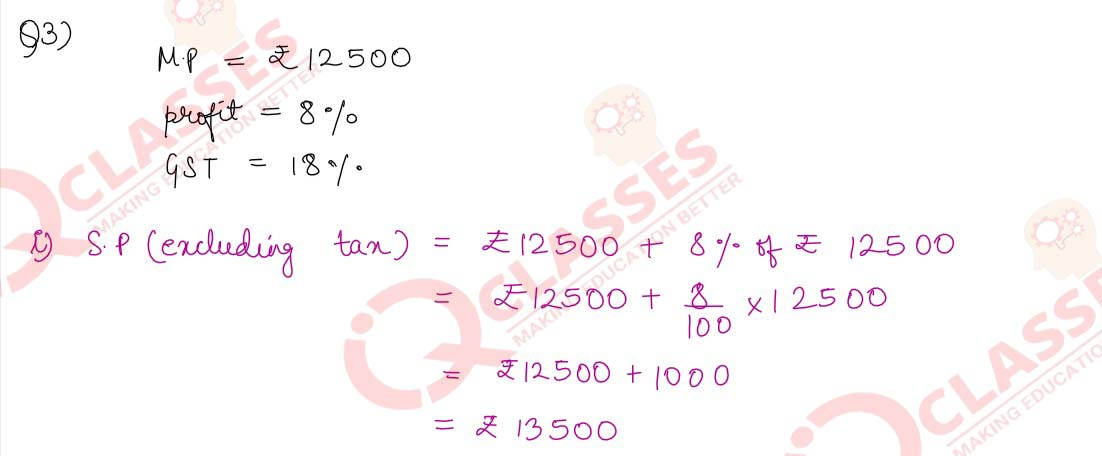

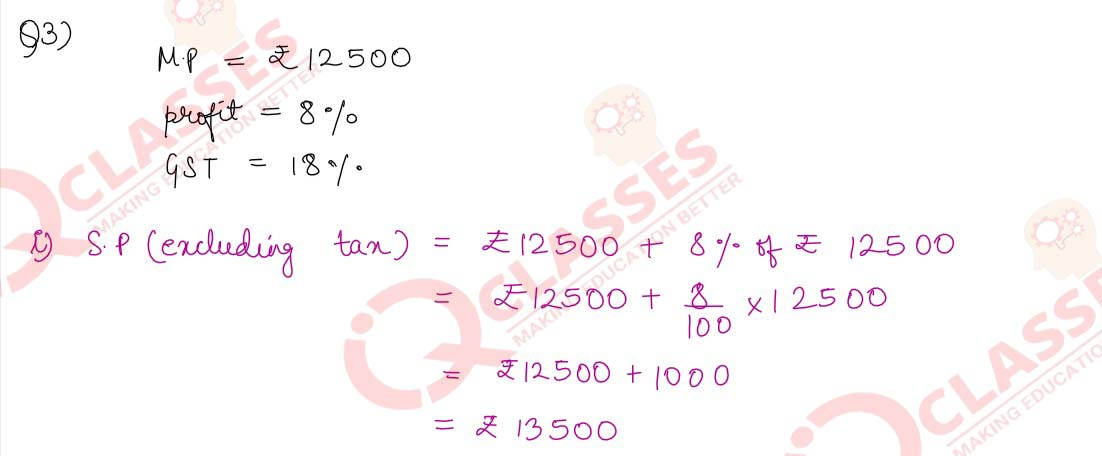

Q3

The marked price of an article is 12500. A dealer in Kolkata sells the article to a

consumer in the same city at a profit of 8%. If the rate of GST is 18%, find

solutions

- the selling price (excluding tax) of the article.

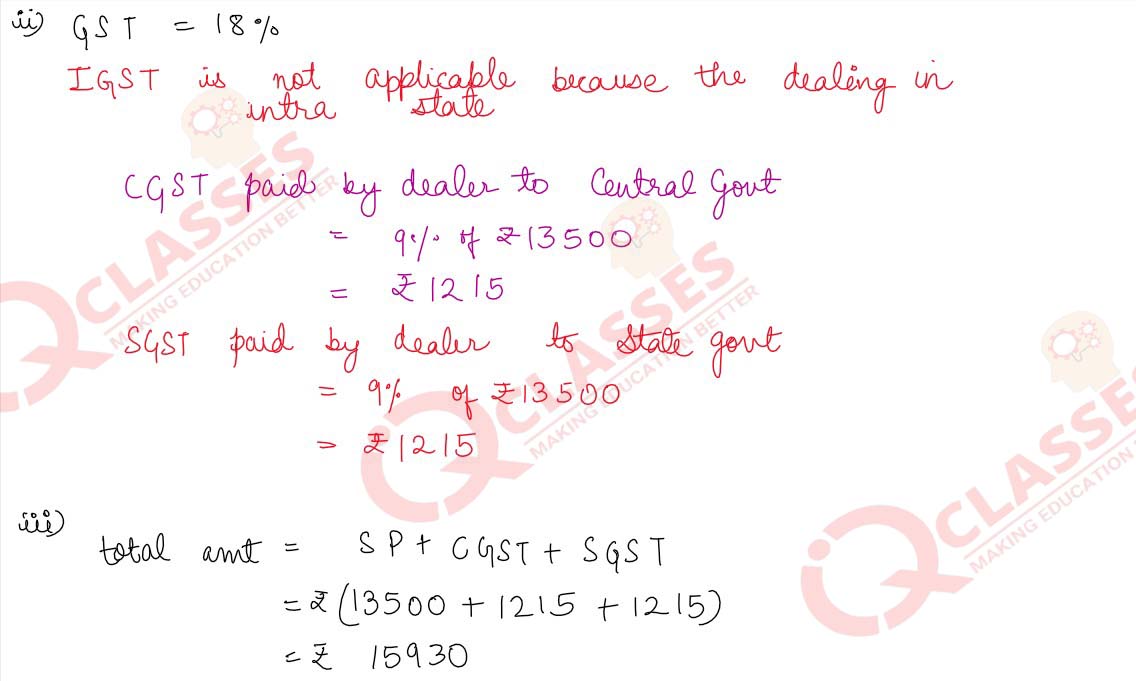

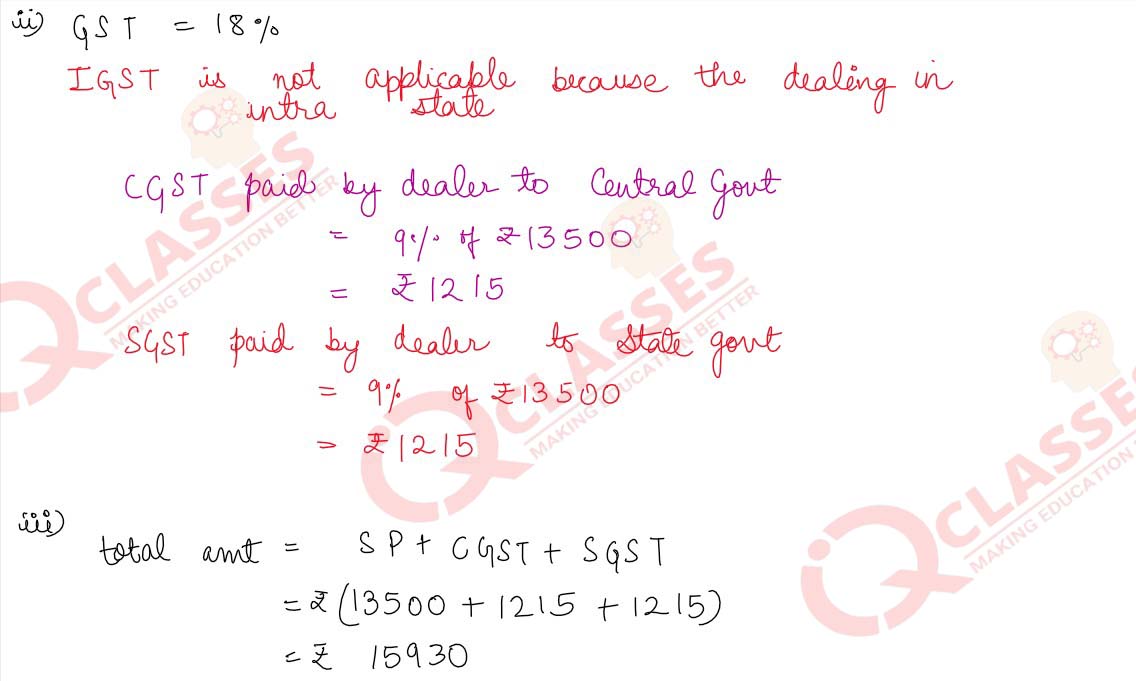

- IGST, CGST and SGST paid by the dealer to the Central and State Governments.

- Sthe amount which the consumer pays for the article.

solutions

Q4

A manufacturer buys raw material worth 7500 paying GST at the rate of 5%. He sells

the finished product to a dealer at 40% profit. If the purchase and the sale both are

intra-state and the rate of GST for the finished product is 12%, find:

solutions.jpg)

.jpg)

.jpg)

.jpg)

- the input tax (under GST) paid by the manufacturer.

- the output tax (under GST) collected by the manufacturer.

- the tax (under GST) paid by the manufacturer to the Central and State Goverments.

- the amount paid by the dealer for the finished product

solutions

.jpg)

.jpg)

.jpg)

.jpg)

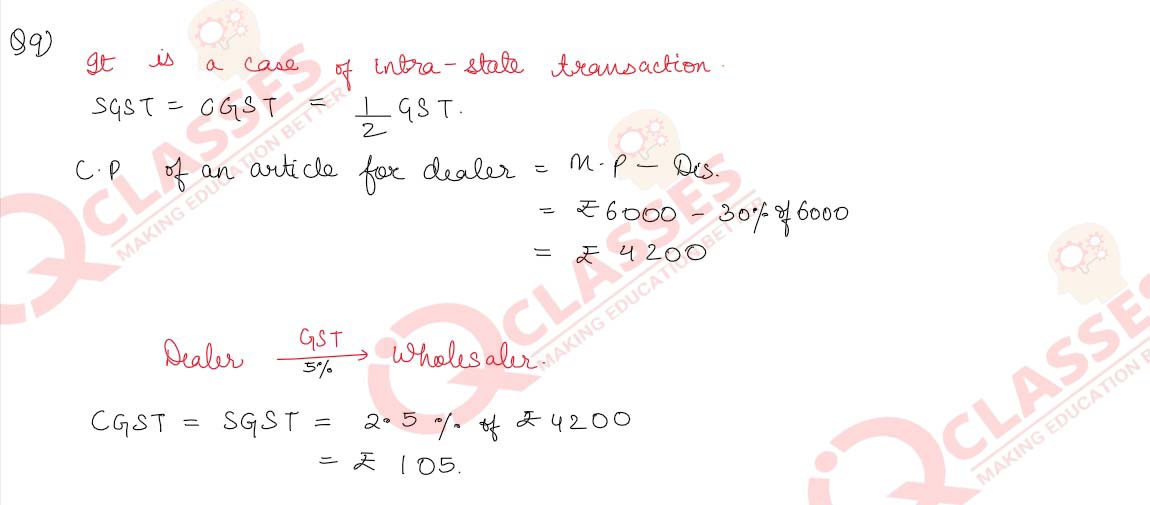

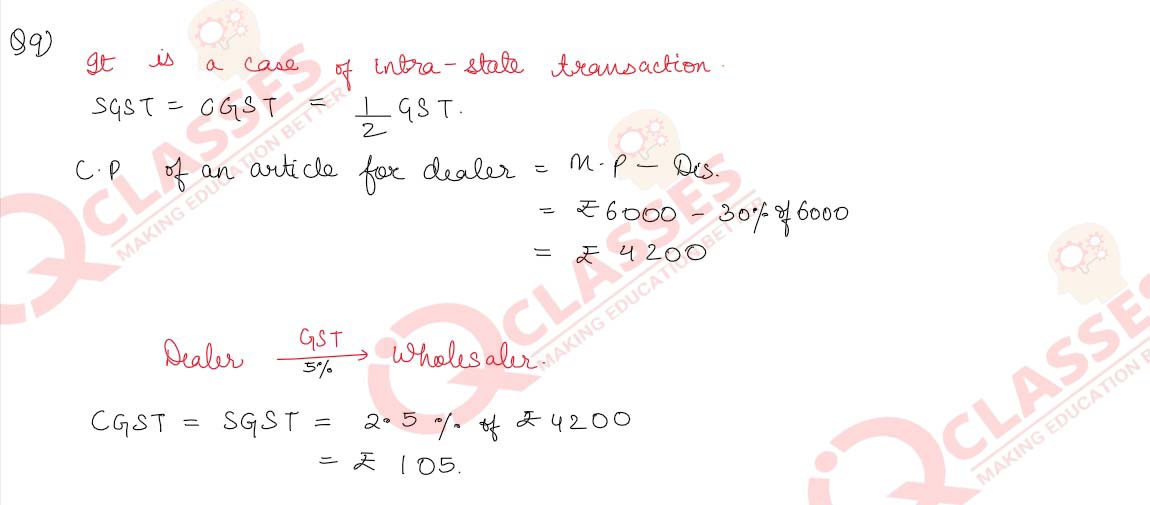

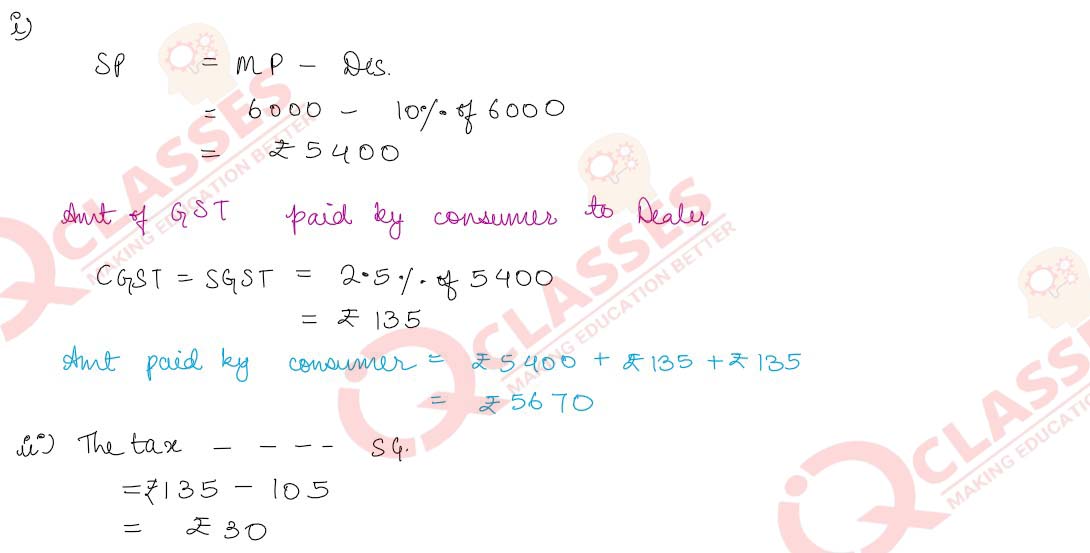

Q5

A dealer buys an article at a discount of 30% from the wholesaler, the marked price

being ₹6000. The dealer sells it to a consumer at a discount of 10% on the marked price.

If the sales are intra-state and the rate of GST is 5%, find:

solutions

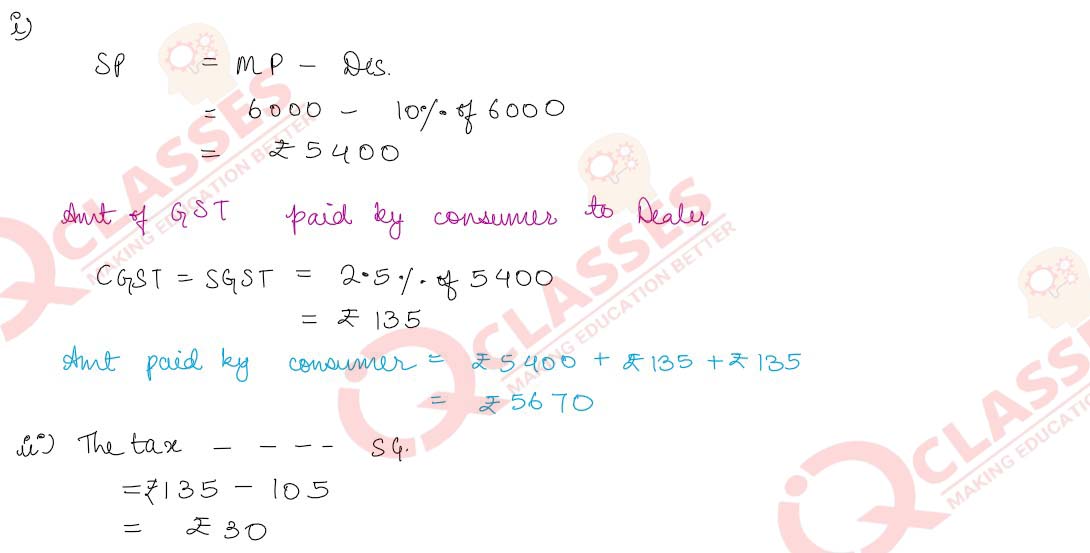

- the amount paid by the consumer for the article.

- the tax (under GST) paid by the dealer to the State Government.

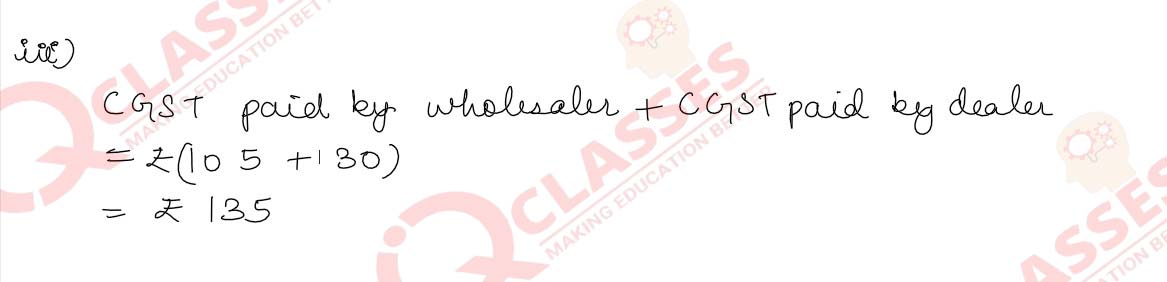

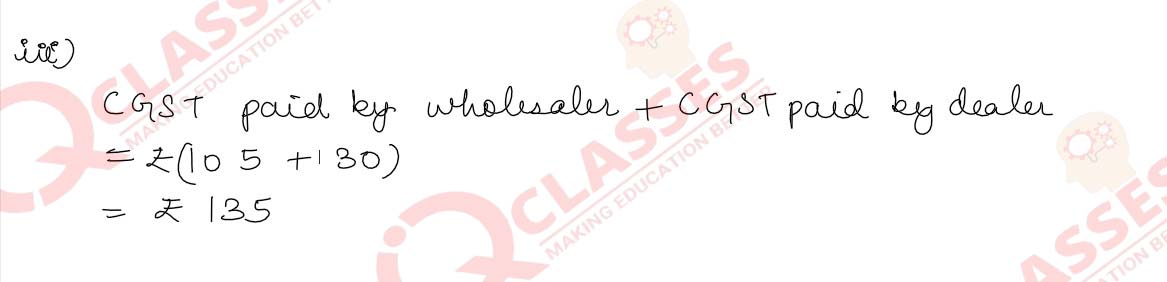

- the amount of tax (under GST) received by the Central Government.

solutions

Reach Us

SERVICES

- ACADEMIC

- ON-LINE PREPARATION

- FOUNDATION & CRASH COURSES

CONTACT

B-54, Krishna Bhawan, Parag Narain Road,

Near Butler Palace Colony Lucknow

Contact:+918081967119

Add a comment